Colorado's Best Individual Dental Insurance Plans: A List to Smile About

Individual dental insurance colorado is a vital consideration for anyone seeking to maintain their oral health without breaking the bank. If you're new to health insurance, or simply exploring your best options in Colorado, here's what you need to know:

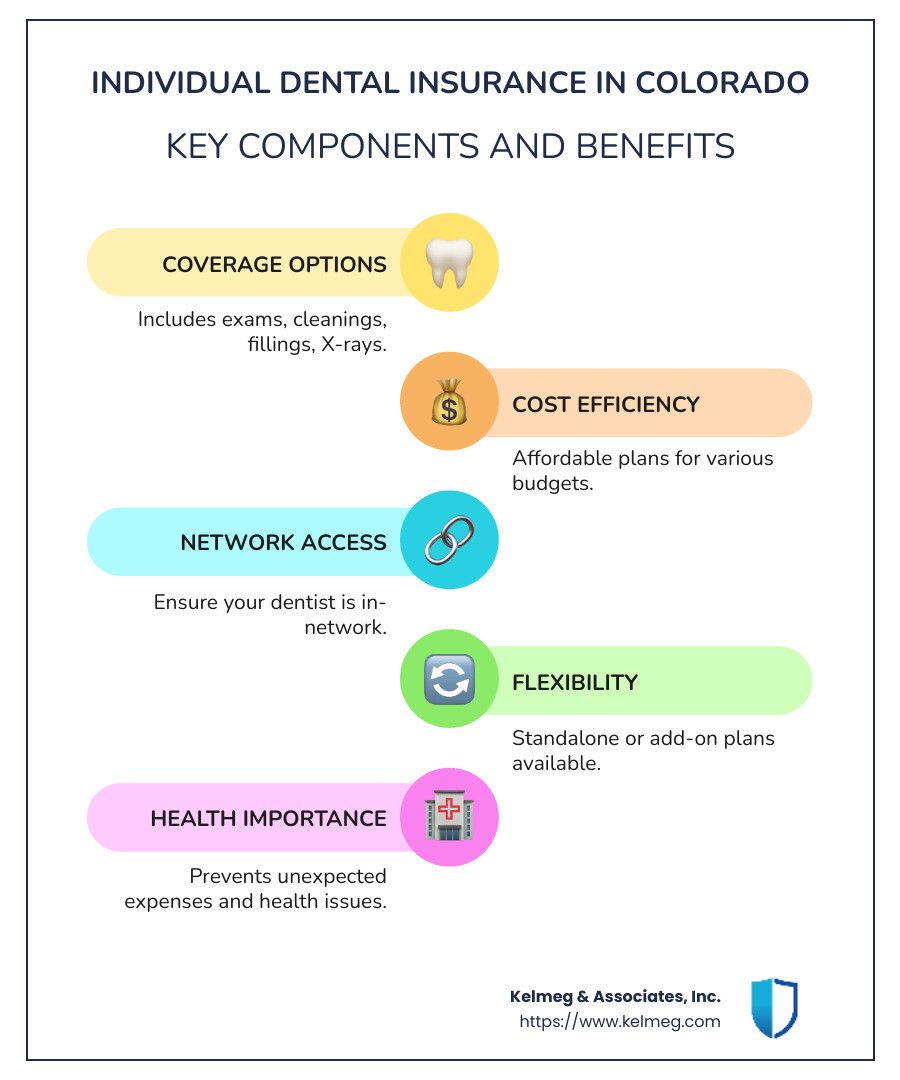

- Coverage Options: Plans typically include preventive exams, cleanings, and routine procedures like fillings and X-rays.

- Cost: Affordable plans are available, custom to fit various budgets.

- Network Access: Ensure your preferred dentist is within the insurance network to minimize costs.

- Flexibility: Options range from standalone plans to plans that can be added to your health insurance.

Dental health is crucial not just for a healthy smile but for your overall well-being. In Colorado, with its unique insurance landscape, choosing the right dental plan can prevent unexpected expenses and health issues down the line.

My name is Kelsey Mackley, an insurance specialist at Kelmeg & Associates, Inc. With experience in guiding clients through the complexities of individual dental insurance colorado, I'm here to simplify your search for the perfect coverage.

Understanding Individual Dental Insurance in Colorado

When it comes to individual dental insurance Colorado, understanding your options is key to making the best choice for your needs. Let's break down the essentials:

Coverage Options

Individual dental insurance plans in Colorado typically cover a range of services. Most plans include:

- Preventive Care: Routine exams and cleanings are often covered at no additional cost. This helps keep your teeth healthy and catch any potential issues early.

- Basic Procedures: Fillings and X-rays are generally covered, ensuring that minor dental problems don't turn into major ones.

- Major Procedures: Some plans extend coverage to more complex services like root canals, dentures, and bridges. It's important to compare plans to see which procedures are included.

Cost Range

The cost of dental insurance can vary based on the level of coverage you choose. In Colorado, plans are designed to be affordable, catering to a wide range of budgets. Here's a general idea of what you might expect:

- Basic Plans: These usually have lower premiums, making them a good choice if you primarily need preventive care.

- Comprehensive Plans: These cover a broader range of services and may have higher monthly premiums but can save you more in the long run if you need extensive dental work.

No Waiting Periods

One standout feature of many dental insurance plans in Colorado is the absence of waiting periods for preventive services. This means you can start using your benefits right away for routine care, which is a huge plus for maintaining your oral health.

Choosing the right individual dental insurance Colorado plan can be straightforward when you know what to look for. By considering your specific needs and budget, you can find a plan that provides peace of mind and keeps your smile bright.

Top Features of Individual Dental Insurance Plans in Colorado

When selecting an individual dental insurance Colorado plan, it's important to focus on three key features: comprehensive coverage, flexible options, and affordability. Let's explore each of these features in detail to help you make an informed decision.

Comprehensive Coverage

One of the standout features of dental insurance plans in Colorado is their comprehensive coverage. Most plans cover:

- Preventive Services: Routine cleanings and exams are typically included at no extra cost. This proactive approach helps prevent more serious dental issues down the line.

- Basic Procedures: Treatments like fillings and X-rays are usually covered, ensuring that minor dental problems are addressed promptly.

- Major Procedures: Many plans also include coverage for more complex services, such as root canals, bridges, and dentures. This can be particularly beneficial if you anticipate needing significant dental work.

Flexible Options

Flexibility is another major advantage of Colorado's dental insurance plans. Whether you're looking for a plan that offers a wide network of dentists or one that allows you to see specialists without referrals, there's likely an option that fits your needs:

- Network Variety: Plans often include a broad network of dental providers, giving you the freedom to choose a dentist you trust.

- Plan Types: From PPOs that offer more provider choices to HMOs that reduce costs, you have the flexibility to choose a plan that aligns with your preferences and budget.

Affordability

Affordability is a crucial factor when choosing dental insurance. Colorado offers a range of plans designed to fit different financial situations:

- Competitive Pricing: The cost of dental insurance in Colorado is generally competitive, with options available for every budget.

- Cost Savings: By investing in a comprehensive plan, you can save money in the long run, especially if you require extensive dental care. Preventive services are often covered at no cost, helping you maintain oral health without breaking the bank.

In summary, the top features of individual dental insurance Colorado plans—comprehensive coverage, flexible options, and affordability—make them a smart choice for anyone looking to maintain their oral health. By understanding these features, you can select a plan that not only meets your dental needs but also fits your financial situation.

Next, let's dive into the benefits of individual dental insurance and how it can positively impact your overall health and finances.

Benefits of Individual Dental Insurance

Choosing an individual dental insurance Colorado plan comes with several key benefits that can make a significant difference in your oral health and finances. Let's explore these benefits in detail.

Preventive Care

One of the biggest advantages of having dental insurance is access to preventive care. Regular check-ups and cleanings are typically covered at 100%, meaning you can get routine care without worrying about costs. This proactive approach helps catch potential issues early, preventing more serious (and costly) problems down the line.

According to the research, plans often cover routine cleanings and exams without a deductible, making it easier to maintain good oral health.

Cost Savings

Dental procedures can be expensive, but with the right insurance plan, you can significantly reduce your out-of-pocket expenses. Most plans cover a portion of the costs for basic and major procedures, such as fillings, X-rays, and even root canals. This means you won't have to bear the full cost of dental treatments.

Consider this: By investing in a comprehensive plan, you not only save on preventive care but also on more extensive treatments. This can lead to long-term savings, especially if you anticipate needing significant dental work.

Network Access

Having a wide network of dental providers is another benefit of individual dental insurance. Many plans offer access to a broad range of dentists, giving you the flexibility to choose a provider you trust. This network access ensures you can find a dentist who meets your needs and preferences.

For instance, plans like PPOs provide the freedom to see specialists without referrals, while HMOs help keep costs low by offering services within a specific network. This means you can choose a plan that aligns with your needs and budget, making dental care more accessible and affordable.

By understanding the benefits of individual dental insurance Colorado plans—preventive care, cost savings, and network access—you can make an informed decision about your dental health. These benefits not only help maintain your oral health but also provide financial peace of mind.

Next, let's address some frequently asked questions about individual dental insurance in Colorado.

Frequently Asked Questions about Individual Dental Insurance Colorado

How much does dental insurance cost per month in Colorado?

The cost of dental insurance in Colorado varies depending on the plan you choose. On average, the monthly premium for a stand-alone family dental plan in 2023 was about $59.01. However, you can find plans ranging from as low as $0 up to $232 per month. The price largely depends on the level of coverage, your location, and the insurance provider. It's essential to compare different plans to find one that fits your budget and meets your dental needs.

Is it worth paying for dental insurance?

Absolutely! Paying for dental insurance can be a smart financial move, especially when considering preventive care and long-term savings. Dental insurance often covers preventive services like check-ups and cleanings at 100%, which helps catch issues early and avoid costly treatments later on. This proactive care can significantly reduce the likelihood of expensive procedures in the future, such as root canals or crowns. By investing in dental insurance, you not only protect your oral health but also save money over time.

Why are dentists no longer taking insurance?

Some dentists are opting out of insurance networks due to loss of autonomy and treatment restrictions. Insurance companies often have strict guidelines on what treatments are covered and how much they will pay, which can limit a dentist's ability to offer personalized care. Dentists may feel that insurance constraints prevent them from providing the best possible treatment to their patients. As a result, some choose to operate outside of insurance networks to maintain control over their practice and ensure they can offer the treatments they believe are most beneficial for their patients.

Conclusion

In the journey to finding the right individual dental insurance in Colorado, having expert guidance can make all the difference. That's where we at Kelmeg & Associates, Inc. come in. Our mission is to simplify the process of choosing a dental plan that aligns perfectly with your needs and budget.

We offer personalized plans that cater to individuals, families, and even small businesses. Our team understands the complexities of dental insurance and is committed to helping you steer through various options. Whether you need comprehensive coverage or a more basic plan, we ensure you have access to the best choices available.

What sets us apart is our dedication to providing expert guidance at no extra cost. We believe everyone deserves peace of mind when it comes to their health and finances. By partnering with us, you gain access to our wealth of knowledge and experience, empowering you to make informed decisions about your dental care.

Take the next step towards securing your dental health by exploring our individual and family insurance options. With Kelmeg & Associates, Inc., you’re not just choosing a plan; you’re choosing a partner in your health journey. Let us help you smile with confidence, knowing you're covered.

SUBSCRIBE

Stay Updated

We are here to offer expert guidance and help make sure that you are covered with peace of mind. Contact us now to discuss your options.

SUBSCRIBE

We will get back to you as soon as possible.

Please try again later.

Kelmeg & Associates, Inc. provides Medicare plans, individual and family insurance, employer group benefits, and supplemental coverage. We offer personalized service to help you navigate healthcare and find the best coverage, ensuring your health and financial well-being are protected.

Contact Information

Follow Us

Services

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Our Partners

© 2024 All Rights Reserved |

Kelmeg & Associates, Inc | Designed by

Lingows