Kaiser Medicare in Colorado: What You Need to Know

When it comes to kaiser medicare colorado, finding the right plan can feel overwhelming. But don't worry; we've gathered some vital points to help you make an informed choice:

- Kaiser Medicare: Known for offering comprehensive Medicare Advantage plans custom to the unique needs of Colorado residents.

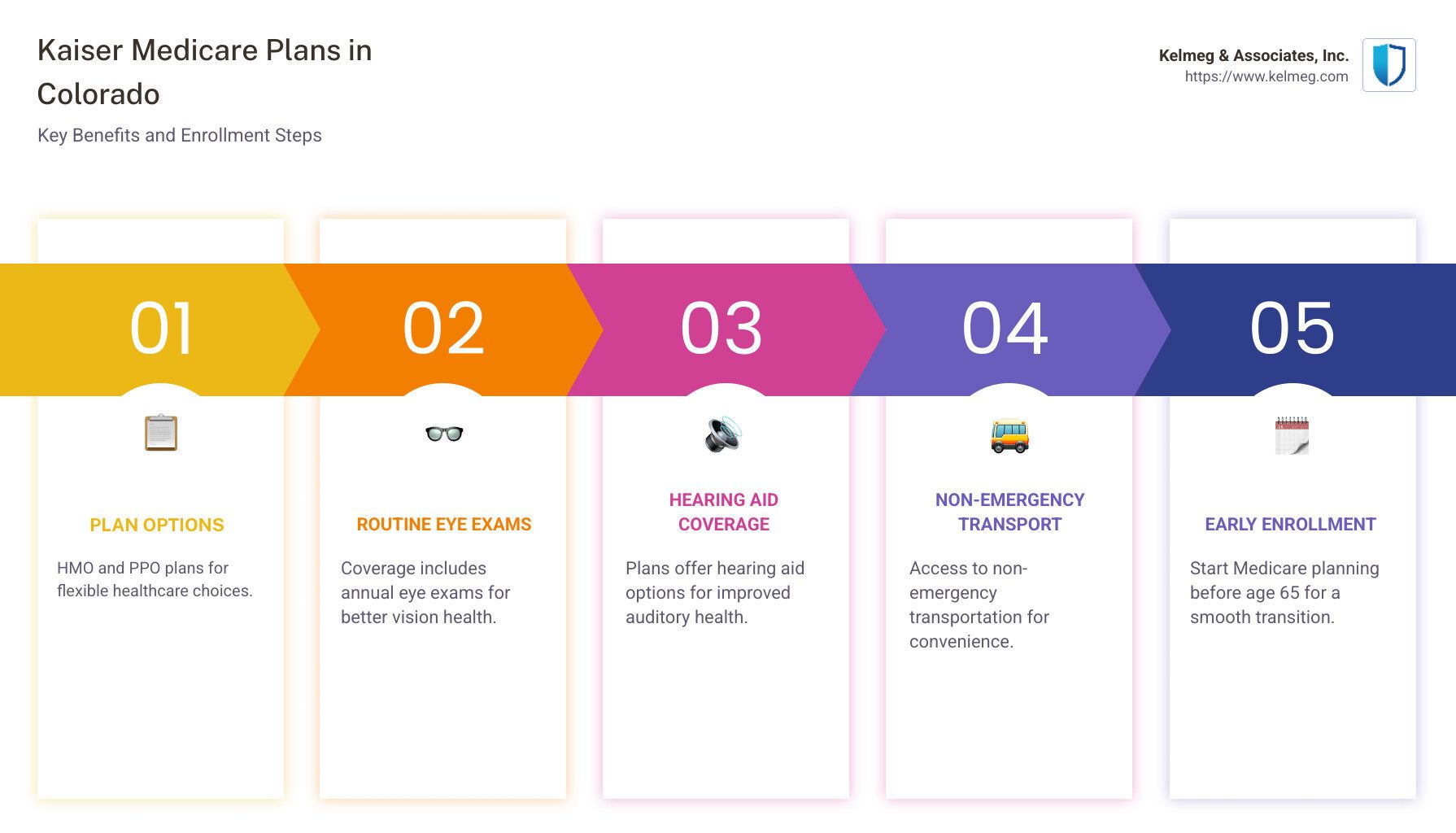

- Plans Available: Includes options like HMO and PPO to ensure flexibility in your healthcare choices.

- Benefits: Coverage often includes routine eye exams, hearing aids, and even access to non-emergency transportation.

- Enrollment: Stay ahead by starting your Medicare planning before your 65th birthday to ensure a smooth transition.

Medicare can seem like a maze. But you don’t have to steer it alone. At Kaiser Permanente, we’re committed to simplifying healthcare choices, offering peace of mind to residents across Colorado.

I'm Kelsey Mackley. With years of expertise in kaiser medicare colorado, I specialize in crafting personalized health insurance solutions. At Kelmeg & Associates, my goal is to make complex insurance concepts more approachable so you can choose the best plan with confidence.

Understanding Kaiser Medicare in Colorado

When exploring Medicare Advantage plans in Colorado, it's important to understand the basics. These plans are an alternative to Original Medicare, offering bundled benefits through private insurance companies.

Medicare Advantage: A Brief Overview

Medicare Advantage plans, also known as Medicare Part C, provide all the benefits of Part A (hospital insurance) and Part B (medical insurance). They often include additional perks such as prescription drug coverage, vision, hearing, and dental care.

Medicare Advantage plans are available in two main formats: HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization).

HMO vs. PPO: What's the Difference?

- HMO Plans: These require you to choose a primary care doctor and get referrals to see specialists. They typically have lower premiums but require you to use the plan's network of doctors and hospitals.

- PPO Plans: These offer more flexibility in choosing healthcare providers. You can see any doctor or specialist without a referral, even outside the network, though it might cost more.

Medicare Advantage plans in Colorado are known for their comprehensive coverage and excellent service. They aim to provide a seamless healthcare experience with a network of skilled providers.

Benefits of Kaiser Medicare Plans

Exploring Kaiser Medicare Colorado uncovers a range of benefits that can improve your healthcare experience. Here's a closer look at some key features:

Senior Advantage

The Senior Advantage plan is designed specifically for seniors, offering comprehensive healthcare coverage. This plan includes all the benefits of Original Medicare, plus extra perks like vision, hearing, and dental services. It aims to provide a holistic healthcare experience that supports seniors in maintaining their health and well-being.

Fitness Programs

Staying active is crucial for maintaining good health, especially as we age. Kaiser Medicare plans often include access to fitness programs, encouraging members to keep moving. These programs might offer gym memberships, online fitness classes, or discounts on wellness activities. Staying fit can lead to better health outcomes and a more active lifestyle.

Eyewear Coverage

Vision care is an essential part of overall health, and Kaiser Medicare Colorado plans recognize this by including eyewear coverage. Members receive an allowance for eyeglass lenses and frames, as well as contact lenses, fitting, and dispensing. This benefit ensures that you can maintain clear vision without worrying about high costs.

Hearing Aid Coverage

Hearing loss can significantly impact quality of life, so having access to hearing aid coverage is a valuable benefit. Kaiser Medicare plans include an allowance for hearing aids, providing one hearing aid per ear every two years. This coverage helps ensure that members can stay connected and engaged in their daily lives.

With these benefits, Kaiser Medicare Colorado plans are designed to offer more than just basic healthcare. They provide comprehensive support to help you lead a healthy, active, and fulfilling life.

Frequently Asked Questions about Medicare in Colorado

Choosing a Medicare plan can be overwhelming, especially with so many options available. Here are some common questions about Medicare in Colorado to help you make an informed decision.

Is Medicare Advantage a good option?

Medicare Advantage plans are often considered a strong choice for Medicare, thanks to their high CMS ratings. The Centers for Medicare & Medicaid Services (CMS) uses a star rating system to evaluate the quality of Medicare plans, and many Medicare Advantage plans consistently receive high ratings. These ratings reflect factors like customer service, patient outcomes, and preventive care measures.

Additionally, Medicare Advantage offers a variety of plan types, including Health Maintenance Organization (HMO) plans, which can provide comprehensive care with lower out-of-pocket costs. However, it's important to review the specific plan ratings and benefits in your area to ensure it meets your needs.

Can I join a Medicare Advantage Plan?

Yes, you can join a Medicare Advantage Plan if you have Medicare. These plans, including HMO plans, require you to use a network of doctors and hospitals. To join, you need to be enrolled in both Medicare Part A and Part B and reside in the plan's service area. When you enroll, you'll enter into a Medicare contract with the provider, outlining your coverage and benefits.

What are the downsides of Medicare Advantage Plans?

While Medicare Advantage offers many benefits, there are some potential downsides to consider:

- Limited Network: HMO plans typically require you to use healthcare providers within their network. This can limit your choices if you prefer a specific doctor or facility outside of the network.

- Copays and Deductibles: Although Medicare Advantage plans can offer lower premiums, you may still face copays and deductibles. These out-of-pocket costs can add up, especially if you need frequent medical care.

Understanding these aspects can help you weigh the pros and cons of choosing a Medicare Advantage Plan for your needs. By evaluating your healthcare priorities and financial situation, you can decide if this type of plan is the right fit for you.

Conclusion

Navigating Medicare can feel like a daunting task, but with Kelmeg & Associates, Inc. by your side, it doesn't have to be. We specialize in guiding you through the complexities of Kaiser Medicare Colorado plans, ensuring you find the best coverage that suits your unique needs.

Our team offers expert guidance at no extra cost, helping you understand the various options available, from Medicare Advantage plans to supplemental coverages. We focus on providing personalized plans that align with your health priorities and financial situation. Whether you're considering an HMO plan with Kaiser Permanente or exploring other Medicare options, we are here to assist you every step of the way.

Choosing the right Medicare plan is crucial for your health and peace of mind. By partnering with us, you gain access to custom advice and support, ensuring your Medicare journey is as smooth and informed as possible.

Ready to explore your options? Visit our Medicare service page to learn more about how we can help you secure the right Medicare plan. Let us provide you with the peace of mind that comes with knowing you're covered by a plan that truly meets your needs.