Your Guide to Medicare Insurance Agencies in Colorado

Finding the Right Medicare Insurance Provider in Colorado

Colorado's Medicare landscape offers a wealth of options, but that abundance of choice can sometimes feel overwhelming. As a Colorado resident myself, I understand the importance of finding coverage that truly fits your unique healthcare needs and budget.

Medicare insurance providers for Colorado include well-known national carriers and respected regional organizations. Several plans have earned top 5-star ratings for 2025, bringing extensive provider networks, integrated care models, robust dental and vision benefits, wellness perks, and even widespread $0-premium availability to the table. Whether you prioritize extra benefits, broad doctor choice, or a company with deep Colorado roots, there is a solution that can match your lifestyle and finances.

You're in good company as you explore these choices. Colorado has over 1 million Medicare beneficiaries who've steered these same waters. The good news? The Medicare Advantage marketplace is becoming more affordable. While the number of available plans has decreased slightly from 132 to 120 for 2025, the average monthly premium has dropped from $15.11 to $12.20. Even better, virtually all Medicare-eligible Coloradans (99.7%) can access at least one plan with a $0 premium.

I'm Kelsey Mackley, and at Kelmeg & Associates, I've guided countless Colorado residents through the Medicare maze. My goal is always the same – helping you find coverage that delivers the care you need at a price that makes sense.

What You'll Learn

This guide isn't just about listing Medicare insurance providers for Colorado – it's about equipping you with the knowledge to make confident decisions about your healthcare coverage. We'll explore:

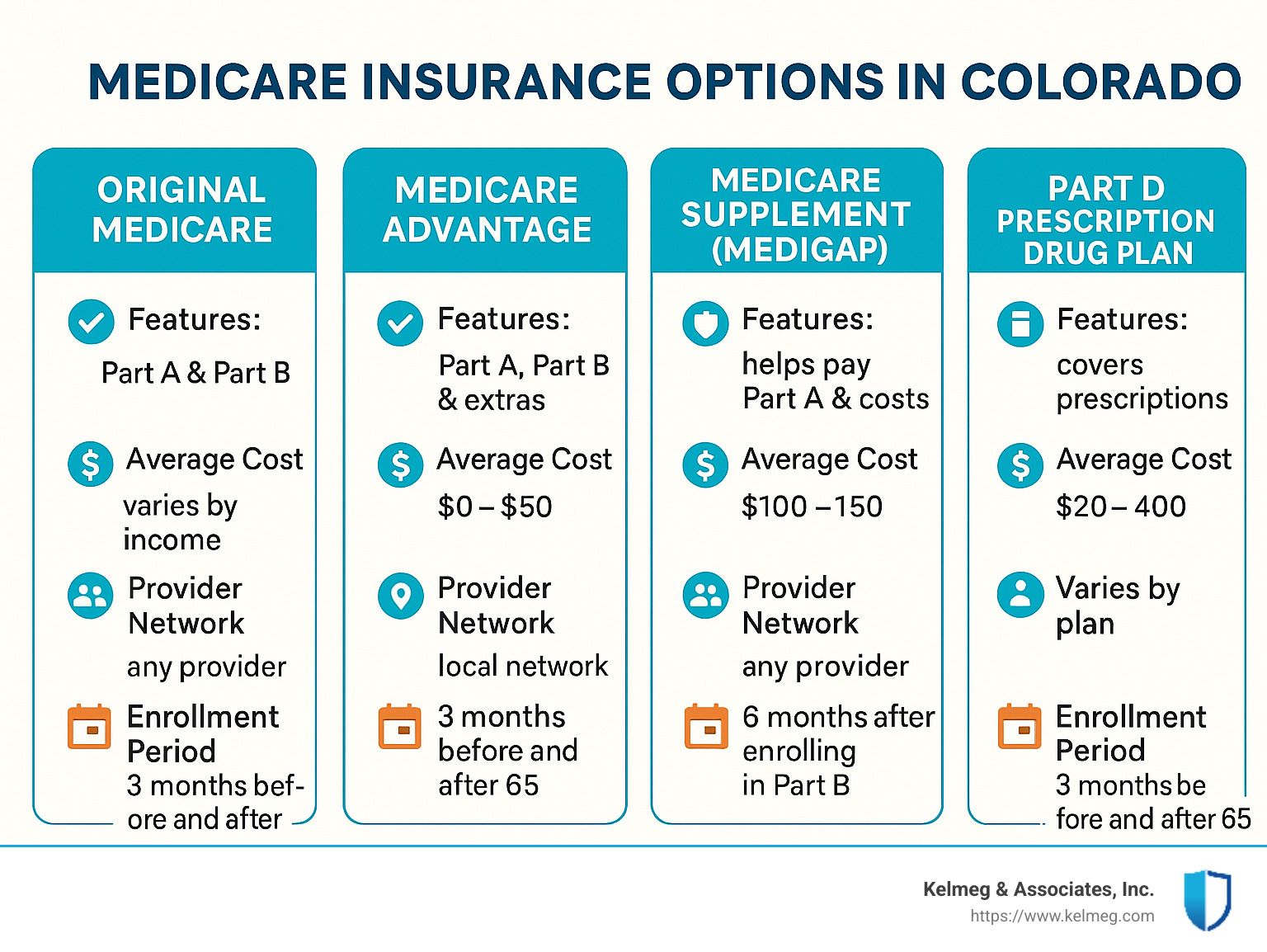

The distinct categories of Medicare providers available across Colorado, from Original Medicare to Medicare Advantage and supplements. You'll understand how to evaluate different plans based on what matters most – whether that's cost, coverage breadth, or quality ratings.

We'll dive into the dollars and cents with current premium averages and explain what those star ratings really mean for your care experience. Most importantly, we'll help you connect your specific health needs to the right provider options.

Timing matters with Medicare, so we'll highlight critical enrollment windows and strategies to avoid those pesky late penalties that can follow you for years.

Whether you're approaching your 65th birthday, recently relocated to our beautiful state, or simply wondering if better coverage options exist, consider this your Colorado Medicare roadmap. Let's steer this journey together, with clarity and confidence.

Understanding Medicare in Colorado

When it comes to healthcare in Colorado's beautiful mountain state, Medicare plays a vital role for our senior community. With nearly 1 in 6 Colorado residents now age 65 or older, understanding how Medicare works here is essential for accessing quality healthcare without breaking the bank.

I've helped countless Coloradans steer their Medicare journey, and the first thing to know is that Medicare eligibility in our state follows federal guidelines. You qualify if you're 65 or older, a U.S. citizen or legal resident who's lived in the U.S. for at least 5 years, and you or your spouse has worked long enough (usually 10 years) to qualify for Social Security benefits.

Colorado currently has over 1 million Medicare beneficiaries, and each one has unique healthcare needs. Let me walk you through the building blocks of Medicare coverage:

Part A (Hospital Insurance) covers your inpatient hospital stays, skilled nursing facility care, hospice services, and some home health care. Good news – most Coloradans don't pay a premium for Part A if they or their spouse paid Medicare taxes while working.

Part B (Medical Insurance) is your coverage for doctor visits, outpatient care, medical supplies, and preventive services. For 2025, the standard Part B premium is $174.70 monthly with a $257 deductible. This is essential coverage for regular healthcare needs.

Part C (Medicare Advantage) offers an alternative to Original Medicare through private insurance companies approved by Medicare. Many Colorado Medicare Advantage plans include prescription drug coverage and extra benefits like dental, vision, and fitness programs.

Part D (Prescription Drug Coverage) helps manage your medication costs. These plans, offered by private insurance companies following Medicare guidelines, are crucial for anyone taking regular prescriptions.

Medigap (Medicare Supplement Insurance) fills the "gaps" in Original Medicare coverage, helping with copayments, coinsurance, and deductibles. For many Colorado seniors, this provides financial peace of mind against unexpected medical bills.

Important Enrollment Periods

Timing is everything with Medicare! Missing enrollment windows can result in lifelong penalties and gaps in coverage. Here's when you can sign up:

Your Initial Enrollment Period spans 7 months—starting 3 months before your 65th birthday month, including your birthday month, and ending 3 months after. This is your prime opportunity to enroll without penalties.

During the Annual Enrollment Period (October 15 to December 7), you can join, switch, or drop Medicare Advantage or prescription drug plans for coverage starting January 1.

If you're already in a Medicare Advantage plan, the Medicare Advantage Open Enrollment Period (January 1 to March 31) allows you to switch to a different Advantage plan or return to Original Medicare.

Special Enrollment Periods exist for specific life situations, such as moving to a new area or losing employer coverage.

Be aware that missing your Initial Enrollment Period can trigger late enrollment penalties that last as long as you have Medicare. For Part B, that's an extra 10% for each 12-month period you could have enrolled but didn't—a costly mistake I've seen too many Colorado residents make.

Want more detailed information about Medicare insurance providers for Colorado and the basics of Medicare coverage? Visit our comprehensive Medicare information page where we break down everything you need to know in simple, clear language.

1. Original Medicare – The Federal Foundation

When it comes to Medicare insurance providers for Colorado residents, everything starts with Original Medicare. Think of it as the foundation of the Medicare house—solid, reliable, and nationwide in scope.

Original Medicare comes directly from the federal government through the Centers for Medicare & Medicaid Services (CMS). It's made up of two essential parts: Part A for hospital coverage and Part B for medical services. This dynamic duo handles most of your basic healthcare needs, from hospital stays to doctor visits.

Key Features of Original Medicare in Colorado:

One of the biggest perks of Original Medicare is its incredible flexibility. Unlike other health plans that tie you to specific networks, Original Medicare gives you the freedom to see any doctor or hospital in the entire country that accepts Medicare. For Coloradans who love to travel or spend winters in warmer states, this nationwide coverage is a huge advantage.

"Many of my clients who split their time between Colorado's beautiful summers and Arizona's warm winters particularly value Original Medicare's nationwide acceptance," shares Kelsey Mackley of Kelmeg & Associates. "They don't have to worry about being 'out of network' when they're away from home."

The cost structure is straightforward too. In 2025, most people pay $174.70 monthly for their Part B premium, along with a $257 annual deductible. After that, you typically pay 20% of Medicare-approved costs for most services, with no cap on your potential out-of-pocket expenses.

However, Original Medicare does have some significant gaps. It wasn't designed to cover everything, and notably doesn't include prescription drug coverage. You'll need to add a separate Part D plan for that. It also lacks an out-of-pocket maximum, meaning your 20% responsibility continues indefinitely—potentially creating financial risk with serious illnesses or injuries.

That's why many savvy Colorado seniors improve their Original Medicare with supplemental coverage. Adding a Medicare Supplement (Medigap) policy helps cover those gaps in coverage, while a Part D plan ensures your medications are covered.

"Original Medicare provides excellent basic coverage, but it was never designed to be a complete solution," I often tell my clients. "It's more like a reliable foundation that you can build upon based on your personal health needs and budget."

For those who want to dig deeper into the data behind Medicare providers and coverage details, CMS offers extensive scientific research on provider data that's publicly accessible.

2. Medicare Advantage Plan Carriers Operating in Colorado

When it comes to Medicare Advantage plans, Colorado seniors have plenty of choices. These plans (also called Part C) bundle your Part A and B benefits together, with most throwing in prescription drug coverage and extra perks that Original Medicare doesn't offer.

Good news for your wallet - the average monthly premium for Medicare Advantage plans in Colorado has dropped from $15.11 in 2024 to just $12.20 in 2025. Even better, nearly all Medicare-eligible Coloradans (99.7%) can access at least one plan with a $0 monthly premium. In total, there are 120 Medicare Advantage plans available across Colorado for 2025, giving you plenty of options to compare.

Major Medicare Advantage Carriers in Colorado:

Colorado offers several highly-rated Medicare Advantage carriers with impressive benefits. You'll find options with 5-star ratings for 2025 that offer extensive provider networks throughout Colorado, plus extras like dental coverage, vision benefits, and fitness programs that keep you active.

Some carriers take an integrated care approach where everything happens under one roof - doctors, hospitals, and pharmacies all work together. While this creates a seamless experience, these networks may be limited to specific areas in Colorado, mostly along the Front Range.

Many carriers provide several options with $0 or low monthly premiums. These often include nice extras like transportation to medical appointments and allowances for over-the-counter health items.

You'll also find locally-based carriers that bring decades of Colorado-specific experience to the table. As local providers, they understand the unique healthcare needs of Coloradans, from mountain communities to urban centers.

Several carriers offer well-rated plans (4.5 stars) with $0 premiums in most Colorado counties. They're particularly known for their strong prescription drug coverage options.

"I always tell my clients that the $0 premium plans can be great, but you need to look at the whole picture," says Kelsey from Kelmeg & Associates. "A plan with a slightly higher premium might actually save you money if it has lower copays for the services you use most often."

Types of Medicare Advantage Plans in Colorado:

The plan structure matters just as much as the carrier. Here in Colorado, you'll find several types:

Health Maintenance Organization (HMO) plans keep costs lower by requiring you to stay within their provider network except in emergencies. You'll typically need referrals from your primary doctor to see specialists.

Preferred Provider Organization (PPO) plans offer more flexibility. You can see doctors outside the network (though you'll pay more), and you usually don't need referrals for specialists.

Private Fee-for-Service (PFFS) plans are less common but work differently. The plan determines how much it pays providers and how much you pay when receiving care.

Special Needs Plans (SNPs) are designed for people with specific health conditions or circumstances (we'll cover these more in section 5).

3. Stand-Alone Part D Prescription Drug Plan Sponsors

If you've chosen Original Medicare, you'll need to add prescription drug coverage separately – that's where Part D plans come in. Think of these as the "à la carte" prescription option for your Medicare coverage menu.

Colorado seniors have plenty of choices when it comes to Medicare insurance providers for Colorado offering standalone prescription coverage. In 2024, you can choose from 21 different Part D plans across the state, with monthly premiums spanning from as low as $0 to as high as $132. Deductibles also vary widely, ranging from $0 to the maximum allowed $545. We expect similar options for 2025, with updated details becoming available during the Annual Enrollment Period.

Major Part D Plan Providers in Colorado:

When it comes to prescription coverage, several trusted carriers serve our Colorado communities. You'll find multiple plan options with different drug lists and premium levels to match various needs. Some carriers stand out for their competitive pricing and flexible pharmacy networks.

If you prefer mail-order convenience, you'll find options with strong mail-order pharmacy benefits. Some carriers take an interesting approach with tiered pharmacy networks that can help you save money by choosing preferred pharmacies. Many plans balance competitive premiums with comprehensive drug lists that cover many commonly prescribed medications.

"I always tell my clients that the lowest premium doesn't necessarily mean the lowest overall cost," shares Kelsey Mackley. "What really matters is whether your specific medications are covered and at what tier level."

Understanding Part D Plan Components:

Your Part D plan has several key pieces that affect both coverage and cost. The formulary is essentially your plan's approved medication list, organized in tiers with different costs for each tier. Before enrolling in any plan, it's absolutely essential to verify that your current medications appear on the plan's formulary.

The pharmacy network can dramatically impact your costs too. Plans partner with specific pharmacies to negotiate better rates, and using these preferred pharmacies can save you significant money each month.

Most people have heard about the infamous Coverage Gap (often called the "Donut Hole"). In 2024, once your total drug costs hit $5,030, you enter this gap where you'll pay 25% of drug costs until your out-of-pocket spending reaches $12,447. After that threshold, you'll enter Catastrophic Coverage, where you'll only pay a small coinsurance or copayment for covered medications for the remainder of the year.

"One of my clients saved over $1,200 last year just by switching to a different Part D plan that covered her medications at lower tiers," Kelsey notes. "That's why at Kelmeg & Associates, we help our clients analyze their options annually – formularies and costs can change dramatically each year."

Extra Help Program for Part D Costs

If prescription costs are straining your budget, you might qualify for the Extra Help program. This valuable assistance helps people with limited income and resources manage their Part D expenses. For 2024, individuals with resources under $16,660 (or $33,240 for married couples living together) may qualify.

The benefits are substantial: reduced or eliminated premiums, lower or no deductible, smaller copayments, and no coverage gap to worry about. To see if you qualify, visit the Social Security Administration website or call 1-800-772-1213.

For Colorado seniors looking to understand the details of Medicare costs beyond prescriptions, the scientific research on Medicare costs page provides valuable insights backed by data.

Prescription drug coverage isn't just about having insurance—it's about having the right insurance for your specific medication needs. That's where personalized guidance can make all the difference in both your health and your wallet.

4. Medigap (Medicare Supplement) Insurance Companies

Medigap, or Medicare Supplement Insurance, fills the financial gaps that Original Medicare leaves behind. Think of it as your financial safety net for those copayments, coinsurance, and deductibles that can otherwise add up quickly. These policies come with letter designations (A through N) and are sold by private companies throughout Colorado.

Key Medigap Providers in Colorado:

When Colorado residents ask me about reliable Medicare insurance providers for Colorado offering Medigap plans, I typically highlight several trusted companies. You'll find comprehensive coverage with competitive rates across all plan types from various carriers. Many of my clients appreciate stable rate histories and household discounts that can save couples money. Some carriers stand out for their user-friendly online tools and competitive pricing, while others bring innovative wellness programs to the table. For those concerned about company stability, several carriers consistently receive strong financial ratings.

Understanding Medigap Plans:

The beauty of Medigap plans lies in their standardization. A Plan G from one company offers identical basic benefits as Plan G from another company. This makes comparison shopping much simpler—you're basically comparing prices and company reputation rather than trying to decode complicated benefit differences.

In my experience helping Colorado Medicare beneficiaries, Plan G has become the gold standard since Plan F was discontinued for new enrollees in 2020. Plan G covers everything Plan F did except for the Part B deductible ($257 in 2025). Many of my clients find this an excellent value since the premium savings often exceed the deductible amount.

For those looking to save a bit more on monthly premiums, Plan N offers a solid alternative. You'll pay slightly less each month but will have small copays for some office visits (up to $20) and emergency room visits that don't result in hospital admission (up to $50). For healthy, budget-conscious seniors, this trade-off often makes good financial sense.

Important Medigap Enrollment Considerations:

Timing matters tremendously with Medigap. Your 6-month Medigap Open Enrollment Period begins the first month you have Medicare Part B and are 65 or older. This is your golden ticket to guaranteed coverage without health questions or higher rates due to pre-existing conditions. Miss this window, and you might face medical underwriting, higher premiums, or even denial of coverage.

I always make sure my clients understand how their policy is priced. Community-rated policies charge everyone the same premium regardless of age. Issue-age-rated policies base your premium on your age when you purchase, while attained-age-rated policies increase as you get older. That bargain-priced attained-age policy might not look so affordable ten years down the road!

For higher-income earners, I always discuss IRMAA (Income-Related Monthly Adjustment Amount). If your income exceeds certain thresholds, you'll pay surcharges on your Part B and Part D premiums. This won't affect your Medigap premium directly, but it's an important part of your overall Medicare budget.

"What I love about Medigap plans is the predictability they offer," I often tell my clients. "Yes, the monthly premium might be higher than a Medicare Advantage plan, but there's tremendous peace of mind in knowing exactly what your costs will be. There are no surprise network restrictions or unexpected bills—just straightforward coverage that works the same way anywhere in the country."

For more detailed information about the various Medigap options available to Colorado residents, I encourage you to visit our Medigap options page.

5. Medicare Special Needs Plan (SNP) Providers

When standard Medicare plans don't quite fit your unique health situation, Medicare Special Needs Plans (SNPs) step in to fill the gap. These specialized Medicare Advantage plans are designed with particular health challenges in mind, offering custom benefits that address specific conditions or circumstances.

Colorado residents currently have access to 21 different SNPs in 2024, each crafted to serve particular groups with care approaches that understand their unique needs. Think of these plans as custom-fitted healthcare rather than one-size-fits-all coverage.

Types of SNPs Available in Colorado:

Walking through the grocery store recently, I met Maria, who cares for her mother with both Medicare and Medicaid. She was overwhelmed by coordinating the two programs until she found Dual-Eligible SNPs (D-SNPs). These plans are specifically designed for people in her mother's situation, bringing together benefits from both programs under one umbrella.

D-SNPs often include extras that make a real difference in daily life: transportation to doctor appointments (no more stressful driving in Colorado snow), monthly allowances for over-the-counter health items, dental care that regular Medicare doesn't cover, and even meal delivery after hospital stays. For many dual-eligible Coloradans, these added benefits address crucial needs that affect overall health.

For those living with ongoing health conditions, Chronic Condition SNPs (C-SNPs) offer specialized support. Whether you're managing diabetes, heart failure, lung disease, or kidney problems, these plans include care coordination and medication coverage specifically aligned with your condition.

One of my clients with severe diabetes told me his C-SNP was "like having a healthcare team that actually understands what I deal with every day." The specialized provider networks in these plans mean you're seeing doctors who have expertise in your specific condition.

Major SNP Providers in Colorado:

When exploring Medicare insurance providers for Colorado in the SNP category, several stand out for their comprehensive offerings:

You'll find robust options with both D-SNPs and C-SNPs featuring strong care management programs. The care coordinators from these plans often receive praise from my clients for helping them steer complex health situations.

Some D-SNPs are known for generous supplemental benefits that go beyond basic medical care, addressing many of the social factors that impact health.

If you're looking for a D-SNP with additional services custom to dual-eligible individuals, you'll find plans worth considering, with strong local provider networks throughout Colorado.

For those with diabetes or heart conditions, several C-SNPs provide focused care with specialists who understand these common but challenging health issues.

Coloradans often appreciate the locally-focused approach of regional health plans, whose SNP options feature integrated care systems that coordinate all aspects of your healthcare journey.

"Special Needs Plans often become a lifeline for eligible individuals," Kelsey Mackley from our team at Kelmeg & Associates explains. "They address not just medical needs but also things like transportation and nutrition that deeply impact health outcomes. I've seen these plans transform the healthcare experience for many of our most vulnerable clients."

Key Benefits of SNPs:

The real value of SNPs lies in their specialized approach. Rather than navigating the healthcare system alone, you'll have dedicated care coordinators who help you manage both your health condition and the complex healthcare landscape. This personalized guidance is especially valuable for those with complicated health needs.

Benefits in these plans are thoughtfully designed for specific populations. If you require multiple medications for a chronic condition, for example, you'll find the prescription coverage in a C-SNP is built with your needs in mind.

For dual-eligible members, the integrated care approach means less paperwork, fewer headaches, and a more seamless experience. Instead of juggling Medicare and Medicaid separately, a D-SNP brings everything together under one plan.

Perhaps most appealing for many members is the cost structure. Most D-SNPs offer very low or even no out-of-pocket costs for covered services, thanks to the coordination with Medicaid benefits.

To qualify for an SNP, you need to meet the specific eligibility requirements of the plan (having both Medicare and Medicaid for D-SNPs, or having a qualifying chronic condition for C-SNPs) and live within the plan's service area in Colorado.

If you think an SNP might be right for your situation, our team at Kelmeg & Associates can help determine your eligibility and find the plan that best addresses your unique healthcare needs.

6. Independent Medicare Insurance Agencies & Counseling Resources in Colorado

Let's face it – Medicare can feel like trying to solve a puzzle with too many pieces. That's why so many Colorado residents turn to independent Medicare insurance agencies and free counseling resources to help them put it all together.

The Role of Independent Medicare Insurance Agencies

Think of independent agencies like Kelmeg & Associates as your personal Medicare guides. Unlike agents who can only offer plans from one insurance company, we can show you options from multiple carriers to find what truly fits your needs.

Working with an independent Medicare insurance agency gives you several advantages:

First, you get unbiased guidance. Since we represent multiple insurance companies, we can focus on finding what's best for you, not pushing a particular company's plans. When I sit down with clients, I often say, "I don't care which carrier you choose – I care that you get the right coverage."

You'll also benefit from personalized plan comparisons. We take the time to check if your doctors, preferred hospitals, and prescription medications are covered by each plan we consider. This detailed analysis often reveals differences that aren't obvious at first glance.

Perhaps most valuable is the ongoing support throughout the year. Medicare doesn't end after enrollment – questions about claims, coverage issues, and annual plan changes will come up. Having someone familiar with your situation who can help steer these challenges is invaluable.

Our local expertise means we understand the nuances of Colorado's healthcare landscape. We know which plans work well in mountain communities versus urban areas, and which provider networks are strongest in different regions of our state.

Best of all, these services come at no extra cost to you. Insurance companies pay agents like us, so you get professional guidance without paying more for your Medicare plan.

"Medicare is not one-size-fits-all," I often tell my clients at Kelmeg & Associates. "What works perfectly for your neighbor or friend might not be the right fit for you. We take the time to understand each client's unique healthcare needs, preferences, and budget to find the most appropriate coverage."

For assistance from a Medicare Licensed Insurance Agent in Colorado, contact us at Kelmeg & Associates for a free, no-obligation consultation.

Free Medicare Counseling Resources in Colorado

Beyond independent agencies like ours, Colorado offers several excellent free resources to help you steer Medicare insurance providers for Colorado:

The State Health Insurance Assistance Program (SHIP) provides free, unbiased Medicare counseling through 17 local assistance sites around Colorado. Their counselors can answer questions about benefits, coverage, and your rights. You can reach Colorado SHIP at 1-888-696-7213.

If you're concerned about potential Medicare fraud or billing errors, the Senior Medicare Patrol (SMP) can help. They assist beneficiaries in preventing, detecting, and reporting Medicare fraud and abuse. Contact Colorado SMP at 1-800-503-5190.

Medicare.gov offers the Medicare Plan Finder tool, which allows you to enter your specific medications and preferences to compare plans. It's a great starting point, though many people appreciate having someone walk them through the results.

The Social Security Administration handles Medicare enrollment and applications for Extra Help with prescription drug costs. You can call them at 1-800-772-1213 or visit your local Social Security office.

"We often work in conjunction with these free resources," I tell clients. "For example, we might help you narrow down your options, then suggest you confirm your decision with SHIP counselors for additional peace of mind."

If you need help finding a doctor who accepts Medicare, you can use the Medicare Doctor Finder tool to search for providers in your area.

At Kelmeg & Associates, we believe that making informed Medicare decisions shouldn't be a solo journey. Whether you work with us or another resource, having knowledgeable guidance through the Medicare insurance providers for Colorado landscape can make all the difference in finding coverage that truly meets your needs.

Frequently Asked Questions about Medicare Insurance Providers for Colorado

What's the difference between Medicare Advantage and Medigap?

When my clients ask about this crucial distinction, I explain it this way: think of Medicare Advantage and Medigap as two different paths to improved coverage, each with its own approach.

With Medicare Advantage, you're essentially replacing Original Medicare with a private plan (though you still have Medicare). These plans typically bundle everything together - they include prescription drug coverage and often add extra goodies like dental, vision, and gym memberships. The monthly premiums tend to be lower (many $0-premium options exist in Colorado), but you'll generally have network restrictions and variable costs when you actually use services. The good news? There's always an annual cap on your out-of-pocket spending for covered services.

Medigap (Medicare Supplement) takes a different approach. It works alongside your Original Medicare, stepping in to pay many of the costs Medicare doesn't cover. You'll need a separate Part D plan for prescription drugs, and you won't get those extra benefits like dental care. The monthly premiums are typically higher, but your out-of-pocket costs become much more predictable, and you can see any doctor nationwide who accepts Medicare.

"I find that clients who prioritize flexibility and predictability often prefer Medigap, while those focused on lower upfront costs and all-in-one convenience tend to choose Medicare Advantage," explains Kelsey Mackley. "There's no universally 'better' option - it's about matching the approach to your personal preferences and healthcare needs."

Are $0-premium Medicare Advantage plans really free?

The short answer? Not exactly. While the "$0 premium" label is technically accurate, it's important to understand the complete cost picture.

Even with a $0-premium plan, you'll still pay your Medicare Part B premium ($174.70/month for most people in 2025). And when you actually use healthcare services, you'll typically have copayments or coinsurance - perhaps $25 for a primary care visit, $50 for a specialist, or $295 per day for the first few days of a hospital stay.

Many of these plans also have deductibles for certain services, particularly prescription drugs. And while there is an annual out-of-pocket maximum (a crucial protection), that cap might be several thousand dollars.

"I always help my clients look beyond the premium to understand their likely total annual costs," says Kelsey. "For someone who rarely sees doctors, a $0-premium plan might truly be very low-cost. But for someone managing multiple health conditions with frequent appointments and prescriptions, a plan with a modest premium but lower copays might actually save money in the long run."

How do I check if my doctor is in a plan's network?

This question is absolutely critical when considering Medicare insurance providers for Colorado, especially for Medicare Advantage plans where going out-of-network can significantly increase your costs.

The most reliable approach is to contact the insurance company directly - either call their customer service line or use their online provider directory search tool. Be sure to have your doctors' full names and addresses handy, as many physicians with common names practice in the same area.

You can also call your doctors' offices directly and ask which Medicare Advantage plans they accept. This approach has the added benefit of confirming whether they're still accepting new Medicare patients.

If you're working with an agent like our team at Kelmeg & Associates, we can research this information for you as part of our complimentary service. We have access to up-to-date provider directories and can often save you hours of phone calls.

"Provider networks can and do change throughout the year," Kelsey cautions. "I always recommend verifying with both the plan and your providers before making a final decision, and then re-checking periodically, especially if you're referred to a new specialist."

When can I change my Medicare coverage?

Medicare provides several specific windows for making changes to your coverage. Understanding these periods is essential for managing your healthcare effectively.

The Annual Enrollment Period (October 15-December 7) is your main opportunity each year to join, switch, or drop a Medicare Advantage Plan or a Medicare drug plan. Any changes you make during this period will take effect on January 1.

If you're already in a Medicare Advantage Plan and want to make a change, you get a second chance during the Medicare Advantage Open Enrollment Period (January 1-March 31). During this time, you can switch to a different Medicare Advantage Plan or return to Original Medicare (and join a separate Medicare drug plan if needed).

Life doesn't always follow a schedule, which is why Medicare also offers Special Enrollment Periods for specific situations - perhaps you've moved outside your plan's service area, lost employer coverage, your plan has left Medicare, or you've qualified for Extra Help with prescription costs.

"Even if you're happy with your current coverage, I recommend reviewing your options during the Annual Enrollment Period each fall," Kelsey advises. "Plans adjust their benefits, costs, and networks annually, and your health needs may have changed too. A quick review can either confirm you're still in the right plan or reveal a better option."

What assistance is available for low-income Medicare beneficiaries in Colorado?

Medicare costs can strain limited budgets, but several valuable programs can help Coloradans with limited income and resources.

The Extra Help program provides substantial assistance with Part D prescription drug costs, reducing or eliminating premiums and deductibles and lowering your copayments. For many people, this benefit is worth thousands of dollars annually.

Medicare Savings Programs (MSPs) help pay Medicare Part B premiums (saving you $174.70 monthly in 2025) and, depending on which specific program you qualify for, may also cover deductibles, coinsurance, and copayments.

Those with very limited income and resources may qualify for Medicaid, which provides additional coverage alongside Medicare. And if you have both Medicare and Medicaid, you might benefit from a Dual-Eligible Special Needs Plan (D-SNP) - these specialized Medicare Advantage plans are specifically designed to coordinate these two types of coverage.

"I've found that many people who qualify for these assistance programs don't realize they're eligible," notes Kelsey. "The income and resource limits are often higher than people expect, especially for Extra Help. At Kelmeg & Associates, we can help screen for eligibility and connect you with the right resources to apply."

Conclusion

Navigating Medicare insurance providers for Colorado doesn't have to be overwhelming. With the right information and guidance, you can find a plan that meets your healthcare needs and fits your budget.

At Kelmeg & Associates, Inc., we're dedicated to helping Colorado residents find their way through the Medicare maze. From Lafayette to Broomfield, Boulder to Adams County, and everywhere in between, we're here to support you with personalized guidance that won't cost you a penny extra.

I've been helping Colorado seniors with their Medicare decisions for years, and I've seen how the right coverage can bring peace of mind. The Medicare landscape in our beautiful state offers plenty of options – Original Medicare as your foundation, Medicare Advantage plans with their extra benefits, Part D coverage for your medications, and Medigap plans to fill those coverage gaps.

What makes Colorado special for Medicare beneficiaries in 2025? Nearly all Medicare-eligible residents can access at least one $0-premium Medicare Advantage plan. And the average premium has actually decreased to $12.20, down from $15.11 last year – bucking the trend of rising healthcare costs.

Remember though, the lowest premium doesn't always mean the lowest overall cost. That's where our expertise comes in handy. As an independent agency, we compare plans from multiple carriers rather than pushing a single company's options. We'll help you understand the full picture – premiums, deductibles, copays, and whether your doctors and medications are covered.

Beyond our services, don't forget that Colorado offers excellent free resources like the State Health Insurance Assistance Program (SHIP). These counselors provide unbiased Medicare guidance that can complement the assistance we provide.

Whether you're turning 65 and new to Medicare, considering a change during the Annual Enrollment Period, or helping a parent or loved one with their coverage, we're here to help. We'll sit down together, review your specific needs, and find the Medicare solution that works best for you.

For more information about Medicare guidance and to schedule a no-obligation consultation, visit our Medicare information page. Let's work together to find the Medicare coverage that gives you the care you need at a price you can afford.