Your Guide to Group Health Insurance Agents in Colorado Springs

Finding Group Health Insurance for Your Colorado Springs Business

Navigating colorado springs group health insurance shouldn't feel like climbing Pikes Peak without a map. As a local business owner, you're looking for coverage that protects your team without breaking the bank—and we're here to help guide you through the process.

When your Colorado Springs business offers group health coverage, you're doing more than checking a benefits box. You're creating a powerful tool for attracting top talent in our competitive local market while potentially securing more affordable coverage than your employees could find on their own. By pooling risk across your team, you typically open up more stable rates and better coverage options—a win-win for everyone.

Colorado springs group health insurance comes with financial advantages beyond employee satisfaction. Your contributions toward premiums are tax-deductible business expenses, directly improving your company's bottom line while investing in your most valuable asset: your people.

Here in the Pikes Peak region, businesses have several distinct options. Traditional fully-funded ACA plans offer predictability, while newer level-funded alternatives can provide significant savings (often 10-20%) for healthier groups. The right choice depends on understanding your unique workforce needs, budget constraints, and compliance requirements.

For small businesses with 2-50 employees, you qualify for small group coverage with specific protections under the ACA. Your premiums will be based on factors like employee age, your group size, and your business location within El Paso County. To qualify, you'll need at least one full-time employee working 30+ hours per week (besides the owner).

Independent brokers like us at Kelmeg & Associates provide access to multiple carriers, ensuring you get unbiased recommendations rather than being pushed toward a single insurance company's offerings. This approach gives your business more options and often better rates.

Hi there—I'm Kelsey Mackley, an insurance specialist at Kelmeg & Associates with years of experience helping Colorado Springs businesses find their ideal health insurance solutions. I understand our local market inside and out, and I'm committed to making this process as smooth as possible for you and your team.

Colorado Springs Group Health Insurance 101

Group health insurance isn't just another employee perk—it's a powerful tool for your business growth and team wellbeing. At its heart, colorado springs group health insurance provides health coverage through a single policy that protects your employees and often their family members too.

In our Colorado Springs market, small group health insurance specifically refers to plans for businesses with 2-50 full-time equivalent employees. This size distinction matters because insurance carriers in Colorado must accept any employer group within this range, as long as you commit to covering all eligible employees.

What is Group Coverage?

Think of group coverage as a shared umbrella of protection. Rather than each employee facing the health insurance marketplace alone with their individual risk factors, group plans spread that risk across your entire team.

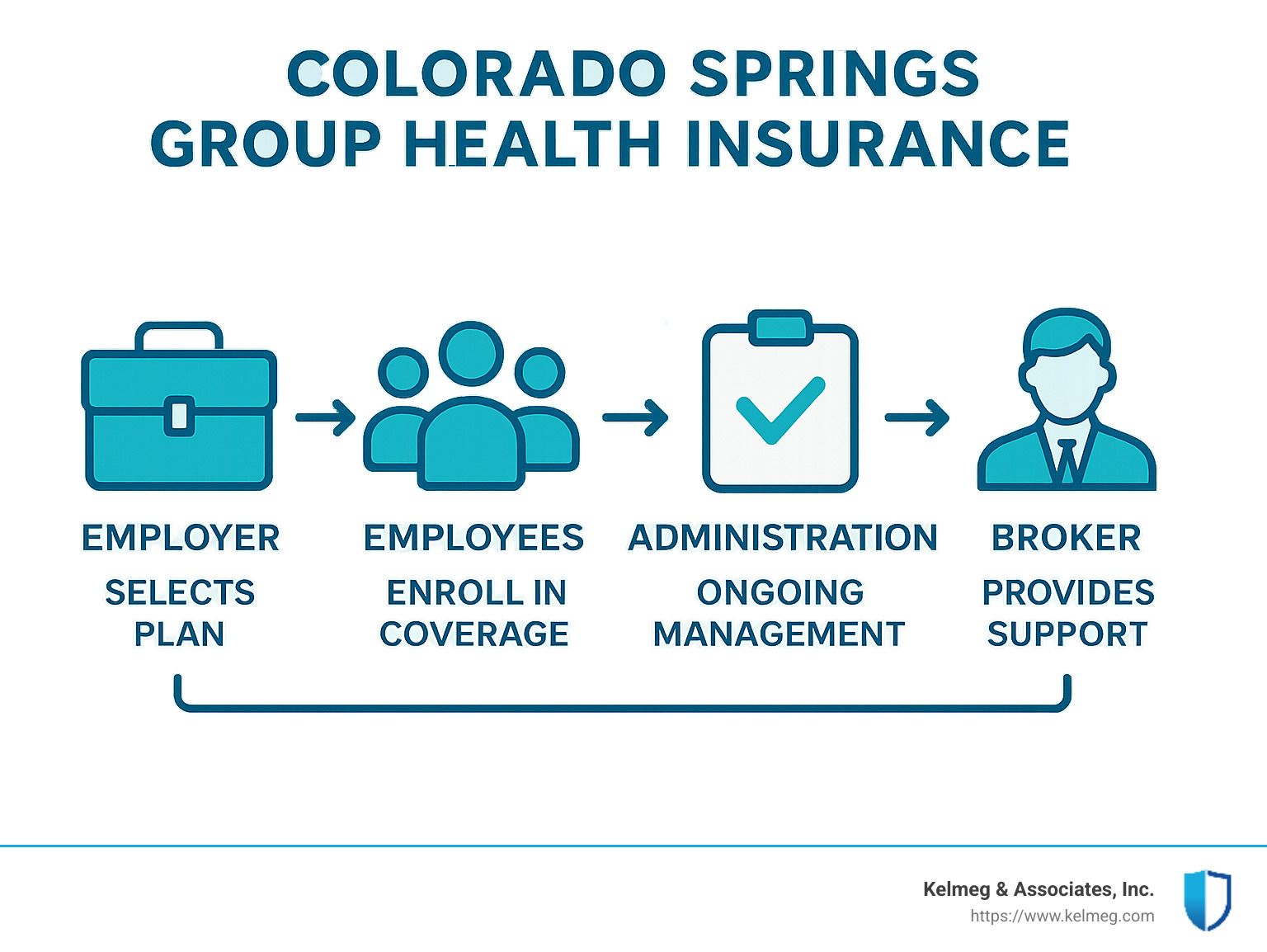

The beauty of this arrangement is its simplicity. You, as the employer, select the plan options and decide how much to contribute toward premiums. Your employees then enroll, perhaps paying a portion through convenient payroll deductions, and gain access to healthcare when they need it. Meanwhile, the insurance carrier handles the behind-the-scenes work of processing claims and maintaining provider networks.

Most Colorado Springs businesses share premium costs with employees—some covering the full employee-only premium while others contribute a set percentage. These contributions are tax-deductible business expenses, creating a financial win alongside the obvious benefit of healthier employees.

As Maria, a local restaurant owner, shared with us: "When we started offering colorado springs group health insurance, I was worried about the cost. But the tax advantages and how much easier it's made hiring good people has more than made up for it."

How Does It Work in Colorado Springs?

Our local market has some distinct characteristics worth understanding. El Paso County sits in its own rating area within Colorado's health insurance system, meaning our premiums and options differ from those in Denver or Grand Junction.

For Colorado Springs business owners, group health insurance typically works through:

Connect for Health Colorado Small Business – Our state's health insurance marketplace offers a SHOP (Small Business Health Options Program) with access to qualified health plans and potential tax credits for eligible smaller businesses.

Beyond the marketplace, many Colorado Springs companies work directly with independent brokers like us at Kelmeg & Associates to access plans from the full range of carriers serving our area. This approach often provides more options and personalized guidance.

Our unique local landscape influences what makes sense for your team. With major employers like the military installations, healthcare systems, and growing tech sector, Colorado Springs has workforce needs unlike other parts of the state. Local provider networks and hospital systems also affect which plans will work best for your employees.

We understand these Pikes Peak region dynamics and can help you steer them to find the perfect colorado springs group health insurance solution that balances your budget with your employees' needs.

Comparing Plan Types & Costs in Colorado Springs

Shopping for colorado springs group health insurance can feel a bit like browsing a menu where everything sounds good, but you're not quite sure what fits your budget. Let's break down your options in a way that makes sense for your business.

Fully Funded "Classic Rock" Plans

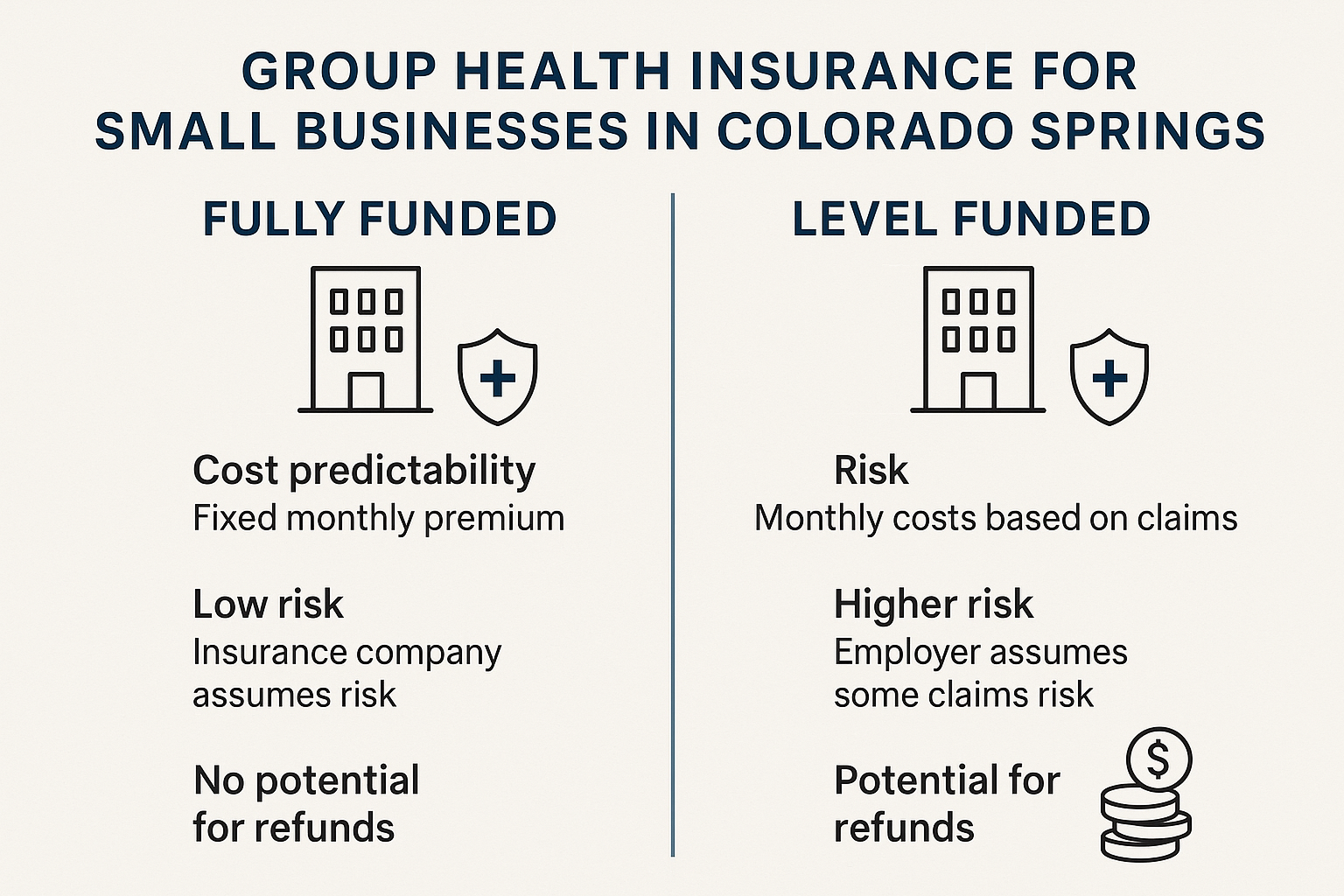

Think of fully funded plans as the reliable classics on your favorite radio station – they've been around forever because they work. Since the Affordable Care Act rolled out in 2008, these traditional plans have been the go-to choice for many Colorado Springs businesses.

With these plans, your business pays a set monthly premium that doesn't change regardless of how much healthcare your team actually uses. The insurance carrier takes on all the financial risk, which means you get predictability for your budget. Your premiums stay stable throughout the year, making financial planning much easier.

One Colorado Springs restaurant owner told me, "I chose a fully funded plan because I wanted to know exactly what was coming out of our account each month. We might pay a bit more, but that certainty helps me sleep at night."

These plans follow ACA community rating rules, meaning carriers can't charge you more based on your employees' health status. Everyone gets covered, regardless of pre-existing conditions, and all essential health benefits are included by law.

Level Funded "New Kid" Plans

Level funded plans are the exciting newcomers that have been shaking up the colorado springs group health insurance scene. They offer a fresh approach that many small businesses find appealing.

These hybrid plans work a bit differently. You still pay a fixed monthly amount, but it's divided into three buckets: funds for expected claims, stop-loss insurance (protection against unexpectedly high claims), and administrative costs. The magic happens at the end of the year – if your team had fewer claims than expected, you could get money back in the form of a refund.

"We switched to level funded last year," a local tech company founder shared with me over coffee. "Not only did we save about 12% on our monthly payments compared to our old plan, but we got a nice little refund check at renewal that covered our company holiday party."

For healthier groups, these plans can deliver savings of 10-20% compared to traditional fully funded options. That's real money back in your business.

Key Cost Drivers

When it comes to what affects your colorado springs group health insurance costs, several factors come into play:

Your team's age profile makes a big difference – since the ACA, small group rates are based on each employee's age. A younger workforce typically means lower premiums. Your group size matters too – more employees generally means better rates as the risk spreads wider.

Your business's specific location within Colorado Springs and El Paso County affects pricing, as insurance costs vary by geographic rating area. Some carriers also consider your industry type when setting rates, with certain business categories facing potential premium adjustments.

How much your business contributes toward premiums not only affects your bottom line but also impacts employee participation rates. Finding the sweet spot in your contribution strategy can make a big difference.

Research from healthcare.gov shows that thoughtful cost-sharing approaches often create the best balance between keeping premiums affordable and ensuring employees don't avoid necessary care due to out-of-pocket costs.

Colorado Springs Group Health Insurance Price Benchmarks

While every business is unique, here's what you can generally expect to pay for colorado springs group health insurance in 2025:

For single coverage, monthly premiums typically run between $500-$850 per employee. Family coverage is naturally higher, usually falling somewhere between $1,350-$2,200 monthly. If you're looking to save, HSA-eligible high-deductible plans often come with premiums that are 15-25% lower than standard plans.

These figures represent the total premium before your business's contribution. Most Colorado Springs employers cover between 50-100% of employee-only premiums, with a smaller percentage (if any) of dependent coverage.

One of the nicest surprises for employees is that group health insurance is almost always more affordable than what they'd find on the individual market. Between your contribution as an employer and the power of group risk-pooling, your team members typically come out ahead financially – creating that rare win-win situation we're always hoping to find in business.

How to Qualify, Get Quotes & Enroll Employees

Getting colorado springs group health insurance for your business doesn't have to be complicated. In fact, when you work with the right partner, the process becomes surprisingly straightforward. Let me walk you through how it all works, from checking if you qualify to getting those shiny new insurance cards in your employees' hands.

Qualification Checklist

First things first – does your business actually qualify for small group health insurance? The good news is that the bar isn't as high as many business owners think. Here's what you need:

You must have at least one full-time employee who isn't you (the owner) or your spouse. That's right – just one! According to the IRS full-time definition, "full-time" means they work at least 30 hours per week.

These employees need to be W-2 employees, not 1099 contractors. And most carriers in Colorado Springs require that at least 70% of your eligible employees enroll in the plan (though there are sometimes exceptions during special enrollment periods).

I recently helped a local startup with just three employees get group coverage. They were shocked they qualified! "We thought we needed at least 10 employees," the founder told me. "Finding out we could get better coverage at a lower cost than our individual plans was a game-changer for our team."

The Quote-to-Card Timeline

Once we establish that you qualify, here's how the process typically unfolds:

It starts with your employee census – a simple spreadsheet with basic information about each employee (age, zip code, and whether they'll include dependents). With just this information, we can generate quotes from multiple carriers.

At Kelmeg & Associates, we pride ourselves on our quick turnaround. Provide us your census today, and you'll have comprehensive quotes to review by tomorrow. No waiting around for weeks wondering what your options might be.

After reviewing your quotes, you'll select the plan that best fits your team's needs and budget. Then comes enrollment, which is typically handled through user-friendly online portals where employees can review their options and complete their applications.

Before you know it, coverage begins on your effective date, and those insurance cards arrive (either physical cards in the mail or digital versions for immediate access).

One Colorado Springs dental practice we work with described the process as "surprisingly painless." Their office manager told me, "I was dreading this whole process, but you made it so simple. Our team had their insurance cards within two weeks of our initial conversation."

Managing Ongoing Support

Getting your colorado springs group health insurance plan set up is just the beginning of our relationship. The real value comes in the day-to-day management and support throughout the year.

We'll handle your annual renewals, starting the conversation 60-90 days before your renewal date to make sure you have plenty of time to review options without feeling rushed. Throughout the year, we process employee changes as your team evolves – new hires, departures, or life events like marriages or new babies.

For employees who leave, we help with COBRA administration, ensuring compliance with continuation coverage requirements. And when your employees inevitably have questions about claims or coverage, we're there to help. Nothing is more frustrating than being stuck on hold with an insurance company for hours – that's why we handle those calls for you.

A local engineering firm's HR director summed it up perfectly: "What I appreciate most is never having to deal directly with the insurance company. When an employee had a major hospital bill incorrectly denied, our Kelmeg advisor spent three hours on the phone getting it resolved. That kind of service is priceless."

We also keep you updated on compliance requirements and changes to healthcare laws that might affect your business. The healthcare landscape is always evolving, and staying compliant shouldn't be another full-time job for you.

For a complete look at how we support your business year-round, check out our services page.

What Makes a Great Group Health Insurance Agent in Colorado Springs

Finding the right partner for your colorado springs group health insurance needs isn't just about getting quotes – it's about finding someone who'll be in your corner throughout the entire journey. Let me share what truly separates exceptional insurance professionals from the merely adequate ones.

Independent & Unbiased

There's a world of difference between brokers and captive agents. While captive agents work for a single insurance company, independent brokers like us at Kelmeg & Associates represent multiple carriers. This distinction matters tremendously for your business.

When you work with an independent broker, you get access to a variety of options rather than being limited to whatever one company offers. We don't have sales quotas for specific carriers, which means our recommendations are genuinely based on what's best for your business – not what earns us the biggest commission.

I recently helped a local construction company switch from a captive agent to our independent services. The owner was shocked when we presented options from six different carriers, telling me, "Our previous agent only ever showed us one option – I had no idea we had so many choices!"

Deep Knowledge of Colorado Springs Group Health Insurance Market

Local expertise isn't just a nice bonus – it's essential. The colorado springs group health insurance market has unique characteristics that require specialized knowledge. A great local agent understands:

Which hospital systems and medical groups participate in which networks (crucial information when your employees want to keep their doctors)

How El Paso County's specific rating area affects your premiums compared to Denver or other regions

Which regional carriers offer competitive rates specifically in our area

Our team at Kelmeg lives and works in Colorado Springs. We know which plans give the best access to UCHealth facilities, which networks include the most popular specialist groups in town, and which carriers have built solid reputations for service in our community. This local insight simply can't be matched by national call centers or online-only brokers.

Tech-Enabled Enrollment Tools

Today's best insurance professionals blend personal service with smart technology. We've invested in tools that make life easier for you and your employees:

Online enrollment portals eliminate stacks of paperwork and allow employees to complete their selections from anywhere. Mobile apps give your team instant access to ID cards and benefits information. And our systems can integrate with your existing HR software, creating a seamless experience.

As one local business owner told me after their first digital enrollment: "My HR person almost cried with joy when she realized she wouldn't have to chase down paper forms from 23 employees. Everyone completed their selections online in just two days!"

Proactive Compliance & ACA Guidance

The regulatory landscape for health insurance is complex and constantly shifting. Great agents don't just sell you a policy and disappear – they provide ongoing guidance to keep you compliant.

At Kelmeg, we regularly update clients on changing regulations, assist with required employee notices, guide you through ACA reporting requirements, and help with Summary of Benefits and Coverage (SBC) distribution. For larger groups, we also provide support with Form 5500 filings.

This compliance assistance is particularly valuable for small businesses without dedicated HR departments. Our proactive approach helps you avoid potential penalties while reducing your administrative burden.

Hands-On Employee Education

Your investment in colorado springs group health insurance only delivers full value when employees understand and appreciate their benefits. The best agents recognize this and offer comprehensive education:

We conduct on-site enrollment meetings where we explain options in clear, jargon-free language. We provide one-on-one consultations for employees with specific questions or concerns. And recognizing Colorado Springs' diverse workforce, we offer multilingual support, particularly in Spanish.

A local manufacturing company owner recently shared: "The difference was night and day. Instead of just handing out confusing booklets, Kelmeg's team held meetings in both English and Spanish. For the first time, all our employees truly understood their benefits."

The right insurance partner becomes an extension of your team – someone who knows your business, understands your employees' needs, and works tirelessly to deliver the best possible coverage at the most competitive rates. When you're evaluating potential partners for your colorado springs group health insurance, look beyond the initial quotes to find someone who'll deliver this level of comprehensive service.

Business & Employee Benefits of Offering Group Plans

When you offer colorado springs group health insurance to your team, you're doing more than just providing healthcare—you're making a strategic investment that pays dividends for both your business and your employees. Let's explore the impressive returns this investment can generate.

Add-On Coverages to Boost Value

Think of health insurance as the foundation of your benefits house—solid and essential. But the real magic happens when you add complementary coverages that transform a basic plan into a comprehensive benefits package.

Dental insurance is often the first add-on businesses consider, and with good reason. It's relatively affordable yet highly valued by employees and their families. Regular dental care promotes overall health and prevents costly problems down the road. As one Colorado Springs restaurant owner told us, "Adding dental coverage was a no-brainer—it cost us about $25 per employee monthly but became one of our most appreciated benefits."

Vision insurance is another low-cost, high-value addition. Covering eye exams, glasses, and contacts, vision plans address needs that medical plans typically don't touch. For employees staring at screens all day (which describes most of us these days!), this benefit offers practical, everyday value.

Life insurance provides peace of mind that resonates deeply with employees who have families depending on their income. Group rates make this coverage surprisingly affordable, and most plans offer guaranteed issue for all employees regardless of health status. You can structure it as fully employer-paid or offer it as a voluntary benefit.

Disability insurance creates a financial safety net that many employees wouldn't secure on their own. Whether it's short-term coverage for common situations like maternity leave or long-term protection for serious illnesses, disability insurance helps employees maintain financial stability during challenging times.

Employee Assistance Programs (EAPs) might be the most underrated benefit in your arsenal. These programs provide confidential counseling and support for mental health concerns, legal issues, work-life balance challenges, and more. The cost is typically just a few dollars per employee monthly, but the return in wellbeing and productivity can be enormous.

For more comprehensive information about these and other benefit options, visit our Employer Group Benefits page.

ROI for Small Businesses

The business case for offering colorado springs group health insurance goes far beyond simply checking a benefits box. Smart employers recognize the substantial return on investment these plans deliver.

Talent attraction becomes markedly easier when you offer quality health benefits. In Colorado Springs' competitive job market, candidates often choose between similar salary offers based on benefits packages. Health insurance consistently ranks as the most desired non-salary benefit, giving businesses that offer it a decisive edge in recruiting. One local software company shared, "Before we offered group health insurance, we lost three top candidates to competitors. Since implementing our plan, our offer acceptance rate has jumped from 65% to 92%."

Employee retention improves dramatically with quality health coverage. The costs of turnover—recruiting, training, lost productivity, and institutional knowledge—typically far exceed the employer's share of insurance premiums. Health benefits create what some HR professionals call "golden handcuffs"—a positive connection that makes leaving more difficult. A Colorado Springs manufacturing company reported: "We reduced annual turnover from 37% to just 12% after implementing comprehensive health benefits. The savings in recruitment and training alone more than covered our premium contributions."

Tax advantages sweeten the deal considerably. Your contributions toward employee premiums are fully tax-deductible as a business expense. Meanwhile, employee contributions can be made pre-tax through Section 125 plans, reducing both their taxable income and your payroll taxes. Some small businesses may even qualify for the Small Business Health Care Tax Credit.

Productivity improvements might be harder to measure but are no less real. Employees with good health coverage are more likely to seek preventive care, address health issues early, and miss fewer workdays due to illness. They also experience less financial stress over medical costs, allowing them to focus more fully on their work. As one local business owner put it, "The peace of mind our team feels knowing they're covered is reflected in their engagement and output every single day."

Workplace culture benefits profoundly from offering health coverage. When you invest in your employees' wellbeing, you signal that you value them as people, not just as workers. This fosters loyalty, trust, and a more positive work environment. Many Colorado Springs employers report that implementing health benefits marked a turning point in their company culture, creating a more cohesive, committed team.

At Kelmeg & Associates, we've helped hundreds of Colorado Springs businesses implement group health plans that deliver meaningful returns on investment. We'd love to help you find how the right benefits package can transform your business while supporting your most valuable asset—your people.

Colorado Springs Group Health Insurance FAQs

How much does it cost for a 10-person team?

When Colorado Springs business owners ask me about costs for a 10-person team, I always start with "it depends" – because it truly does! Your final colorado springs group health insurance costs will vary based on your employees' ages, the plans you select, and which carrier you choose.

That said, I can share some general benchmarks based on what we're seeing in the market for 2025:

For a typical 10-person Colorado Springs business, monthly premiums often range:

- Basic coverage with higher deductibles might run $5,000-$6,500 total per month

- Mid-level coverage with moderate deductibles and copays typically falls between $6,000-$8,000 monthly

- Premium coverage offering low deductibles and comprehensive benefits could reach $7,500-$9,500 monthly

These figures represent the total premium before your company's contribution. Most Colorado Springs businesses contribute between 50-75% of the employee-only premium, with employees covering the rest plus any dependent costs.

One of our local clients, a software development firm, recently shared: "For our team of 12, we pay about $4,000 monthly toward employee premiums. While it's our second-largest expense after payroll, the value we get in retention and recruitment makes it completely worthwhile."

Are group plans cheaper than individual policies?

The short answer? Yes, colorado springs group health insurance plans typically provide better value than individual policies for most people. This cost advantage stems from several key factors:

First, group plans benefit from risk pooling – spreading healthcare costs across multiple employees creates more stable, predictable pricing. Second, employer contributions significantly reduce what employees pay out-of-pocket. Third, employee contributions usually come out pre-tax, effectively giving them a discount equal to their tax rate. Finally, group plans enjoy administrative efficiencies that lower per-person costs.

To put this in perspective, a 40-year-old Colorado Springs resident shopping for an individual Silver plan might pay $550-$650 monthly with zero employer help. That same person on a group plan might contribute just $120-$220 per month after their employer's contribution.

It's worth noting that lower-income individuals might qualify for marketplace subsidies that can make individual coverage competitive in some cases. However, for middle-income employees without subsidy eligibility, group coverage almost always delivers better value and coverage.

Can startups with only two employees qualify?

Absolutely! This is one of the biggest misconceptions I encounter about colorado springs group health insurance. Many entrepreneurs assume they need a large team to qualify, but that's simply not true in Colorado.

The reality is that businesses with as few as one full-time W-2 employee (who isn't the owner or owner's spouse) can qualify for group health insurance. This makes quality group coverage accessible to startups and micro-businesses throughout the Pikes Peak region.

For these very small groups, you'll need to meet a few basic requirements:

- At least one W-2 employee working 30+ hours weekly

- A legitimate, established business (with tax ID, business license, etc.)

- Coverage offered to all eligible employees

- Meeting minimum participation requirements (typically 70%)

I recently worked with a Colorado Springs tech startup founder who told me, "We started with just three people and assumed group insurance was completely out of reach. Our broker showed us we not only qualified but could actually get better coverage than we had cobbled together with individual plans."

For budget-conscious startups, I often recommend starting with a more basic plan that can be improved as your business grows. This approach lets you offer the valuable benefit of group coverage while managing your initial expenses in those critical early years.

Conclusion

Finding the right colorado springs group health insurance solution feels a bit like hiking Pikes Peak – the journey might seem daunting at first, but with the right guide by your side, you'll reach your destination feeling confident and prepared.

At Kelmeg & Associates, we've walked this path with hundreds of Colorado businesses, from small startups to established companies with dozens of employees. We understand that each business has its own unique needs, culture, and budget considerations.

Our approach combines local expertise with personalized service. We don't just hand you a quote and disappear – we become your year-round partner in managing your benefits program. As one client recently told us, "It's like having an insurance department without having to hire one."

We pride ourselves on offering:

- Truly independent recommendations based on your needs, not carrier incentives

- Deep knowledge of Colorado Springs healthcare networks and providers

- Streamlined enrollment processes that minimize disruption to your business

- Ongoing support for both HR teams and individual employees

- Clear, jargon-free explanations that help everyone understand their benefits

Whether you're offering group health insurance for the first time or looking to improve your existing benefits package, we're here to help you steer the options. Our no-pressure consultations give you space to ask questions, explore possibilities, and make informed decisions about your company's healthcare strategy.

Investing in colorado springs group health insurance isn't just about checking a box for benefits – it's about creating a healthier, more productive workplace where employees feel valued and protected. It's about gaining a competitive edge in recruiting and keeping your best talent. And yes, it's about managing costs in a way that makes sense for your bottom line.

Ready to explore your options? We offer complimentary consultations to discuss your specific situation and needs. Our team serves businesses throughout Colorado, including Lafayette, Broomfield, Boulder, Adams County, and of course, our home base in Colorado Springs.

For more information or to schedule your consultation, visit our Employer Group Benefits page or reach out directly. We're real people who genuinely care about helping your business thrive through better benefits solutions.

Your employees trust you with their livelihoods – we'd be honored to help you protect their health and wellbeing while strengthening your business for the future.