Medicare in Colorado Springs: Finding the Right Care for You

Understanding Colorado Springs Medicare

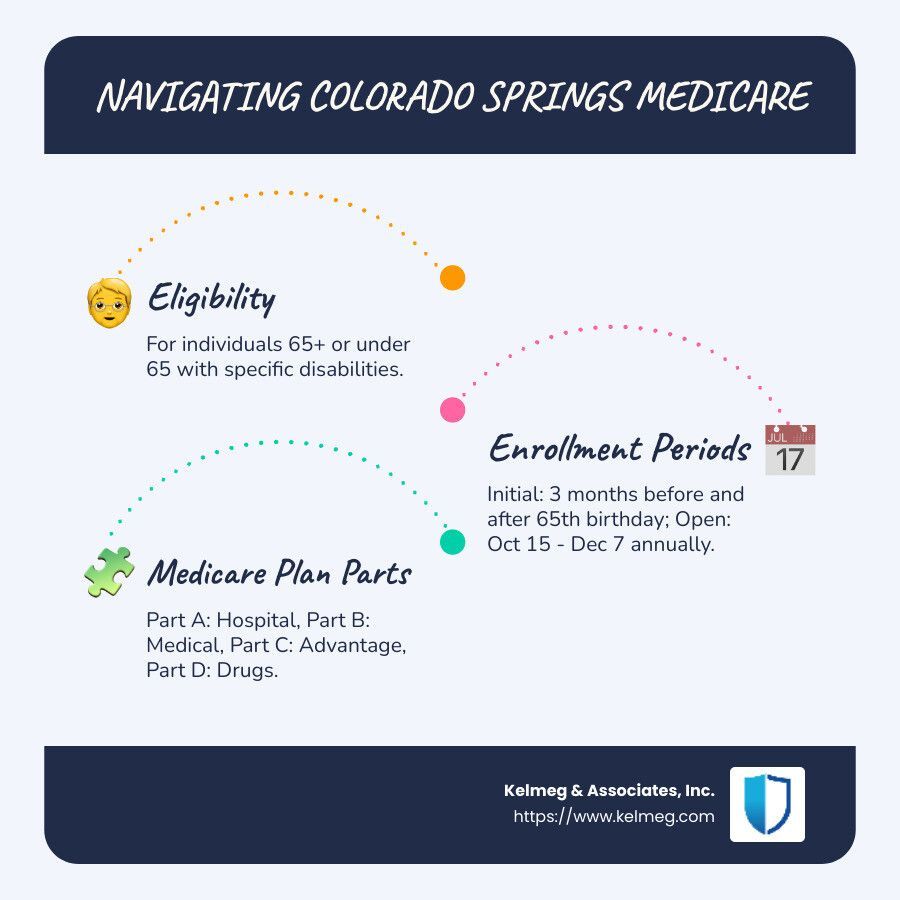

Navigating colorado springs medicare can feel overwhelming, especially for those new to health insurance. The good news is that Medicare offers residents a variety of plans custom to their needs. Here’s what you need to know at a glance:

- Eligibility: Generally for individuals aged 65 and over, or those under 65 with specific disabilities.

- Enrollment Periods: Initial enrollment starts 3 months before your 65th birthday, ends 3 months after. Open enrollment happens annually from October 15th to December 7th.

- Plan Parts: Medicare is divided into four parts — A, B, C, and D, with each covering different health care services.

My name is Kelsey Mackley. At Kelmeg & Associates, Inc., I specialize in helping clients find their way through colorado springs medicare options. With experience in insurance, my focus is on providing transparent, personalized solutions that best fit your health and financial needs.

Understanding Medicare in Colorado Springs

Navigating Medicare can be complex, but understanding the basics can help you make informed decisions. Here's a straightforward breakdown of the different parts of Medicare and what they cover:

Medicare Parts

- Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people don't pay a premium for Part A if they or their spouse paid Medicare taxes while working.

- Part B (Medical Insurance): Covers certain doctors' services, outpatient care, medical supplies, and preventive services. There is a monthly premium for Part B, and it's important to enroll during your initial period to avoid penalties.

- Part C (Medicare Advantage): Plans offered by private companies that contract with Medicare to provide Part A and Part B benefits. They often include additional benefits like vision, dental, or hearing, and many include prescription drug coverage.

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription drugs, and is offered by insurance companies and other private companies approved by Medicare.

Eligibility

To qualify for Medicare in Colorado Springs, you typically need to be 65 or older. However, younger individuals with certain disabilities or conditions like End-Stage Renal Disease may also be eligible. Understanding your eligibility and enrolling at the right time is key to avoiding penalties.

Enrollment Periods

- Initial Enrollment Period (IEP): Begins three months before you turn 65, includes your birth month, and ends three months after. This is your first chance to sign up for Medicare Parts A and B.

- Open Enrollment Period: From October 15 to December 7 each year, you can make changes to your Medicare Advantage or Medicare prescription drug coverage.

Missing these periods can result in penalties. For example, if you don't sign up for Part B during your IEP, you may face a 10% increase in your premium for each 12-month period you were eligible but didn't enroll.

Understanding these components is crucial for navigating Medicare in Colorado Springs effectively. For personalized assistance, the team at Kelmeg & Associates, Inc. is ready to help you find the right plan that fits your needs and budget.

How to Enroll in Medicare

Enrolling in Medicare can feel like navigating a maze, but understanding the key enrollment periods and potential penalties can make the process smoother. Here's what you need to know:

Initial Enrollment Period (IEP)

Your Initial Enrollment Period is a seven-month window that starts three months before you turn 65, includes your birthday month, and ends three months after. During this time, you can sign up for Medicare Parts A and B. It's crucial to enroll during this period to avoid any penalties.

- Example: If your 65th birthday is in June, your IEP runs from March 1 to September 30.

Open Enrollment Period

The Open Enrollment Period occurs annually from October 15 to December 7. This is your opportunity to make changes to your Medicare Advantage or prescription drug coverage for the following year. During this period, you can:

- Switch from Original Medicare to a Medicare Advantage Plan or vice versa.

- Change Medicare Advantage Plans.

- Join, switch, or drop a Medicare Part D prescription drug plan.

Penalties

Failing to enroll in Medicare on time can lead to penalties, which can increase your costs significantly:

- Part B Penalty: If you don't sign up for Part B during your IEP, your monthly premium can increase by 10% for each full 12-month period you could have had Part B but didn't. This penalty lasts for as long as you have Part B.

- Part D Penalty: If you go without Part D or other creditable prescription drug coverage for 63 or more consecutive days after your IEP, you may pay a late enrollment penalty. This penalty is calculated based on the number of months you were without coverage.

Understanding these enrollment periods and penalties is key to making informed decisions about your colorado springs medicare coverage. For personalized guidance, Kelmeg & Associates, Inc. is here to help you find the best plan custom to your needs and budget.

Colorado Springs Medicare Providers

Finding the right Medicare-approved providers in Colorado Springs is essential for accessing quality healthcare services. Medicare-approved providers are doctors, hospitals, and other healthcare facilities that accept Medicare and agree to its payment terms. This ensures you receive care without unexpected costs.

Outpatient Services are a significant part of Medicare coverage. These services include doctor visits, preventive care, and certain outpatient procedures. If you have Medicare Part B, these services are generally covered, but you may still have some out-of-pocket costs like copayments or coinsurance. It's important to verify that your chosen provider accepts Medicare to minimize these costs.

Medicare Advantage Plans, also known as Part C, offer an alternative to Original Medicare. These plans are provided by private insurance companies approved by Medicare and often include extra benefits like vision, dental, and hearing coverage. In Colorado Springs, there are numerous Medicare Advantage Plans available, each with different networks and benefits. Choosing the right plan means considering your healthcare needs, preferred providers, and budget.

Kelmeg & Associates, Inc. can assist you in navigating these options to find the best fit for your situation. With their expertise, you can explore various Medicare Advantage Plans and understand the network of providers available in Colorado Springs. This ensures you receive comprehensive care without unnecessary expenses.

For more detailed information on colorado springs medicare providers and plans, reach out to Kelmeg & Associates, Inc. Their team is ready to help you make informed decisions about your healthcare coverage.

Finding the Best Medicare Plans in Colorado Springs

When it comes to choosing the best Medicare plans in Colorado Springs, you have several options to consider, including Medicare Advantage, Medigap plans, and secondary coverage. Each has its own benefits and can be custom to fit your unique healthcare needs.

Medicare Advantage Plans

Medicare Advantage, also known as Part C, is an all-in-one alternative to Original Medicare. Offered by private insurance companies, these plans often bundle hospital, medical, and prescription drug coverage. In Colorado Springs, you can find a variety of Medicare Advantage Plans that provide extra benefits like vision, dental, and hearing care. When choosing a plan:

- Evaluate Network Choices: Check if your preferred doctors and hospitals are in-network.

- Compare Extra Benefits: Look for plans offering services that matter to you, such as wellness programs or telehealth options.

- Consider Costs: Assess premiums, deductibles, and out-of-pocket maximums to find a plan that fits your budget.

Medigap Plans

Medigap, or Medicare Supplement Insurance, helps cover the gaps in Original Medicare, such as copayments, coinsurance, and deductibles. These plans are standardized, meaning Plan G from one insurer is the same as Plan G from another. However, costs can vary, so it's important to:

- Compare Premiums: Different insurers may charge different premiums for the same coverage.

- Check Enrollment Periods: The best time to buy a Medigap policy is during your Medigap Open Enrollment Period, which starts when you turn 65 and are enrolled in Medicare Part B.

- Understand Coverage Levels: Choose a plan that covers the expenses you anticipate, such as foreign travel emergencies or excess charges.

Secondary Coverage

Secondary coverage can help reduce out-of-pocket expenses not covered by Medicare. This might be through Medicaid, employer-sponsored insurance, or other supplemental plans. If you qualify for Medicaid, it can serve as secondary insurance to cover costs such as premiums and coinsurance.

For those who need assistance navigating these options, Kelmeg & Associates, Inc. provides expert guidance. They can help you compare plans, understand your choices, and select the best Medicare coverage for your needs. Their team is dedicated to ensuring you have peace of mind with a plan that fits your lifestyle and budget.

For personalized assistance and more information on colorado springs medicare, contact Kelmeg & Associates, Inc. Their knowledgeable team is ready to help you make informed decisions about your healthcare coverage.

Frequently Asked Questions about Colorado Springs Medicare

How do I contact Medicare in Colorado?

If you need assistance with Colorado Springs Medicare, you can reach out to Medicare directly by calling 1-800-MEDICARE (1-800-633-4227). This hotline is available 24/7 to answer your questions and guide you through your Medicare options.

For local support, the Pikes Peak Area Council of Governments (PPACG) is a valuable resource. They're a nonprofit organization dedicated to helping Medicare recipients understand their benefits and options. You can contact them at (719) 471-2096 or visit their website at ppacg.org for more information.

What happens if I don't sign up for Medicare Part B?

Failing to sign up for Medicare Part B during your initial enrollment period can lead to penalties. Specifically, your monthly premium may increase by 10% for each 12-month period you were eligible but did not enroll. This penalty is typically permanent and can result in higher costs over time, so it's important to enroll as soon as you're eligible to avoid these additional expenses.

Does Medicare cover assisted living?

Medicare coverage for assisted living is limited. Generally, Medicare does not cover the cost of assisted living facilities or long-term custodial care. However, Medicare may cover certain healthcare services you receive while in an assisted living facility, such as doctor visits or physical therapy, if they are deemed medically necessary.

There are exceptions and additional resources that might help cover these costs, such as Medicaid or long-term care insurance. If you're considering assisted living, it's crucial to explore all available options and understand what each plan covers to ensure you have the necessary support.

For more information and personalized guidance on colorado springs medicare, Kelmeg & Associates, Inc. is here to help. Their team can assist you in navigating the complexities of Medicare, ensuring you make informed decisions that best suit your needs.

Conclusion

Navigating Colorado Springs Medicare can feel overwhelming, but you don't have to do it alone. At Kelmeg & Associates, Inc., we specialize in providing expert guidance to help you find the right Medicare plan custom to your unique needs. Our team understands the intricacies of Medicare, from Advantage Plans to Medigap options, and we're here to simplify the process for you.

We believe in the power of personalized plans. Every individual's healthcare needs are different, and so are their financial situations. That's why we work closely with you to understand your specific circumstances and guide you toward the best possible coverage. Whether you're exploring Medicare Advantage for additional benefits or seeking Medigap plans to cover out-of-pocket expenses, we're committed to finding the perfect fit for you.

Our services come at no extra cost to you. We pride ourselves on offering expert advice without any hidden fees, ensuring you get the best coverage without the stress of added expenses. With locations across Colorado, including Lafayette, Broomfield, Boulder, and Adams County, we're conveniently positioned to serve you wherever you are.

For more information on how we can assist you with Medicare in Colorado Springs, contact us today. Let Kelmeg & Associates, Inc. be your trusted partner in securing peace of mind and comprehensive healthcare coverage.