Step-by-Step Guide to Medicare Insurance Plans in Colorado

Medicare insurance Colorado offers several options for residents looking to manage healthcare costs during retirement or disability. To quickly understand your choices:

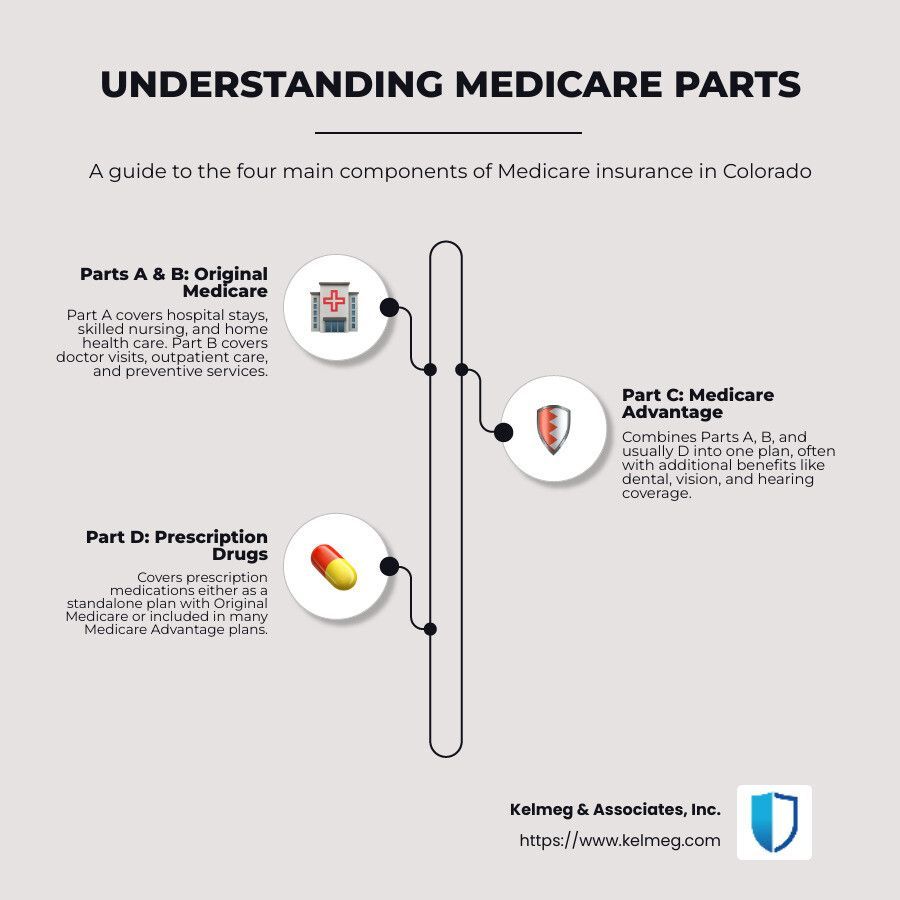

- Original Medicare (Parts A & B): Covers hospital and medical expenses, but leaves gaps in coverage.

- Medicare Advantage (Part C): Combines Parts A, B, and usually D (prescription drugs), often including extra benefits like dental or vision, sometimes at $0 premiums.

- Medicare Supplement (Medigap): Helps cover remaining out-of-pocket expenses left from Original Medicare.

- Prescription Drug Plans (Part D): Offers medication coverage either standalone or within Medicare Advantage.

Understanding these options can mean the difference between manageable expenses and overwhelming medical bills. As Medicare.gov puts it:

"Medicare was never intended to cover all your healthcare costs, leaving you with potentially overwhelming out-of-pocket expenses without supplemental coverage."

I'm Kelsey Mackley, and as an insurance specialist at Kelmeg & Associates, Inc., I've spent years helping individuals and businesses steer Medicare insurance Colorado. I simplify the complexity, ensuring my clients choose the right plans for stable, budget-friendly healthcare coverage.

Understanding Medicare Coverage Options in Colorado

With over 1 million Colorado residents enrolled in Medicare, having a clear grasp of your coverage choices can make all the difference in both your health and your finances. The truth is, Medicare isn't one-size-fits-all. In fact, there are several Medicare insurance Colorado options custom to various healthcare needs and budgets.

Let's break down each choice clearly so you can confidently pick the one that suits you best.

Original Medicare: Parts A and B

Original Medicare is the traditional program offered by the government and includes two main pieces: Part A and Part B.

Part A (Hospital Insurance) takes care of your inpatient hospital stays, skilled nursing care, hospice care, and certain home health care services. Good news? If you or your spouse have worked and paid sufficient Medicare taxes (usually for at least 10 years), you won’t pay a premium for Part A. But—here’s the catch—there is a deductible ($1,632 in 2024), which applies each benefit period (typically each hospital stay).

Part B (Medical Insurance) covers outpatient care, doctor visits, preventive screenings, and some home healthcare. Unlike Part A, Part B does charge a monthly premium (in 2024, it’s $174.70 for most people). After paying the annual deductible ($240 in 2024), you're responsible for 20% of your medical costs with no annual limit.

As Ray from Boulder told us with a nervous laugh, "When I first learned about Original Medicare coverage, I was shocked I'd need to pay 20% of my medical bills—and that my costs could keep stacking up without limit! With my chronic condition, figuring out supplemental coverage became a big priority."

Unfortunately, Original Medicare has some noticeable gaps, including no maximum limit on out-of-pocket spending, no coverage for dental, vision, hearing, prescriptions, or long-term care. These gaps can add up fast and lead to unexpected costs down the road.

Medicare Advantage Plans in Colorado

Medicare Advantage (also called Part C) is another popular choice. Offered by private insurance companies, these plans bundle together Medicare Parts A, B, and usually Part D (prescription coverage) into a single, streamlined package.

Colorado residents have plenty of good choices here. For 2025, there will be 120 Medicare Advantage plans available, slightly fewer than the 132 plans offered in 2024. But here's some good news for your wallet: the average monthly premium for Medicare Advantage plans dropped from $15.11 in 2024 to just $12.20 in 2025.

Medicare Advantage plans differ from Original Medicare in a few key ways. First, they typically require you to use a provider network—meaning you'll need to stick to specific doctors and hospitals. But there's a tradeoff: these plans often offer additional perks Original Medicare doesn't, like dental and vision coverage, gym memberships, hearing aids, and even transportation services.

Another key benefit: Medicare Advantage plans have an annual cap on your out-of-pocket spending, protecting you from sky-high medical bills. Plus, nearly all Coloradans (99.7%) have access to at least one $0-premium Medicare Advantage plan.

As our Medicare specialist here at Kelmeg & Associates notes with a smile, "Many of my clients from Lafayette and Boulder appreciate these plans because they simplify healthcare coverage, offer predictable costs, and include extra benefits. It’s like getting bonus toppings on your pizza—who doesn’t love that?"

Medigap (Medicare Supplement) Plans in Colorado

Medicare Supplement—also known as Medigap—plans step in to fill the coverage gaps left open by Original Medicare. Private insurance companies in Colorado offer these standardized plans, each identified by letters (Plan A, B, C, D, F, G, K, L, M, and N). The good news is each plan of the same letter covers the same benefits across different insurance companies. However, premiums can vary quite a bit, so it pays to compare.

The most popular Medigap plans among Coloradans include Plan F, Plan G, and Plan N. Plan F is the most comprehensive, covering virtually all costs Original Medicare leaves behind, but it's only available if you were eligible for Medicare before January 1, 2020. Plan G offers similar benefits but does not cover the Part B deductible. Plan N can have lower premiums but includes some cost-sharing (like small copays for certain doctor visits and emergency room trips).

One major perk of Medigap plans is flexibility—you're free to see any doctor or provider nationwide who accepts Medicare, with no network restrictions. So, if you're someone who enjoys traveling or spends winters out of state, Medigap might be your perfect match.

"For many of my clients who value choice, flexibility, and predictable medical costs, Medigap is often a solid choice," explains our advisor from Boulder. "Though monthly premiums tend to be higher than Medicare Advantage, the peace of mind knowing most costs are covered can be priceless."

Whether you’re leaning toward Original Medicare plus Medigap coverage or a comprehensive Medicare Advantage plan, having a clear picture of your options is essential. With Medicare, there's truly no one-size-fits-all solution—just the right choice for your unique needs and lifestyle.

Still have questions? At Kelmeg & Associates, we’re here to help you sort through the alphabet soup of Medicare insurance Colorado plans at no extra cost. Let’s find the perfect fit for your healthcare and budget!

Enrollment Periods for Medicare Plans in Colorado

Understanding when you can enroll in Medicare insurance Colorado plans is crucial. Picking the right coverage at the right time can save you money, prevent coverage gaps, and keep you from facing penalties. Let's break down these periods clearly so you can mark your calendar and rest easy.

Initial Enrollment Period (IEP)

The Initial Enrollment Period is your first-ever chance to sign up for Medicare. It lasts seven months in total—starting three months before you turn 65, including your birthday month, and continuing for three months afterward. For example, if you're turning 65 on July 15th, your IEP runs from April 1st until October 31st.

During this window, you can enroll in Original Medicare (Parts A and B), Medicare Advantage (Part C), Prescription Drug Coverage (Part D), or a Medicare Supplement (Medigap) plan. If you miss this timeframe, you not only risk a gap in healthcare coverage but could also face a permanent late enrollment penalty on your Part B premiums.

At Kelmeg & Associates, we always encourage our friends around Broomfield, Boulder, and Lafayette to apply three months before turning 65. That way, your Medicare coverage kicks in right on time, ensuring that there's no lapse in your healthcare benefits.

Annual Enrollment Period (AEP)

Think of the Annual Enrollment Period, sometimes called Open Enrollment, as your annual healthcare check-up—running each year from October 15th through December 7th. During this time, you can take stock of your healthcare needs and coverage options and make important adjustments.

You have the flexibility to switch from Original Medicare to Medicare Advantage, choose a different Medicare Advantage plan, return from Medicare Advantage back to Original Medicare, or sign up for, change, or drop a Prescription Drug Plan. Changes made during this period become effective the following January 1st.

Because healthcare needs change and plans evolve (sometimes drastically!), the Annual Enrollment Period is the perfect opportunity to review your current coverage. Our Adams County Medicare advisor puts it best: "Just because your plan was a great fit last year doesn't mean it will still be perfect next year—always double-check your options."

Special Enrollment Periods (SEPs)

Life happens—especially during retirement or when moving to Colorado—and that's why Medicare created Special Enrollment Periods. SEPs let you enroll in or switch Medicare plans outside of the usual enrollment windows if you've experienced specific situations or life events.

Some common scenarios that trigger SEPs include moving to a new home outside your current plan's service area, losing employer-sponsored or union health coverage, or qualifying for Medicaid or Extra Help for prescription drugs. Additionally, if you move into or out of a skilled nursing facility or long-term care hospital, you also gain eligibility for a Special Enrollment Period.

Did you enroll in a Medicare Advantage Plan but aren't thrilled with your choice? Medicare also offers a Medicare Advantage Open Enrollment Period from January 1st to March 31st. During this time, you can switch to another Medicare Advantage plan or return to Original Medicare and add a stand-alone Prescription Drug Plan if desired.

Recently, one of our clients moved from Denver to Boulder and needed help finding a new Medicare Advantage plan that fit her new location. Thanks to a Special Enrollment Period, we made sure she transitioned smoothly without losing access to her favorite doctors.

No matter your situation, the Medicare specialists at Kelmeg & Associates are here to guide you every step of the way. We'll take the confusion out of enrollment, making sure you have the right Medicare insurance Colorado coverage exactly when you need it.

How to Choose the Right Medicare Plan in Colorado

Choosing the right Medicare insurance Colorado plan can feel a bit like picking a favorite ice cream flavor—there are many tempting options, but not all of them are right for everyone. At Kelmeg & Associates, we’ve guided countless Colorado seniors through the process, helping them find coverage that perfectly matches their healthcare needs and budget.

Here's how you can confidently steer your choices and land on the ideal plan:

Evaluating Your Healthcare Needs

Every person’s healthcare needs are unique. That’s why the first step in selecting a Medicare plan is to honestly assess what matters most to you.

Think about your health situation: Do you have chronic conditions that mean regular visits to the doctor or specialist? Are certain prescription medications essential to your daily life? Not every plan covers medications equally, so knowing what prescriptions you take matters tremendously.

Also consider how important it is for you to stay with your preferred healthcare providers. Do you have a doctor or specialist you’ve trusted for years? For instance, we recently helped a client in Lafayette who was absolutely determined to keep her long-time specialists. Knowing this upfront, we immediately narrowed our search to plans that included her current doctors—saving her from the headache of switching providers.

Frequency of care is another important factor. If you rarely need medical treatment, you might prefer a low-premium Medicare Advantage plan. On the other hand, if you anticipate needing more frequent care or specific treatments, a Medigap plan could offer better protection from unexpected bills.

Don’t forget to consider your travel plans. Many Coloradans spend part of the year traveling or living out-of-state. While Medicare Advantage plans typically have network restrictions, Medigap plans can offer more freedom, allowing you to see any provider who accepts Medicare nationwide.

Comparing Plan Costs and Coverage

When looking at Medicare insurance Colorado plans, it's easy to focus only on monthly premiums. But that’s like choosing a car based solely on the sticker price—you’ve got to factor in the full cost of ownership.

Beyond premiums, you’ll want to look closely at deductibles (the amount you pay up-front before your coverage kicks in), copayments (fixed fees at each doctor’s visit), and coinsurance (your share of the treatment cost). It's also crucial to consider the plan's out-of-pocket maximum—the most you'll have to pay in a year, a feature unique to Medicare Advantage plans.

For example, we recently advised a Boulder couple who initially leaned toward a $0 premium Medicare Advantage plan. After reviewing all their costs—including prescriptions and specialist visits—we finded a plan with a modest monthly premium actually saved them nearly $2,000 per year compared to the free plan!

Taking a holistic view of costs ensures you won’t get hit with unpleasant surprises when medical care is needed most.

Considering Additional Benefits

Here comes the fun part—many Medicare Advantage plans offer extra perks that Original Medicare doesn’t cover. These additional benefits can truly improve your quality of life and save you money.

For example, some plans offer dental coverage, so routine cleanings, fillings, or even dentures become more affordable. Vision care might be included, covering regular eye exams and helping pay for glasses or contacts. Hearing services could mean the difference between getting the hearing aids you need or going without.

Beyond the basics, plans can offer wellness programs, gym memberships specifically designed for seniors, transportation to your medical appointments, and even meal delivery after hospital stays. One of our Broomfield clients takes full advantage of her plan's dental and vision coverage, saving her roughly $800 annually—money she happily spends spoiling her grandkids instead!

The key is to pick benefits you’ll actually use and enjoy. If you rarely see yourself using these extras, a simpler plan might better suit your needs. But if they align closely with your lifestyle, these benefits can be a genuine game-changer.

Choosing a Medicare plan is a deeply personal decision, and at Kelmeg & Associates, we’re here to help. Our expert guidance never costs you a dime, and we’d love to help you find the Medicare coverage that truly fits your health, your budget, and your life here in beautiful Colorado.

Resources for Colorado Medicare Beneficiaries

Navigating Medicare insurance Colorado plans can feel overwhelming—but you're not alone! Colorado offers several helpful resources to guide you through the Medicare maze, so you can confidently choose the best coverage for your health and budget.

Getting Help with Medicare Costs

If you're concerned about paying for Medicare coverage, there are programs that can make healthcare more affordable. For instance, Medicare's Extra Help Program significantly reduces prescription drug expenses for those who qualify. In 2023, eligible individuals had monthly income limits of $1,660 ($2,339 for couples) and asset limits of $10,590 for singles ($16,630 for couples). Extra Help can dramatically lower premiums, deductibles, and copayments, making prescriptions much easier to manage.

Colorado also offers Medicare Savings Programs (MSPs). These state-run programs can cover Part A and Part B premiums, deductibles, copayments, and coinsurance if you qualify based on your income and resources.

Additionally, Pharmaceutical Assistance Programs (PAPs) provided by drug manufacturers can offer free or reduced-cost medications to eligible individuals.

At Kelmeg & Associates, we recently helped a client from Adams County enroll in Extra Help, cutting her prescription costs down by more than 75%! She couldn't believe how much relief it provided her monthly budget—and how simple the process was once she had expert guidance.

If you think you might qualify for one of these programs, you're encouraged to apply—it could make all the difference for your healthcare affordability. You can apply online through the Social Security Administration website, by phone at 1-800-772-1213, or by contacting Colorado's State Health Insurance Assistance Program (SHIP) at 1-888-696-7213.

Contacting Local Medicare Advisors

The Medicare process can be complicated, full of confusing terms and tight deadlines. That's why getting some personalized advice can make a world of difference. At Kelmeg & Associates, Inc., we specialize in helping Colorado residents—including folks right here in Lafayette, Broomfield, Boulder, and throughout Adams County—simplify Medicare decisions.

Our experienced advisors will take the time to clearly explain the basics of Medicare, compare multiple plans custom specifically to your healthcare needs, and guide you step-by-step through enrollment periods and deadlines. Plus, our support doesn't just stop once you've signed up. We're always here to help you with claims, billing questions, and annual plan reviews.

And the best part? Our consultations are completely free to you! We get compensated through the insurance companies when you enroll, so you'll never pay extra for our professional expertise.

As our Boulder Medicare advisor puts it, "Medicare can feel like trying to solve a complicated puzzle without the picture on the box. We're here to hand you the picture and place the pieces together, making the whole process smooth and stress-free."

So, whether you're enrolling for the first time, considering switching your current plan, or just have questions, reach out to us at Kelmeg & Associates. We'll make sure you feel confident, comfortable, and cared for every step of the way.

Frequently Asked Questions about Medicare Insurance in Colorado

What is the average cost of Medicare Advantage plans in Colorado?

The average monthly premium for Medicare Advantage plans in Colorado has actually decreased over the past year—from about $15.11 in 2024 down to just $12.20 in 2025. But before you celebrate those savings too quickly, here's something even better: 99.7% of Colorado residents with Medicare can access $0-premium Medicare Advantage plans.

Of course, while $0 premiums certainly sound appealing (and they can be!), it's wise to look carefully at the bigger picture. As our Medicare specialist at Kelmeg & Associates often says with a smile, "There's more to a plan than just its monthly premium! Be sure to consider copays, deductibles, prescription coverage, and out-of-pocket maximums. Sometimes, a low-premium plan ends up costing more overall if it doesn't match your individual healthcare needs."

How do I enroll in a Medicare plan in Colorado?

Here in Colorado, enrolling in Medicare insurance Colorado plans is easier than you might think. You've got plenty of options to sign up, depending on what works best for you.

One of the simplest ways is to go online and visit Medicare.gov. Through the website, you can apply for Medicare Parts A and B, explore Medicare Advantage or Prescription Drug options, and enroll directly.

Prefer a good old-fashioned conversation? No worries! Call the Social Security Administration at 1-800-772-1213. They can help you enroll in Parts A and B over the phone. If you'd rather get assistance face-to-face, you can always visit your local Social Security office.

For personalized guidance that takes your specific healthcare needs into account, connecting with a licensed Medicare advisor is a smart choice. At Kelmeg & Associates, Inc., we offer free, personalized consultations. We'll walk you through your Medicare enrollment step-by-step, ensuring you understand all your options and deadlines clearly.

And speaking of deadlines: We recommend signing up for Medicare Parts A and B at least three months before you want your benefits to start. That way, you avoid coverage gaps and possible late enrollment penalties. If you haven't received your enrollment information, just give Social Security a quick call to ensure everything is on track.

Can I get help paying for Medicare if I have a low income?

Absolutely! Many Coloradans don't realize they're eligible for programs specifically designed to offset Medicare costs if they have limited income or resources.

One valuable program is called Extra Help, and it significantly reduces prescription drug costs. Eligible beneficiaries see big savings on premiums, deductibles, and copays for Medicare Part D coverage.

Additionally, Colorado offers Medicare Savings Programs (MSPs). These state-run programs can help cover Medicare Part A and Part B premiums, deductibles, and coinsurance amounts.

Lastly, if your income is very low, you might qualify for Medicaid (Health First Colorado) alongside Medicare. With both Medicare and Medicaid, out-of-pocket costs shrink dramatically, making quality healthcare far more accessible and affordable.

At Kelmeg & Associates, we've seen how life-changing these assistance programs can be. One of our Adams County clients used to spend nearly half his monthly budget on prescription medications. After we helped him apply for Extra Help, his medication costs dropped by 75%. The relief he felt was incredible—and it warmed our hearts too.

Wondering if you qualify for any of these programs? Finding out is easy. Simply get in touch with:

- Social Security Administration: 1-800-772-1213

- Colorado SHIP (State Health Insurance Assistance Program): 1-888-696-7213

- Health First Colorado (Medicaid): 1-800-221-3943

A few minutes of your time could bring significant monthly savings and genuine peace of mind.

Conclusion

Navigating Medicare insurance Colorado doesn't have to feel like wandering in the dark. While Medicare can seem complex at first, understanding your options helps protect both your health and your savings.

Original Medicare provides solid foundational coverage, but it has some notable gaps. Without additional coverage, you could face significant out-of-pocket expenses. Medicare Advantage plans can fill those gaps, often offering extra benefits like dental, vision, and wellness programs. However, they tend to have network restrictions, so make sure your preferred doctors and hospitals are included.

If flexibility is key for you, Medicare Supplement (Medigap) plans pair with your Original Medicare to cover many remaining costs. With Medigap, you can see any provider who accepts Medicare, making it a great choice if you like to travel or spend time out of state.

Enrollment periods are especially important to keep an eye on. Missing deadlines like your Initial Enrollment Period (around your 65th birthday) or the Annual Enrollment Period (October 15 to December 7) can lead to coverage gaps and lifelong penalties, something we'd all rather avoid!

When comparing Medicare insurance Colorado plans, consider the full picture—not just monthly premiums. Deductibles, copayments, coinsurance, and annual out-of-pocket maximums all factor into your total healthcare costs. And don't forget about additional benefits like dental, vision, hearing aids, or fitness perks, which can add significant value.

For Colorado residents on a limited income, assistance programs like Extra Help and Medicare Savings Programs can drastically reduce your healthcare costs. These programs lower premiums, deductibles, and prescription expenses, helping you stay healthy without breaking the bank.

At Kelmeg & Associates, Inc., we understand that Medicare coverage isn't one-size-fits-all. That's why we offer personalized, expert guidance to help you select the best plan at no additional cost. Our experienced advisors will listen to your needs, answer your questions, and make the Medicare maze feel manageable (and maybe even enjoyable—imagine that!).

As our Medicare specialist likes to say with a smile, "The right Medicare plan doesn't just save you money—it gives you peace of mind, so you can focus on enjoying your retirement here in beautiful Colorado."

Ready to find a Medicare insurance Colorado plan that's just right for you? Reach out to our friendly team at Kelmeg & Associates today. We're here to help you confidently choose the coverage you deserve.