Unlocking Affordable Health Insurance for Colorado's Small Businesses

Quick answer to your search: here's what you need to know right now about health insurance for small business colorado:

- Who qualifies? Businesses in Colorado with 2 to 50 full-time employees.

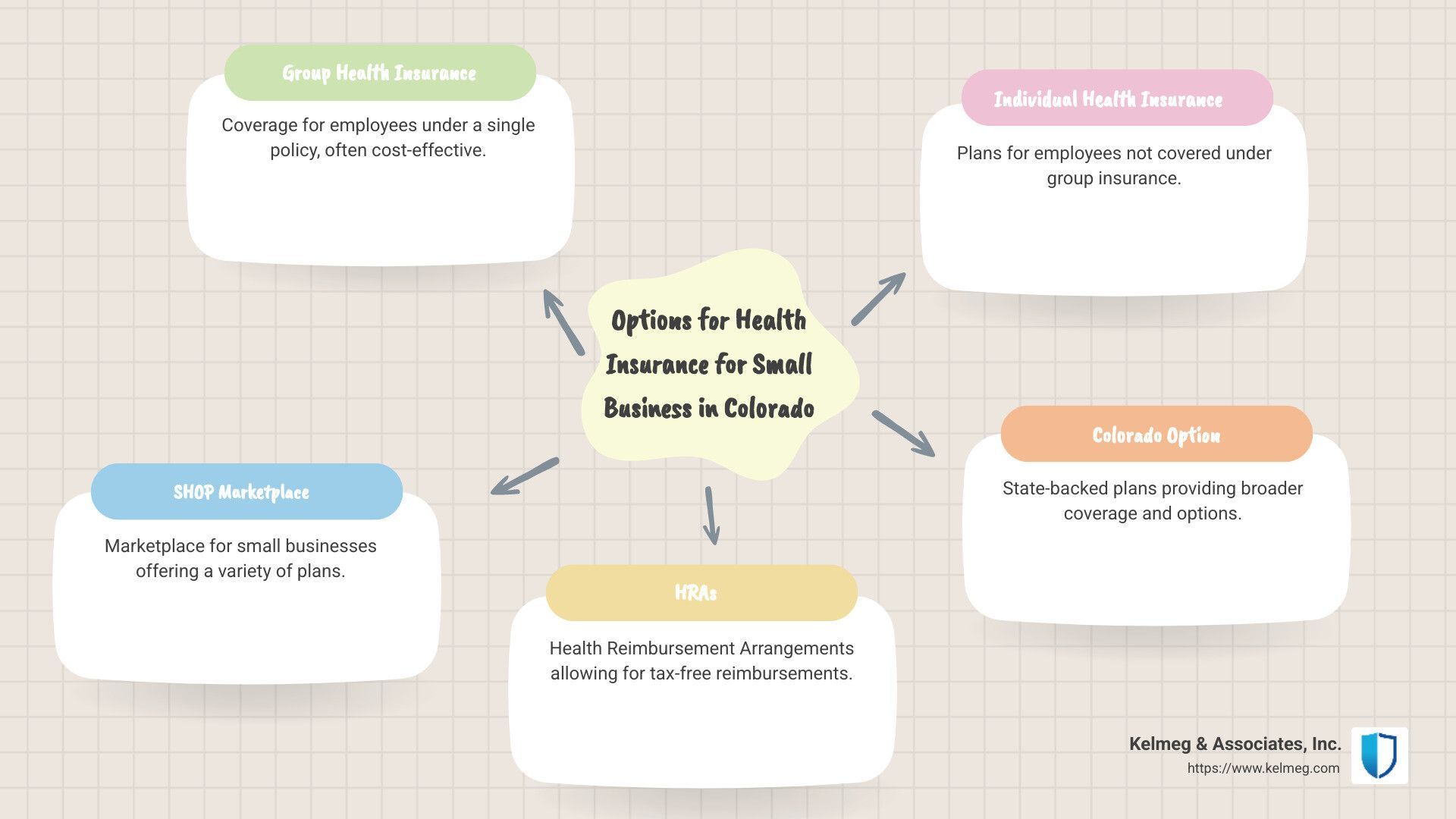

- Plan options include: Group health insurance, SHOP Marketplace, and Health Reimbursement Arrangements (HRAs).

- Tax benefits available: Small business tax credits cover up to 50% of employee premiums.

- What if you don't offer insurance? While businesses with fewer than 50 employees aren't legally required to offer coverage, doing so boosts retention, productivity, and competitiveness.

Finding health insurance is tough, especially if you're new to it. Colorado small businesses face unique challenges: rising healthcare costs, lots of confusing plan types, and complicated ACA compliance rules. And when you're trying to attract and keep great employees, providing affordable and reliable health coverage is a must.

As an insurance specialist at Kelmeg & Associates, I'm Kelsey Mackley, and I've spent years simplifying health insurance for small business colorado, helping businesses just like yours find affordable, straightforward options. Let's walk through your choices step-by-step, starting with the basics:

Health Insurance for Small Business in Colorado: Options and Benefits

When you're running a small business, it can feel like you're juggling ten things at once—and health insurance is often the most confusing ball in the air. But here's the good news: understanding your choices for health insurance for small business Colorado doesn't have to be overwhelming. With the right guidance, you can select a plan that works great for your employees and your budget, helping your business grow stronger at the same time.

Types of Health Insurance Plans Available

In Colorado, small businesses have several great options to consider. Let's take a quick tour:

Health Maintenance Organizations (HMOs) are a popular choice due to their lower premiums. Employees select a primary care physician within the network and typically need referrals before seeing specialists. They're a bit less flexible, but they're budget-friendly.

Preferred Provider Organizations (PPOs) offer more freedom. Employees don't usually need referrals to visit specialists, and there’s broader network flexibility. The trade-off? PPO premiums are typically higher than HMOs—but many employees love the extra choice.

High Deductible Health Plans (HDHPs) have lower monthly premiums but come with higher deductibles. These plans are often paired with Health Savings Accounts (HSAs), which let employees save money tax-free for medical expenses. This combo is popular because it provides savings opportunities and gives employees more control over healthcare spending.

Point of Service (POS) Plans blend features of HMO and PPO plans. Employees still choose a primary care physician but have more flexibility when seeking care out-of-network. It's the best of both worlds if you're looking for balance between cost and choice.

One small business owner from Boulder recently told us, "Before understanding our options, I thought buying group health insurance would be complicated. Once we got proper guidance, it was surprisingly easy—and our employees love the coverage we picked."

Exploring the Colorado Option

Have you heard about the Colorado Option? It's a newer type of health plan created specifically to make quality health coverage more affordable and accessible for Colorado small businesses.

The beauty of the Colorado Option is its simplicity. These standardized plans have consistent core benefits, making it easy to compare coverage and pricing. Another great perk: the Colorado Option aims to keep premiums low over time, helping small businesses better manage health insurance costs.

For small businesses, this means providing employees with reliable, affordable coverage without excessive administrative headaches. Plus, these plans are part of Colorado's broader effort to expand healthcare access, especially in communities that have traditionally been underserved.

Exploring Group Health Insurance Plans

Group health insurance remains the most common way to provide health insurance for small business Colorado—and with good reason. By pooling your employees together, you can access better rates and comprehensive coverage.

With group plans, you can choose from two main approaches: fully funded or level funded.

Fully funded plans are straightforward and predictable. You pay a set monthly premium, and your insurance carrier covers all claims costs. These plans are ACA compliant and offer guaranteed coverage—perfect if you're looking for simplicity and stability. As one insurance expert put it, "Fully funded plans are like the reliable minivan of health insurance: dependable, practical, and easy to manage."

Level funded plans are newer and gaining popularity quickly. They blend elements of self-funding (where you pay employees' claims directly) and traditional insurance protection. The upside? If your employees have fewer claims than expected, you may receive a refund at the end of the year. It offers more flexible plan design options and detailed claims reporting as well—ideal if you'd like more transparency and possible cost savings.

You can even explore plans through the Small Business Health Options Program (SHOP) Marketplace. SHOP plans offer year-round enrollment, flexible coverage choices, and may qualify you for valuable small business tax credits—making them a smart choice to consider.

For more detailed insights, check out our guide on Group Health Insurance Plans in Colorado.

Leveraging Health Reimbursement Arrangements (HRAs)

If traditional group plans aren't ideal for your business, Health Reimbursement Arrangements (HRAs) could be your solution. These employer-funded plans reimburse employees directly for qualified healthcare expenses, including premiums. Think of an HRA as giving your employees the flexibility to choose their own plans—while keeping costs predictable for your business.

There are two main types of HRAs small businesses in Colorado can use:

Individual Coverage HRAs (ICHRAs) allow employers to reimburse employees tax-free for individual health insurance premiums. You decide how much to contribute based on employee classes, and employees select the coverage that fits them best. The ICHRA model offers serious flexibility, and even large employers are jumping on board. For an easy-to-follow overview, see the latest information about ICHRAs.

Qualified Small Employer HRAs (QSEHRAs) are specifically for businesses with fewer than 50 full-time employees. They also reimburse medical expenses and individual insurance premiums tax-free. However, they're subject to annual contribution limits, and employees must have minimum essential coverage.

HRAs offer genuine advantages: they can simplify administration, control costs, and give your employees the freedom to choose. As one Colorado small business owner explained, "Switching to an ICHRA allowed us to better control costs and gave our employees the flexibility they really appreciated. It felt like a win-win."

No matter your choice, understanding these options clearly makes finding the right health insurance for small business Colorado simpler and more manageable. If you'd like personalized help sorting through these choices, our team at Kelmeg & Associates is always here to guide you—at no extra cost.

Eligibility Criteria for Small Business Health Insurance in Colorado

If you're considering offering health insurance for small business Colorado, the first step is understanding whether your business meets the eligibility criteria. The good news? It's usually pretty straightforward—but there are a few important details you'll want to know before diving in.

Basic Eligibility Requirements

In Colorado, to qualify for small group health insurance, your business needs to meet a few key criteria:

First, your business must have at least two eligible employees. This typically includes the owner, as long as the owner isn't the only employee. Generally, insurance companies define eligible employees as those working at least 30 hours per week (full-time), although this can vary slightly by carrier.

Second, your company needs to be officially domiciled in Colorado. In other words, your primary business location and operations should be based right here in our beautiful Centennial State.

Lastly, insurance providers usually ask employers to meet minimum contribution requirements. Most carriers expect businesses to contribute at least 50% of the employee-only premium or a minimum amount per employee (often around $125/month). This helps keep coverage affordable and encourages employee participation.

In Colorado, the term "small business" for health insurance purposes typically applies if you have between 2 and 50 full-time equivalent employees (FTEs). However, some insurance carriers extend this definition to include groups of up to 100 employees, giving slightly larger businesses additional options.

Understanding Full-Time Equivalent (FTE) Employees

You might be wondering, what exactly are "full-time equivalent employees"? Don’t worry, it’s simpler than it sounds!

An FTE calculation includes all full-time employees (those working 30+ hours per week, on average) and part-time workers, whose hours combine to equal additional full-time positions. To calculate your total FTE number:

- Start by counting your full-time employees—each one counts as one FTE.

- Then, add up the total number of hours worked by your part-time employees each month. Divide this monthly total by 120 (the standard benchmark) to find your additional FTE number.

- Finally, add your part-time FTE calculation to your full-time employee count, and voilà—you've got your total FTE number.

Here's a quick example to clear things up: Suppose your small business has 10 full-time employees. You also have 20 part-time staff who each work 60 hours per month. The math looks like this:

- Your 10 full-time workers equal 10 FTEs.

- Your 20 part-timers contribute (20 employees x 60 hours per month) ÷ 120 = 10 additional FTEs.

- Add those two numbers together (10 + 10), and your business has 20 total FTEs.

That wasn't too bad, right?

Minimum Participation Requirements

To qualify for most group health insurance plans in Colorado, your business will typically need to meet minimum participation requirements. Usually, this means around 70% of your eligible employees must enroll in the plan you offer.

For example, let's say you have 10 eligible employees. Generally, at least 7 of those individuals would need to enroll to satisfy a 70% minimum participation rule. But don't stress yet—employees who already have coverage through a spouse's plan, Medicare, or another qualifying insurance source usually don't count against this percentage, making the target easier to reach for your small business.

Meeting these criteria might seem overwhelming at first glance, but it's quite manageable—especially when you have friendly experts to guide you through the process. At Kelmeg & Associates, we specialize in simplifying health insurance for small business Colorado, making sure you understand the details without headaches. After all, you've got enough on your plate running your amazing business!

Tax Credits and Financial Assistance Available

Let's be honest—providing health insurance for small business Colorado isn't always easy on the budget. But here's some good news: the government offers valuable tax credits and financial assistance designed specifically to help small businesses like yours afford quality health coverage.

Small Business Health Care Tax Credit

One of the biggest financial boosts is the Small Business Health Care Tax Credit—created especially to help small businesses with the cost of employee coverage.

To qualify for this credit, your business needs fewer than 25 full-time equivalent employees who earn an average annual wage of less than $50,000 (adjusted annually for inflation). Additionally, you'll need to cover at least half of your employees' premium costs and purchase your insurance through the SHOP Marketplace.

If you meet these criteria, you could enjoy a tax credit covering up to 50% of the premiums you pay for two consecutive tax years. (And if you're a tax-exempt organization, you can still qualify for up to 35% savings on premiums.)

One of our clients, a coffee shop owner in downtown Denver, shared this experience: "Honestly, we were hesitant about offering health coverage at first. But finding this tax credit changed everything—it cut our premiums nearly in half and made health insurance genuinely affordable for our small team."

Maximizing Tax Benefits

Beyond the Small Business Health Care Tax Credit, there are several other ways your business can save money when offering health insurance:

First, your contributions toward employee premiums are typically 100% tax-deductible as a business expense. This means your overall taxable income decreases, lowering your tax bill at year's end.

Second, consider setting up a Section 125 or Cafeteria Plan, which lets your employees pay their share of premiums with pre-tax dollars. Not only does this save them money, it reduces your payroll taxes too. It's a simple and popular way to provide additional value to your employees without extra cost to your business.

Third, if you're offering High Deductible Health Plans (HDHPs), pairing these with Health Savings Accounts (HSAs) can be a win-win. Your contributions to employee HSAs are tax-deductible for your business, and your employees can use these funds tax-free for qualified medical expenses.

To make sure you're tapping into every possible tax advantage, it's smart to regularly review your health insurance arrangement—ideally each year—with a tax professional. They can help you steer IRS guidelines, maximize deductions, and ensure you're fully compliant.

Bottom line: With thoughtful planning and the right support (like the kind you get from our team at Kelmeg & Associates), offering health insurance for small business Colorado can become not just manageable—but genuinely affordable.

Navigating ACA Compliance in Colorado

When you're running a small business, keeping track of healthcare rules might not top your list of favorite things. (Right up there with tax season, right?) But understanding the Affordable Care Act (ACA) and its impact on health insurance for small business Colorado is essential. The good news: it's simpler than it sounds once you have the basics down.

Let's dive in gently—no jargon or scary stuff ahead!

Key ACA Requirements for Small Businesses

First things first: your ACA responsibilities depend on how many full-time equivalent (FTE) employees you have.

If your Colorado business has fewer than 50 FTE employees, you're not legally required to offer health insurance. That's right—no penalties, no mandates. But if you do choose to offer coverage (and there are plenty of good reasons to!), the plans must follow certain ACA rules. This means your coverage needs to include essential health benefits, can't put dollar limits on benefits, and must offer preventive services (like screenings and check-ups) without any cost-sharing. Plus, young adults can stay on their parents' plan until they turn 26.

However, if your business has 50 or more FTE employees, the ACA rules get more serious. You're required to offer "affordable" and "minimum value" health insurance to your full-time employees and their dependents. Plus, you'll need to report your coverage details to the IRS every year. If you don't meet these criteria, you might face penalties. (And let's be honest—no one enjoys penalties.)

In short, even if your business is on the smaller side, understanding ACA compliance can save you headaches down the road. And if your team is approaching the 50-employee mark, it's especially important to stay prepared. That way, you'll smoothly transition into meeting ACA requirements.

Utilizing the SHOP Marketplace

Feeling overwhelmed by the ACA rules? Colorado's Small Business Health Options Program (SHOP) Marketplace is designed specifically to simplify your life when it comes to offering ACA-compliant insurance.

The SHOP Marketplace helps small businesses (with 1–50 FTE employees) easily offer coverage and keeps administration as straightforward as possible. With SHOP, you can access exclusive benefits like the Small Business Health Care Tax Credit, giving eligible businesses significant savings (up to 50% of employee premium costs—pretty generous, right?).

SHOP plans offer flexibility, too. You can select a coverage category—Bronze, Silver, Gold, or Platinum—and either pick a single plan or let your employees choose from multiple options within the category. You just decide how much you'll contribute toward employee premiums (at least 50% to qualify for the tax credit).

Another big plus? SHOP lets you enroll employees year-round. Unlike individual coverage, you aren't limited to a short open enrollment window. That means you can start offering great health insurance anytime—a huge advantage for growing businesses that are always welcoming new team members.

The enrollment process is straightforward:

- Confirm your business eligibility (1–50 FTE employees in Colorado).

- Pick your preferred coverage category and decide how many plan choices you'll offer employees.

- Determine how much your business will contribute toward premiums.

- Notify your employees about their options.

- Finalize enrollment through an insurance company, directly through the state marketplace, or worked through a SHOP-registered agent.

As a Colorado small business owner shared with us recently, "SHOP made ACA compliance simple and stress-free for our team. It felt great to know our employees were covered and we weren't missing anything important."

So, while ACA rules might seem intimidating at first, you'll quickly find your rhythm. And remember—working with experienced local experts (like us at Kelmeg & Associates) means you'll never have to steer this alone. We'll guide you through ACA compliance smoothly and confidently—so you can get back to running your business.

Benefits of Health Insurance for Small Business in Colorado

Providing health insurance for small business Colorado isn't just about checking a box on your to-do list—it's about investing in the long-term health of your employees and your business. When you offer quality healthcare coverage, you're sending a clear message: you care about your team, their well-being, and their future.

Employee Retention and Satisfaction

Let's face it, happy employees tend to stick around. And in today's highly competitive job market, comprehensive health insurance often ranks at the top of employees' wish lists—right alongside things like flexible hours and good coffee in the break room.

Offering health benefits significantly reduces employee turnover. When employees know their medical needs are covered, they're much less likely to jump ship at the first sign of another opportunity. Reduced turnover means you'll save big on recruiting and training expenses, helping your bottom line.

Beyond that, providing health insurance builds genuine loyalty. Employees who know their employer is invested in their health and happiness become more committed to the company's mission. One local Colorado employee put it best when she said, "It's not just about the pay—it's about the feeling of security knowing your employer has your back. It makes you want to keep showing up."

Health coverage is also a powerful competitive advantage. When you're trying to attract the very best candidates in a tight labor market, offering robust health benefits helps you compete with larger corporations. It levels the playing field and lets you showcase your business as an attractive workplace.

Increased Productivity and Healthier Workforce

Healthy employees are productive employees. When your team has access to quality healthcare, they're more likely to address medical issues promptly, reducing overall absenteeism. Employees don't need to tough it out at home or come to work sick—both situations that can quickly impact your team's efficiency.

Health insurance encourages your team to prioritize preventive care like regular check-ups, screenings, and vaccinations. Catching health concerns early not only helps employees stay healthier—it also lowers costs down the road.

Many plans also provide mental health support, which is increasingly important in today's workplace. When your employees have access to counseling and mental health resources, they'll be better equipped to manage stress, anxiety, and other challenges. This leads to greater well-being and productivity overall.

Finally, health insurance provides your employees with financial security. Medical expenses can be devastating without coverage, causing financial stress that inevitably seeps into productivity and morale. With health insurance, your team members—and their families—can have peace of mind.

Legal Compliance Advantages

Even if you don't have a legal obligation under the ACA to offer health insurance (businesses with fewer than 50 employees generally don't), providing coverage helps you manage other compliance-related issues.

For example, comprehensive healthcare coverage can help reduce reliance on workers' compensation claims. When employees have robust medical coverage, they're less likely to turn to workers' comp for non-work-related health problems.

Additionally, providing insurance plans with mental health coverage can help your business comply with the Americans with Disabilities Act (ADA). You're better equipped to accommodate employees with mental health conditions, fostering an inclusive workplace.

Health insurance also ensures your recruitment practices are equitable and consistent. Offering coverage to all eligible employees signals a commitment to fairness, helping you avoid unintended discrimination issues.

Consequences of Not Providing Health Insurance in Colorado

While there's no legal penalty for smaller companies in Colorado (under 50 full-time equivalent employees) that don't offer insurance, there are still significant potential drawbacks to skipping coverage.

Not offering health insurance can put your business at a competitive disadvantage. Talented potential hires might choose another company—one that offers attractive benefits. Current employees may look elsewhere too, resulting in higher turnover rates and added recruitment and training costs.

Without health benefits, your workforce might delay necessary medical care. Untreated health problems can lead to increased absenteeism and decreased productivity. Financial stress from medical bills or inadequate coverage can negatively impact employee performance and morale.

Finally, your company's reputation as an employer could suffer. You don't want to be known as "that company"—the one that doesn't invest in employee health. As one small business owner in Boulder candidly shared, "When we didn't offer health insurance, we lost valuable employees to competitors who did. The cost of replacing great people far outweighed what we would have spent on premiums."

Offering health insurance for small business Colorado isn't just about compliance or keeping up appearances. It's about creating a thriving workplace, attracting and keeping stellar employees, and ultimately, setting your business up for long-term success.

Finding and Comparing Health Insurance Plans Effectively

Let's face it—shopping for health insurance for small business Colorado can feel overwhelming. With so many plans, providers, and terms to understand, it's easy to feel lost. But don't worry! Finding the right health insurance for your small business doesn't have to be stressful. Let's go through some proven strategies to simplify the process and help you make the best choice for your team.

Working with Health Insurance Brokers

One of the smartest decisions you can make is partnering with an experienced health insurance broker—like the team at Kelmeg & Associates. Brokers bring valuable insights and can help eliminate much of the confusion around choosing coverage.

A good broker will advocate for your best interests, not the insurance company's, and they'll provide personalized recommendations custom specifically to your small business needs. They'll help you understand tricky insurance terminology, guide you through application and enrollment, and even provide ongoing support when questions arise about claims or coverage.

Here's the best part: working with a broker typically won't cost you anything extra. Brokers like Kelmeg & Associates receive compensation directly from insurance providers, meaning you get expert advice and assistance at no additional cost.

Online Tools and Resources

Another helpful way to explore your options is by using online tools. Connect for Health Colorado, the state’s official health insurance marketplace, offers valuable resources to help small businesses compare SHOP plans and understand financial assistance opportunities.

You can also use Quick Cost and Plan Finder tools to estimate premiums, coverage, and potential tax credits. Visiting insurance carrier websites directly can give you additional insight into plan specifics, provider networks, and prescription coverage.

When comparing options online, remember to focus on the big picture—not just the monthly premiums. Look into provider networks (are your employees' favorite doctors included?), deductible amounts, prescription drug coverage, and preventive care services. As one seasoned business owner wisely put it: "The cheapest plan isn't always the best value. Look closer, and you'll often find better options."

Evaluating Plan Options and Coverage

So, what exactly should you be looking for when comparing plans? Start by considering overall costs, including monthly premiums, deductibles, copayments, coinsurance, and out-of-pocket maximums. Don't forget about potential tax benefits available through programs like the Small Business Health Care Tax Credit, either.

Next, pay close attention to coverage aspects. Make sure the plan's provider network includes your employees' preferred doctors and hospitals. Check prescription drug coverage to see if frequently-used medications are covered. Consider whether preventive care services and specialty care visits are offered without too many hoops to jump through.

Lastly, think about administrative ease. You'll want a plan that's straightforward to manage, enroll employees into, and handle claims efficiently. Great customer service, online management tools, and quick claims processing will save you and your team time and frustration down the road.

Benefits of Using a Professional Employer Organization (PEO)

For some small businesses, working with a Professional Employer Organization (PEO) might be an ideal way to simplify health insurance and HR tasks. A PEO essentially partners with your business in a co-employment arrangement. They become the employer of record for tax and insurance purposes—meaning they handle payroll, taxes, compliance, and benefits administration—while you remain in control of daily operations and decision-making.

Why might this work well for you? Because PEOs pool employees from multiple small businesses together, they often have greater negotiating power with insurers. This can mean lower premiums and access to broader, more comprehensive health coverage options than you could find on your own.

Additionally, a PEO handles HR administration, payroll processing, tax compliance, and risk management—freeing you up to focus on running your business. You can learn more about how a PEO can help manage your health insurance and HR tasks on Our Services page.

Resources and Assistance Programs in Colorado

Thankfully, Colorado offers numerous resources specifically designed to support small business owners as they steer the health insurance landscape. You can access certified local experts who provide free, unbiased guidance custom specifically to your business. They'll help determine your eligibility for financial assistance, suggest suitable coverage options, and walk you through the enrollment process step by step.

There's also valuable support offered through state-sponsored programs. The Colorado Division of Insurance provides educational materials for small employers, while the Small Business Development Center Network offers one-on-one consultations on employee benefits strategies. The Connect for Health Colorado marketplace is another excellent resource to find specialized assistance aimed at small businesses like yours.

At Kelmeg & Associates, our certified experts have proudly served small businesses in Lafayette, Broomfield, Boulder, and throughout Adams County for years. We're dedicated to helping you find the perfect health insurance solution—which means clearer choices, less stress, and happier, healthier employees.

If you'd like more personalized guidance or have questions about your options, don't hesitate to reach out. We're here to help you find the best health insurance for your small business in Colorado.

Find more about our Employer Group Benefits today!

Conclusion

Investing in health insurance for small business colorado goes way beyond just another expense—it's truly an investment in your company's success. The right coverage shows your employees that you value their health and well-being, helping you attract and retain the best talent in a competitive job market.

Offering health insurance can lead to happier, healthier employees. When your team has reliable health coverage, they're far more likely to seek preventive care and address health issues early. That means fewer sick days, greater productivity, and a more positive, productive workplace overall.

Let's not forget the financial perks. By providing health coverage, your business could qualify for valuable tax incentives, like the Small Business Health Care Tax Credit. That can significantly lower your overall health insurance costs, making coverage affordable even for tight budgets.

Creating a culture that shows you care about your employees' health also boosts morale and loyalty. Employees who feel supported stick around longer, saving you the headache—and expense—of constant hiring and training. Plus, offering health insurance helps your small business compete with larger companies and stand out as a preferred employer.

But we get it—navigating health insurance can feel overwhelming, especially for busy small business owners like you. The good news? You don't have to figure it out alone. Working with experts like our team at Kelmeg & Associates makes the whole process easier, simpler, and even enjoyable.

After all, every small business is unique—there's no one-size-fits-all health plan. Finding your best-fit coverage depends on your company's unique circumstances, like your budget, your employees' health needs, and your long-term growth goals. At Kelmeg, we're committed to making sure you get the right coverage custom specifically to your small business.

As a small business owner in Lafayette told us recently, "Health insurance doesn't have to be complicated. If you're feeling stuck, just call an expert—it made all the difference for our business."

Ready to take the next step? Reach out to Kelmeg & Associates today for a free, no-obligation consultation. Our friendly team of experts will guide you through your options, answer all your questions, and help you find affordable, comprehensive coverage that fits your business perfectly.

By choosing the right health insurance for small business colorado, you're not just checking off a box—you're making a strategic move that can positively impact your company's future and your employees' lives.