Small Business Health Insurance: Colorado's Best Brokers Revealed

Navigating Health Insurance for Your Colorado Business

Small business health insurance brokers Colorado provide free expert guidance to help companies find affordable group coverage.

Finding affordable health insurance for your Colorado small business gets tougher every year. With complex regulations, rising premiums, and countless plan options, the process can feel overwhelming. Thankfully, you don't have to steer this alone.

Most small business owners are surprised to learn that small business health insurance brokers Colorado provide their services at absolutely no cost to you. That's right - brokers are paid by the insurance companies, not by you, and the rates are identical whether you use a broker or go directly to carriers.

For Colorado businesses with 2-99 employees, group health insurance plans offer significant advantages:

- Premium cost-sharing between employer and employees

- Potential tax advantages for both the business and staff

- Improved employee recruitment and retention

- Customized plans based on your workforce and budget

Small businesses with fewer than 50 full-time employees aren't required to provide health insurance in Colorado, but those that do gain a competitive edge in attracting talent.

I'm Kelsey Mackley, and as an insurance specialist with extensive experience helping Colorado businesses steer the complexities of group health plans, I've guided hundreds of small businesses through the process of selecting small business health insurance brokers Colorado that best match their unique needs and budget constraints.

Why Work With a Local Colorado Health Insurance Broker?

Finding the right health insurance for your Colorado small business shouldn't feel like scaling a 14er without proper gear. That's where local health insurance brokers come in – they're your experienced guides on this journey.

No-Cost Expert Guidance

Here's a pleasant surprise many business owners don't expect: working with a small business health insurance broker in Colorado won't cost you a single penny more than going directly to insurance carriers. That's right – health insurance premiums in Colorado are fixed by law, so you'll pay exactly the same amount either way. The difference? With a broker, you get personalized support and expertise at no additional cost.

One of our clients put it perfectly: "I thought brokers would charge extra fees. Learning they could save me both time and money while providing better service – all without charging me anything – completely changed my approach to business insurance."

Compliance Help When You Need It Most

Let's be honest – the Affordable Care Act didn't exactly simplify things for employers. Add Colorado's state-specific regulations to the mix, and you've got a recipe for compliance confusion. Local brokers stay up-to-date on all these requirements so you don't have to.

If your Colorado business has 50+ full-time employees, you're facing the employer mandate, which requires offering affordable health insurance or potentially facing penalties. Even smaller businesses have notification rules and reporting requirements to steer. Your local broker handles these details, freeing you to focus on what you do best – running your business.

Fully-Insured & Level-Funded Options

Think of fully-insured plans as the reliable old Subaru of the insurance world – dependable, predictable, and well-established. Your business pays a set monthly premium regardless of how much healthcare your team uses.

Level-funded plans, meanwhile, are more like that innovative hybrid vehicle – combining the stability of fixed premiums with the exciting potential for partial refunds if your employees have fewer claims than expected. For Colorado small businesses with generally healthy teams, this modern approach can lead to meaningful savings.

A good small business health insurance broker in Colorado will walk you through both options, helping you determine which model aligns with your company's unique needs.

ICHRA Experts

Individual Coverage Health Reimbursement Arrangements (ICHRAs) represent a relatively new option that many Colorado businesses haven't fully explored. These arrangements allow employers to provide tax-free reimbursements to employees who purchase their own individual health insurance plans.

This approach offers remarkable flexibility – your employees can select plans custom to their specific needs while you maintain better control over your healthcare budget. A knowledgeable broker can explain whether this innovative solution might be the right fit for your company's situation.

Statewide Service

Colorado's diverse geography creates unique healthcare challenges. Insurance networks and costs vary dramatically between Denver's urban corridors and rural mountain communities. A local small business health insurance broker in Colorado understands these regional differences intimately.

As a small business owner in Breckenridge shared with us: "Working with a broker who truly understands the limited provider options in mountain communities was essential. They found us a plan that actually worked for our location, not just something that looked good on paper."

The truth is, you don't need to become an expert in the ins and outs of health insurance – that's what your broker is for. Their expertise allows you to make confident decisions about your company's healthcare without getting lost in insurance jargon and regulatory mazes.

Kelmeg & Associates – Colorado's Home-Grown Concierge Broker

When you're looking for small business health insurance brokers Colorado residents trust, Kelmeg & Associates stands out as a true local partner. We've built our reputation by being more than just insurance sellers – we're your neighbors who understand what Colorado businesses face every day.

Personalized Support From Day One

At Kelmeg, we believe your two-person startup deserves the same dedicated attention as a company with 99 employees. Our approach starts with getting to know your business, your team, and what keeps you up at night.

"I felt like I was just another policy number with my previous broker," one Denver client told us recently. "With Kelmeg, I have my advisor's cell phone number, and she actually answers when I call!"

Local Market Knowledge That Makes a Difference

The health insurance landscape in Colorado is unique – from the provider consolidation in Boulder County to the limited network options in mountain towns. Because we live and work in the communities we serve, we understand these nuances firsthand.

When a Durango client needed a plan that would work for employees split between the Western Slope and Front Range, we knew exactly which carriers offered the most comprehensive statewide networks – knowledge that saved them thousands while improving coverage.

Bilingual Service for Colorado's Diverse Workforce

Health insurance is complicated enough in your first language. That's why our bilingual team members ensure all your employees can fully understand their benefits, regardless of language preferences. This inclusive approach means better plan utilization and happier employees.

Employee Education That Goes Above and Beyond

We don't just help you choose a plan and disappear. Our team conducts engaging enrollment meetings (in-person or virtual), creates custom benefits guides that actually make sense, and remains available to answer questions all year long.

When employees understand their benefits, they value them more – and that improves your return on this significant investment.

Wellness Add-Ons That Boost Employee Health

Many Colorado businesses are finding that wellness initiatives don't just create healthier employees – they can help control insurance costs too. We help clients implement programs that complement their health plans, from discounted gym memberships to incentives for preventive care.

Digital Portals for Easy Administration

Managing your group health plan shouldn't require an accounting degree. Our user-friendly digital portals simplify everything from enrollment to ongoing maintenance. Add new employees, make changes, and access important documents with just a few clicks – freeing you to focus on running your business, not paperwork.

Claims Advocacy When Issues Arise

Ever spent hours on hold with an insurance company trying to resolve a claim issue? Our team steps in when problems occur, becoming your dedicated advocate.

As one Boulder client shared: "When my employee's critical medication was denied, Kelmeg spent three hours on the phone with the insurance company and got it approved by the next day. That kind of service is priceless."

Network Access Statewide

Colorado's geography creates unique challenges for health coverage. We help businesses with multiple locations or remote workers find plans with strong provider networks across the state, ensuring all employees have access to quality care whether they're in Denver or Durango.

Telehealth Emphasis for Modern Workforces

The pandemic changed healthcare delivery forever, with virtual care becoming essential rather than optional. We help clients identify plans with robust telehealth benefits, improving care access while reducing time away from work for routine medical needs.

Provider-Gap Solutions

In some Colorado communities, particularly rural areas, limited provider networks can create real challenges. We help identify creative solutions to these gaps, from improved telehealth options to plans with strategic out-of-network benefits where in-network providers are scarce.

Bundled Dental-Vision Options

Most employees expect more than just medical coverage. We help clients find cost-effective bundled dental and vision plans that provide comprehensive care while simplifying administration and potentially reducing overall costs.

Seasonal Workforce Strategies

For businesses in Colorado's tourism and agricultural sectors, seasonal workforce fluctuations create unique insurance challenges. We've developed specialized approaches that accommodate these variations while maintaining compliance and controlling costs – whether you're a ski resort or a summer camp.

Pharmacy Carve-Outs for Cost Control

Prescription costs often represent 20-30% of healthcare spending for many businesses. We help clients explore specialized pharmacy benefit options, including potential carve-out programs that can provide better control over these expenses without sacrificing quality of care.

Digital-First Solutions for Colorado Small Businesses

The digital revolution has transformed how Colorado small businesses can shop for, implement, and manage their health insurance benefits. At Kelmeg & Associates, we accept technology that simplifies the insurance process while maintaining the personal touch that sets us apart.

Instant Quoting Engines

Gone are the days of waiting weeks for health insurance quotes. Our digital platforms provide instant preliminary quotes based on your business's basic information, giving you a starting point for understanding potential costs. While these initial estimates will be refined as we gather more specific details about your workforce, they provide valuable insight during the early stages of your search.

A tech startup founder from Boulder recently shared with us, "Being able to get ballpark figures instantly helped us narrow down our options before diving into the details. It made the whole process much more efficient."

Side-by-Side Comparisons

Remember those confusing spreadsheets and benefit summaries that made comparing plans feel like solving a puzzle? Our digital tools present clear, side-by-side comparisons of plan options, highlighting key differences in premiums, deductibles, out-of-pocket maximums, and provider networks.

These visual comparisons make it easier to understand trade-offs between different plans and identify the options that best align with your business's needs and budget. We don't just show you the numbers – we help you understand what they mean for your specific situation. As your small business health insurance brokers Colorado, we translate insurance jargon into plain English.

Secure E-Sign Capabilities

The enrollment process has been streamlined through secure electronic signature capabilities. Once you've selected a plan, employees can complete their enrollment forms and sign necessary documents electronically, eliminating paperwork delays and reducing administrative burden.

This digital approach is particularly valuable for businesses with remote workers or multiple locations, ensuring a smooth enrollment experience regardless of where employees are based. No more chasing down signatures or dealing with incomplete forms!

Chat Support for Quick Questions

Sometimes you just need a quick answer to a simple question. Our digital platforms include chat support options that connect you directly with our team for real-time assistance. This immediate access helps resolve minor issues before they become major headaches.

One client told us, "Being able to get quick answers without scheduling a call saved me countless hours during our enrollment period." We understand that your time is valuable, and our chat support reflects our commitment to being accessible whenever you need us.

Renewal Dashboards

The renewal process can be one of the most stressful aspects of managing employee benefits. Our digital renewal dashboards provide clear visibility into upcoming changes, rate adjustments, and alternative options well before your renewal date.

These tools help eliminate renewal surprises and give you time to consider your options thoughtfully rather than making rushed decisions as deadlines approach. As small business health insurance brokers Colorado, we believe that informed decisions lead to better outcomes, and our renewal dashboards put that information at your fingertips.

Paperless Onboarding

Adding new employees to your health plan used to involve a flurry of paperwork. Our digital onboarding process simplifies this task, allowing new hires to complete their enrollment electronically while ensuring all necessary information is captured correctly the first time.

One of our clients recently noted, "The paperless onboarding process has been a huge time-saver for our HR team. New employees can complete everything before their first day, so they have coverage from day one without administrative delays."

While we accept these digital solutions, we recognize that technology alone isn't enough. Our digital tools are always backed by our team's personal expertise and support, ensuring you get the best of both worlds – modern efficiency with a human touch. After all, behind every great digital platform are real people who care about your business's success.

Custom Strategies for Start-Ups & Tech Firms

Colorado's vibrant startup ecosystem and growing tech sector have unique health insurance needs that differ from more established businesses. At Kelmeg & Associates, we've developed specialized approaches for these innovative companies that balance comprehensive coverage with the flexibility and cost-control these businesses require.

Level-Funded Plans: The Game-Changer for Healthy Teams

Many Colorado startups and tech companies have relatively young, healthy workforces – exactly the type of groups that can benefit most from level-funded health plans. These innovative arrangements combine the predictability of traditional insurance with the potential for significant savings.

Level-funded plans work a bit like a hybrid model. Your business pays a consistent monthly premium (similar to traditional insurance), but a portion of that premium goes into a claims fund specific to your company. At the end of the year, if your team had fewer claims than expected, you receive a partial premium refund. And don't worry about risk – if claims run higher than projected, stop-loss insurance covers the excess.

We recently helped a Boulder software company with 15 employees (average age 31) switch to a level-funded plan. The result? A 12% premium reduction compared to traditional insurance, plus a $9,300 year-end refund when claims came in lower than projected. That's real money back in their business.

HSA Pairing for Tax Advantages

Health Savings Accounts (HSAs) and high-deductible health plans are like peanut butter and jelly – they just work better together. Many tech employees actually prefer this combination, especially when they understand the triple tax advantages HSAs offer.

First, all contributions are tax-deductible. Second, any growth in the account happens tax-free. And third, when employees withdraw funds for qualified medical expenses, that money isn't taxed either. It's one of the few truly triple tax-advantaged options available.

We find many tech workers appreciate the investment aspect of HSAs too. They view them as an additional retirement savings vehicle that complements their 401(k). For Colorado's forward-thinking workforce, this combination of immediate tax savings and long-term investment potential resonates strongly.

Wellness Stipends for Flexible Support

Colorado's active lifestyle culture demands a different approach to wellness benefits. Rather than one-size-fits-all programs, many tech firms are implementing flexible wellness stipends that employees can use however they prefer – whether that's a gym membership, meditation app, or equipment for mountain biking trips.

As one Denver tech founder told us, "Our wellness stipend program has been one of our most appreciated benefits, especially for our team members who value Colorado's outdoor opportunities." We help companies structure these stipends to complement their health insurance strategy while supporting employees' diverse wellness interests.

Remote-Employee Coverage Solutions

The rise of remote work has created new challenges for small business health insurance brokers Colorado wide. Many tech companies now employ workers across multiple states or even internationally, requiring innovative approaches to ensure consistent coverage.

At Kelmeg & Associates, we specialize in developing multi-state solutions that maintain compliance while providing equitable benefits for all employees, regardless of location. This expertise has become increasingly valuable as remote work becomes the norm rather than the exception.

One Fort Collins software company with employees in four states was struggling to manage different plans in each location. We helped them implement a cohesive strategy that provided comparable benefits across all locations while simplifying administration. Their HR director told us, "Having one partner who understands the nuances of coverage in multiple states has been a game-changer for us."

Recruitment Edge Through Strategic Benefits

In Colorado's competitive tech talent market, innovative health benefits can provide a crucial edge in attracting and retaining top talent. We help startups design benefits packages that stand out to prospective employees while remaining financially sustainable.

"In our industry, everyone offers competitive salaries," explains the HR director at a growing Fort Collins tech company. "Our health benefits package, which Kelmeg helped us design, has become one of our strongest recruitment tools. Candidates are often surprised by the quality of coverage we can offer as a smaller company."

When candidates see thoughtfully designed health plans that reflect their values and needs, it sends a powerful message about your company culture. That's especially important for startups competing against bigger firms with deeper pockets.

Young-Demographic Rating Advantages

Colorado's health insurance rating rules allow for age-based premium variations. For tech companies with predominantly younger workforces, this often translates to more favorable rates compared to businesses with older employee populations.

We help these companies leverage their demographic advantages while ensuring plans still meet the needs of employees across all age groups. This balanced approach maximizes savings while maintaining appropriate coverage for everyone.

When we sit down with startup founders and tech company leaders, we often find they appreciate understanding the "why" behind different insurance models. The table above helps illustrate key differences between traditional fully-insured plans and level-funded alternatives. For most growing tech companies in Colorado, the potential for premium refunds and greater plan flexibility makes level-funded options particularly attractive.

What Do Top Small Business Health Insurance Brokers Colorado Actually Do?

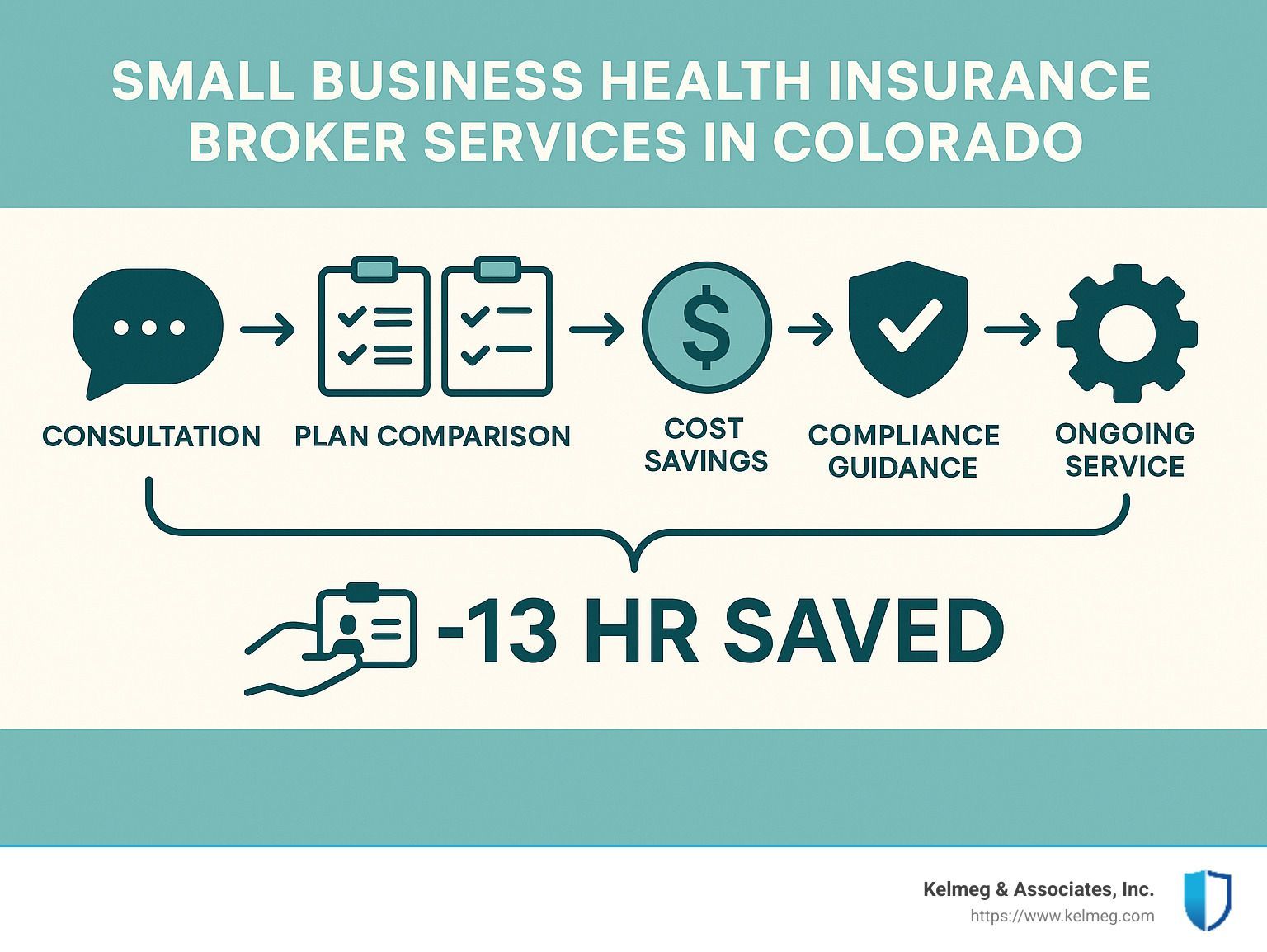

Behind the scenes, small business health insurance brokers Colorado do far more than simply hand you a few quotes and disappear. They're your ongoing partners in navigating the complex health insurance landscape, saving you time, money, and countless headaches along the way.

Plan Shopping Across All Major Carriers

Unlike representatives who work for a single insurance company, independent brokers like us at Kelmeg & Associates have relationships with every major carrier in Colorado. We regularly work with Anthem Blue Cross Blue Shield, Kaiser Permanente, UnitedHealthcare, Cigna, Humana, and Rocky Mountain Health Plans to find the perfect fit for your business.

This matters tremendously for your bottom line. Just last year, we helped a Fort Collins manufacturing company switch to a plan that saved them over 20% on premiums while actually improving their coverage. When you can see the entire marketplace rather than just one corner of it, those kinds of opportunities become possible.

Carrier Negotiation Beyond Standard Rates

While base premium rates are standardized in Colorado, experienced small business health insurance brokers Colorado know where the flexibility exists. We tap into wellness program incentives, multi-line discounts when bundling services, and alternative funding arrangements that better match your risk profile.

"Our broker finded a carrier program that knocked 8% off our premiums just by implementing a simple wellness initiative," one of our clients in Lafayette recently told us. "It was literally money left on the table that we would never have found without their help."

Census Analysis for Accurate Pricing

Getting accurate quotes starts with properly documenting your workforce. We help compile your employee census exactly how carriers need to see it, ensuring quotes reflect your actual situation rather than rough estimates.

This detailed approach often reveals surprising savings opportunities. The age distribution of your team, family coverage patterns, and even zip code locations can significantly impact your premiums when properly documented. We sweat these details so you don't have to.

Compliance Calendar and Reminders

The health insurance world is filled with deadlines and reporting requirements that seem designed to trip you up. Top small business health insurance brokers Colorado provide compliance calendars and automated reminders to keep you on track.

From ACA reporting deadlines to COBRA notification requirements, these compliance services prevent costly penalties. For smaller businesses without HR departments, this ongoing guidance becomes particularly valuable – it's like having a compliance expert on your team without the full-time salary.

ACA & State Filing Assistance

Those dreaded 1095 forms aren't going to complete themselves. Neither are Colorado's state-specific filing requirements. Quality brokers provide guidance and support for these filings, helping ensure accuracy and timeliness.

Many of us also offer specialized compliance tools that simplify these processes considerably. You can learn more about employer requirements from the IRS Affordable Care Act Employers resource, but wouldn't you rather have someone handling this for you?

HRIS Integration for Seamless Administration

Modern brokers help integrate your health insurance administration with your Human Resource Information System, creating a seamless experience for both administrators and employees.

This integration eliminates duplicate data entry, reduces errors, and simplifies processes like open enrollment and new hire onboarding. One of our Denver tech clients reported saving nearly 15 hours of administrative work each month after we helped integrate their systems – that's almost two full workdays!

For more comprehensive information about group health insurance options, visit our group health insurance Colorado page.

Core Services Offered by Small Business Health Insurance Brokers Colorado

Benchmarking Against Industry Standards

Understanding how your benefits compare to competitors is crucial for talent retention. We provide benchmarking data that helps position your offerings appropriately for your industry and region.

As one Boulder professional services firm owner told us, "Finding our deductible was twice the industry average was a real wake-up call. Our broker helped us restructure our plan to be more competitive without increasing our overall costs." These insights help you offer benefits that attract and keep great employees.

Cost Management Strategies

Controlling healthcare costs requires more than just shopping for the lowest premium. Small business health insurance brokers Colorado develop comprehensive strategies that might include plan design optimization, prescription drug program analysis, alternative funding arrangements, consumer-driven health plans paired with HSAs, and wellness initiatives that improve health outcomes.

We recently helped a Grand Junction retail business save nearly 18% on their annual healthcare spend by implementing a strategic combination of these approaches – all while maintaining the coverage their employees valued most.

Renewal Strategy Development

Perhaps the most valuable ongoing service brokers provide is developing effective renewal strategies. Rather than passively accepting your carrier's renewal increase each year, quality brokers begin planning 90-120 days before your anniversary date.

We analyze your group's claims experience when available, shop the market for competitive alternatives, negotiate with your current carrier for better terms, and present multiple options with clear comparisons. This proactive approach consistently yields better results than simply accepting whatever increase comes your way.

Ongoing Support From Small Business Health Insurance Brokers Colorado

Claims Help When Problems Arise

When your employees encounter claims issues, having a broker advocate makes all the difference. Instead of your staff spending precious hours on hold with insurance companies, they can call us to resolve these problems quickly.

One of our Denver clients shared how we helped an employee get approval for a specialized medication after an initial denial: "Our broker spent hours on the phone with the insurance company when we couldn't get anywhere. They had it approved within 24 hours. That level of service is invaluable."

Billing Fixes and Reconciliation

Insurance billing errors happen more often than you might think, especially for businesses with frequent employee changes. We help identify and correct these errors, ensuring you're not overpaying for coverage.

Many small business health insurance brokers Colorado also assist with premium reconciliation, verifying that carrier billing statements accurately reflect your current employee roster and selected coverage options. These small corrections add up to significant savings over time.

New-Hire Onboarding Assistance

Adding new employees to your health plan involves specific processes and timelines that can be confusing. Quality brokers provide guidance for these additions, ensuring new hires gain coverage promptly and correctly.

We help simplify benefit explanations, assist with form completion, and confirm effective dates with carriers. This creates a smoother experience for both your HR team and your new employees during an already busy transition period.

The best part? All these services come at no additional cost to your business. Brokers are paid by the insurance carriers, not by you – making professional guidance one of the best values in the business world today.

Key Factors That Impact Your Group Health Premiums in Colorado

When Colorado small business owners see their health insurance premiums, many wonder why the numbers look the way they do. Understanding what drives these costs can help you make smarter choices about your coverage and potentially save money in the process.

Employee Ages Drive Pricing

Remember the days when everyone in your group paid roughly the same premium? Those days disappeared with the Affordable Care Act. Now, each employee's age directly impacts what you'll pay for their coverage.

This age-banding approach is a double-edged sword for Colorado businesses. If you run a tech startup in Boulder with mostly twenty-somethings, you're likely enjoying lower premiums than your neighbor running an accounting firm with staff averaging in their late 40s. The difference can be substantial – sometimes 2-3 times higher for older employees – even when the coverage is identical.

"When I first saw how much age affected our premiums, I was shocked," shares a Denver business owner. "Our oldest employee costs us nearly three times what we pay for our youngest staff member, despite having the exact same coverage."

County Rating Variations Across Colorado

Colorado's diverse geography creates some dramatic differences in healthcare costs. If you've ever compared notes with a business owner friend in another part of the state, you might have been surprised by how different your premiums are.

Mountain communities like Summit and Eagle counties typically face the highest premiums in the state – sometimes 30% higher than other regions. The Front Range (Denver, Boulder, Fort Collins) sits in the middle of the pack, while some Eastern Plains counties enjoy relatively lower rates.

These variations reflect the reality of healthcare delivery costs in each region. Limited provider competition in mountain towns drives prices up, while greater healthcare options in metropolitan areas help moderate costs. For businesses with multiple locations, these regional differences can significantly impact your overall insurance budget.

Plan Metal Tier Selection

When shopping for coverage, you'll encounter the now-familiar metal tier system: Bronze, Silver, Gold, and Platinum. These tiers represent the percentage of healthcare costs the plan covers for the average person:

- Bronze plans cover approximately 60% of healthcare costs

- Silver plans cover approximately 70% of healthcare costs

- Gold plans cover approximately 80% of healthcare costs

- Platinum plans cover approximately 90% of healthcare costs

While Bronze plans offer the lowest premiums, they also leave employees with higher out-of-pocket costs when they need care. Finding the right balance depends on understanding your workforce. Younger, healthier teams might prefer lower premiums with higher deductibles, while workforces with ongoing health needs often value the predictability of Gold plans despite higher monthly costs.

Funding Model Impact

The way you fund your health plan can significantly impact your bottom line. Traditional fully-insured plans provide maximum predictability – you pay a fixed premium regardless of how much healthcare your employees use. But for many Colorado small businesses, level-funded plans have become an attractive alternative.

Level-funded arrangements combine the predictability of fixed monthly payments with the potential for partial refunds when claims are lower than expected. A 20-employee marketing firm in Colorado Springs recently switched to a level-funded plan and saw not only a 9% premium reduction but also received a $13,500 refund at year-end because their employees had fewer claims than anticipated.

"The refund check was a welcome surprise," their office manager told us. "It's like being rewarded for having a healthy team."

Participation Rate Requirements

Most insurance carriers require a minimum percentage of your eligible employees (typically 70%) to enroll in your health plan. Falling short of this threshold can trigger premium surcharges or even plan cancellation.

Small business health insurance brokers Colorado often help clients boost participation rates through strategic approaches like offering multiple plan options to accommodate diverse employee needs, implementing effective benefits education, or structuring employer contributions to make coverage more affordable for staff.

One restaurant group in Fort Collins increased their participation rate from 65% to 82% simply by offering a lower-cost plan option alongside their standard coverage, ensuring they maintained eligibility for group rates.

Wellness Program Impacts

Wellness initiatives aren't just good for your employees' health – they can be good for your premium costs too. Many carriers offer premium discounts for businesses that implement qualifying wellness programs.

These programs range from basic health assessments to comprehensive initiatives with ongoing coaching and support. A manufacturing company in Broomfield implemented a simple wellness program that qualified for a 4% premium reduction while also reducing employee absenteeism by 7% the following year.

The key is working with small business health insurance brokers Colorado who understand which wellness initiatives qualify for premium incentives with specific carriers, ensuring your efforts translate into actual savings.

Deductible Choices and Their Effect

Perhaps no single plan feature impacts your premium more directly than the deductible level you select. Higher deductibles mean lower premiums, but they also shift more initial costs to employees when they need care.

Many Colorado businesses are finding creative middle ground through partially self-funded Health Reimbursement Arrangements (HRAs). These programs pair higher-deductible plans (which reduce premiums) with employer funding that covers a portion of the deductible, giving employees better protection while still capturing premium savings.

A Denver-based engineering firm recently reduced their premiums by 15% by moving to a $3,000 deductible plan, then used some of those savings to fund the first $1,500 of each employee's deductible through an HRA. The result? Lower overall costs for the company and maintained protection for employees.

Understanding these factors helps you make more informed choices about your health benefits strategy. Working with experienced small business health insurance brokers Colorado can help you steer these variables to find the sweet spot that balances employee needs with your budget realities.

Tax Credits & Savings Only the Best Brokers Open up

Let's face it – health insurance is a significant investment for any small business. What many Colorado business owners don't realize is that there are substantial tax advantages and savings opportunities that can dramatically reduce your actual costs. This is where working with experienced small business health insurance brokers Colorado really pays off.

Small Business Health Care Tax Credit

This might be the best-kept secret in small business health insurance. If you have fewer than 25 full-time equivalent employees earning average annual wages under $50,000, you could qualify for a federal tax credit that covers up to 50% of the premiums you pay for your employees' health coverage.

I recently worked with a family-owned bakery in Fort Collins with 7 employees. They had no idea this credit existed until we ran the numbers. They qualified for a 40% credit, which translated to over $12,000 in annual savings. That difference allowed them to upgrade from a high-deductible plan to more comprehensive coverage without increasing their budget.

To qualify, you need to contribute at least 50% toward employee premiums and purchase coverage through the Small Business Health Options Program (SHOP). The smaller your business and the lower your average wages, the larger your potential credit.

QSEHRA Benefits for Smaller Employers

If traditional group health insurance feels too expensive or complicated for your small business, a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) might be the perfect alternative. This option allows businesses with fewer than 50 employees to reimburse workers tax-free for individual health insurance premiums and qualified medical expenses.

In 2023, you can reimburse up to $5,850 for individual coverage and $11,700 for family coverage. The beauty of QSEHRAs is their flexibility – you decide how much to contribute (up to those limits), and your employees choose the individual plans that work best for them.

A graphic design studio in Denver implemented this approach last year. The owner told me, "It's been a game-changer for us. We can finally offer a health benefit that fits our budget, and my employees appreciate being able to choose plans that match their personal needs."

ICHRA: The Flexible Alternative

Individual Coverage Health Reimbursement Arrangements (ICHRAs) take the QSEHRA concept even further by removing the size restrictions and contribution limits. This newer option has quickly become popular among Colorado businesses looking for maximum flexibility.

With an ICHRA, you can set different contribution amounts for different classes of employees – perhaps offering more to your full-time veterans and a starter amount to part-timers or newer hires. Your employees use these funds to purchase individual health insurance that fits their specific needs.

This approach works particularly well for businesses with employees scattered across Colorado's diverse geographic regions. A construction company with projects from Denver to Grand Junction found that an ICHRA solved their network coverage challenges by allowing each employee to select a plan with strong local providers.

The IRS Affordable Care Act Employers resource offers detailed guidance on implementing these arrangements correctly.

Section 125 Cafeteria Plan Advantages

A Section 125 plan (sometimes called a cafeteria plan or premium-only plan) allows employees to pay their portion of health insurance premiums with pre-tax dollars. This simple change creates a win-win situation: employees reduce their taxable income, effectively lowering their premium costs, while employers save on payroll taxes for these contributions.

Setting up a Section 125 plan requires specific documentation, but the process is straightforward with proper guidance. For a 20-employee manufacturing company in Longmont, implementing this pre-tax approach saved each employee an average of $600 annually while reducing the company's payroll tax burden by over $3,000.

HSA Payroll Pre-Tax Contributions

If your business offers a qualified high-deductible health plan, facilitating pre-tax Health Savings Account (HSA) contributions through payroll creates substantial tax benefits for everyone involved. Employees save on federal income tax, FICA, and usually state income tax, while your business reduces its payroll tax obligations.

HSAs offer what tax experts call the "triple tax advantage" – contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free. By setting up pre-tax payroll contributions, you're helping your employees maximize these benefits while also reducing your own tax burden.

A software company in Boulder implemented this strategy last year, resulting in approximately $4,200 in annual payroll tax savings for the business while providing employees with an average individual tax savings of nearly $800 each.

The right small business health insurance brokers Colorado will proactively identify which of these tax-saving strategies makes the most sense for your specific situation. At Kelmeg & Associates, we review these options with every client as part of our comprehensive approach to making health benefits more affordable.

For more detailed information about these employer benefits options, visit our employer group benefits page.

Step-by-Step: Getting a Quote & Enrolling Through a Broker

Getting health insurance for your small business doesn't have to be complicated. When you work with small business health insurance brokers Colorado like our team at Kelmeg & Associates, we transform what could be an overwhelming process into a straightforward journey. Let me walk you through exactly how it works.

1. Gather Required Information

Before we can find the perfect plan for your business, we'll need some basic information to get started. Think of this as the foundation for your custom insurance solution:

Your employee census is the most important piece – this includes names, birth dates, and zip codes for everyone who'll be offered coverage (including dependents if they'll be joining the plan). We'll also need your business EIN, details about any coverage you currently offer, when you'd like the new coverage to begin, and how much your business plans to contribute toward premiums.

"Having your census ready saved us at least a week in the quoting process," shared a Denver retail owner who recently switched plans. "Our broker explained exactly what they needed upfront, which made everything move faster."

2. Review and Compare Options

Once we have your information, the fun part begins! Within just 24-48 hours, we'll present you with multiple options custom-custom to your business. We don't just throw insurance jargon at you – we translate everything into plain English, focusing on what these plans would actually mean for your company and employees.

We'll sit down together (virtually or in person) and review side-by-side comparisons of premiums and deductibles, analyze provider networks to ensure your employees' doctors are covered, examine prescription coverage details, and highlight special features like telehealth or wellness programs. We'll also point out potential tax advantages you might not have considered.

3. Select Your Carrier and Plan

After reviewing your options, you'll choose the plan that best fits your needs. This decision typically balances several factors: cost considerations, network compatibility, plan features that align with your employees' healthcare needs, and administrative requirements.

A Colorado Springs accounting firm owner recently told us, "What I appreciated most was how our broker helped us understand the tradeoffs. They didn't just push the cheapest plan – they helped us find the right balance between affordable premiums and coverage our team would actually use."

4. Complete and Sign Applications

Once you've selected your plan, we'll help you complete all necessary paperwork. This includes the employer application that establishes your group, individual employee applications, and any additional forms required by your chosen carrier.

The good news? Modern technology has made this process nearly painless. In most cases, everything can be completed and signed online using secure electronic signature tools – no printing, scanning, or faxing required. We guide you through each step, ensuring everything is filled out correctly the first time.

5. Submit Initial Premium Payment

Your coverage is officially "bound" when the carrier receives your first month's premium payment. Most Colorado carriers accept ACH bank transfers (the most common method), checks, and sometimes credit cards. We'll provide clear instructions for this process and confirm receipt with the carrier, so you don't have to wonder if your payment went through.

6. Receive Welcome Materials and ID Cards

Within 7-10 days before your effective date, you'll receive welcome materials and ID cards from your new carrier. These typically include physical and/or digital employee ID cards, Summary of Benefits documents, plan details, network information, and instructions for accessing online portals.

We don't just drop these materials on your desk and disappear. We'll review everything with you to ensure it's correct and help you understand all the resources available to you and your team.

7. Conduct Employee Education Sessions

One of the most valuable services small business health insurance brokers Colorado provide is helping your employees understand and appreciate their new benefits. We conduct education sessions (either in-person or virtually) custom specifically to your workforce.

"The enrollment meeting made all the difference," said an employee at a Boulder tech startup. "Instead of just handing us insurance cards, they explained how to actually use our benefits effectively. I finally understood what my deductible meant and how to find in-network doctors."

These sessions cover plan details, network information, prescription coverage, digital resources, and who to contact with questions. We can even record these sessions for employees who can't attend live.

8. Establish Ongoing Support Processes

Your relationship with your broker doesn't end once your plan is in place. We establish clear processes for ongoing support throughout the year, including specific points of contact for various issues (claims, billing, enrollment changes), regular check-ins, procedures for adding new employees, and a timeline for future renewal discussions.

This proactive approach ensures you're never left wondering who to call when questions arise. As one Durango business owner put it, "Having our broker handle a billing dispute saved me hours of frustration. They knew exactly who to call and how to resolve it – something that would have taken me days to figure out."

For more information about our comprehensive services, visit our services page.

Working with small business health insurance brokers Colorado transforms what could be a confusing, frustrating process into a smooth, supported experience. We handle the complexity so you can focus on what matters most – running your business and taking care of your team.

Frequently Asked Questions about Small Business Health Insurance Brokers Colorado

How many employees do I need to qualify for a group plan in Colorado?

You might be surprised to learn that in Colorado, you can qualify for group health insurance with just one W-2 employee who isn't you (the owner), your spouse, or a business partner. This opens doors for even the tiniest businesses to access quality group coverage.

"Many small business owners are genuinely shocked when I tell them they qualify for group coverage with just one or two employees," our senior benefits consultant often says. "Their faces light up when they realize they have options they never knew existed."

While the one-employee minimum is true, there's a bit more to the story. Most insurance carriers require a certain percentage of your eligible employees—typically around 70%—to participate in the plan. The good news? Employees who have coverage through a spouse's plan or Medicare usually don't count against this participation requirement, making it easier to meet the threshold even in small companies.

Do broker services add extra costs to my premiums?

This is perhaps the biggest misconception we hear about working with small business health insurance brokers Colorado. Let me be crystal clear: working with a broker adds absolutely zero additional cost to your premiums.

Here's why: health insurance premiums in Colorado are filed with and approved by the state's Division of Insurance. These rates are identical whether you purchase directly from the insurance carrier or work through a broker like us. Broker compensation is already built into these approved rates.

Our founder likes to explain it this way: "Think of it like booking a hotel. You'll pay the same rate whether you book directly with the hotel or through a travel agent. The difference is that the agent helps you find the right property and handles any issues that arise during your stay."

By partnering with a broker, you're essentially getting valuable expertise, ongoing support, and an advocate in your corner—all at no additional cost to your business. In fact, a good broker often identifies cost-saving opportunities you might miss on your own, potentially saving you more than what the carrier pays us in commission.

Can a broker help if I only have one full-time employee?

Absolutely! Even the smallest businesses can benefit tremendously from working with a small business health insurance brokers Colorado. If you have just one full-time employee besides yourself, several viable options exist:

First, if your one employee isn't your spouse or immediate family member, you may qualify for traditional small group coverage, which often provides better benefits at lower costs than individual policies.

Second, you might consider an Individual Coverage HRA (ICHRA), which allows you to provide tax-free reimbursements to employees who purchase their own individual health insurance plans. This gives both you and your employee significant flexibility.

Third, a Qualified Small Employer HRA (QSEHRA) works similarly to an ICHRA but has contribution limits and additional restrictions that might actually work better for very small businesses in certain situations.

Finally, if group coverage simply isn't feasible, brokers can still provide invaluable guidance on individual market options for both you and your employees.

We recently worked with a small consulting firm in Lafayette that had just one full-time employee. They had assumed group coverage was out of reach and had been purchasing separate individual policies. After consulting with us, they finded they qualified for a small group plan that provided substantially better coverage at a lower cost than what they'd been paying separately.

Even sole proprietors without any employees can benefit from broker guidance. We often help identify potential subsidies or coverage alternatives on the individual market that might otherwise be overlooked.

Conclusion

Navigating the complex world of small business health insurance in Colorado doesn't have to be overwhelming. The right broker partnership can transform this challenging process into a strategic advantage for your business, providing expert guidance without adding costs to your premiums.

As we've explored throughout this guide, small business health insurance brokers Colorado provide numerous benefits that go far beyond simply finding a policy. They become trusted advisors who understand your business's unique needs and challenges.

Finding affordable, comprehensive health coverage for your team is one of the most important decisions you'll make as a business owner. It affects your ability to attract talent, your employees' wellbeing, and ultimately, your bottom line. That's why having an experienced guide by your side makes all the difference.

Think of a good broker as your personal health insurance translator and advocate. They speak the complex language of deductibles, coinsurance, and networks fluently, but can explain everything in terms that actually make sense to you and your team. When problems arise – and in health insurance, they inevitably do – your broker steps in to resolve issues so you can focus on running your business.

At Kelmeg & Associates, we're committed to providing this high level of service to small businesses across Colorado. Our local expertise means we understand the unique challenges facing businesses in different regions of our state – from the specific provider networks in mountain communities to the competitive talent markets along the Front Range.

Our personalized approach ensures that we don't just sell you a policy; we develop a comprehensive benefits strategy aligned with your business goals and budget. And our ongoing support means you're never alone when questions or problems arise.

Whether you're offering health insurance for the first time or looking to improve your existing benefits package, we invite you to experience the difference that working with a dedicated local broker can make. Our team is ready to provide a free, no-obligation review of your options and help you develop a benefits strategy that supports both your business goals and your employees' wellbeing.

Working with a broker costs you nothing extra – the premiums are identical whether you work directly with carriers or through us. The difference is the personalized guidance, time savings, and ongoing support you receive throughout the year.

For more information about our comprehensive services or to schedule your free consultation, visit our services page or contact our team directly. We look forward to helping your Colorado small business thrive through better benefits solutions.