Your Guide to Medicare Insurance Brokers in Colorado Springs

Colorado Springs Medicare Insurance Agency is your go-to resource for navigating Medicare, providing expert guidance on insurance options in the region. Whether you're just beginning your health insurance journey or seeking to optimize your current plan, understanding Medicare's complexities can be daunting.

Here’s a quick answer if you're looking for affordable, comprehensive Medicare solutions in Colorado Springs:

- Medicare Options: Explore Medicare Advantage, Medigap, and Part D.

- Personalized Guidance: Benefit from expert advice custom to your needs.

- No Added Fees: Find cost-effective solutions without extra charges.

Medicare is a government health insurance program for those 65 or older or who meet specific criteria. Options like Medicare Advantage plans offer additional benefits, while Medigap provides supplemental coverage to bridge gaps in Original Medicare. Working with a knowledgeable broker ensures you get the right guidance to choose the ideal plan for your needs.

As Kelsey Mackley at Colorado Springs Medicare Insurance Agency, I have dedicated my career to providing clear, customized insurance solutions. With expertise in Medicare and a commitment to helping individuals and businesses find the perfect fit, my goal is to simplify your insurance journey.

Understanding Medicare Insurance

Medicare can seem overwhelming, but breaking it down into its core components makes it easier to understand. Let's explore the three main parts: Medicare Advantage, Medigap, and Part D.

Medicare Advantage

Medicare Advantage plans are an alternative to Original Medicare, provided by private insurance companies. These plans must meet Medicare standards but often offer additional benefits like vision, dental, and hearing coverage.

Key Features:

- Network-Based: Many plans require you to use a network of doctors and hospitals.

- Variety of Plans: Choose from HMO, PPO, and other plan types.

- Out-of-Pocket Limit: Protects you from high medical costs.

Medicare Advantage can be a great option if you’re looking for comprehensive coverage beyond what Original Medicare provides. However, these plans might involve copayments and coinsurance.

Medigap (Medicare Supplement Insurance)

Medigap helps cover costs that Original Medicare doesn’t, like copayments, coinsurance, and deductibles. These plans, sold by private companies, offer standardized benefits, making it easier to compare options.

Highlights:

- Standardized Plans: Benefits are the same across companies, only prices vary.

- Fills Gaps: Covers out-of-pocket expenses not paid by Medicare.

- No Network Restrictions: Freedom to choose any doctor or hospital that accepts Medicare.

Medigap is ideal if you want predictable out-of-pocket costs and the flexibility to see any doctor.

Part D (Prescription Drug Coverage)

Part D plans cover prescription drugs and are offered by private insurers. These plans are crucial if you need medication coverage, as Original Medicare doesn't cover most prescriptions.

Essentials:

- Varied Formularies: Each plan has its own list of covered drugs.

- Monthly Premiums: Costs vary based on the plan and drugs covered.

- Penalty for Late Enrollment: Enroll when first eligible to avoid extra costs.

Choosing the right Part D plan involves comparing formularies and ensuring your medications are covered.

By understanding these components, you can make informed decisions about your Medicare options. Whether you're leaning towards a Medicare Advantage plan for its extra benefits, a Medigap policy for its comprehensive coverage, or a Part D plan for drug coverage, working with an experienced broker like those at the Colorado Springs Medicare Insurance Agency can help you steer these choices.

Colorado Springs Medicare Insurance Agency

Navigating Medicare can be a daunting task, but with the right guidance, it becomes manageable. That's where local brokers in Colorado Springs come in. They provide personalized plans and expert advice custom to your unique needs.

Local Brokers: Your Neighborhood Experts

Local brokers are not just insurance experts; they are part of your community. They understand the specific needs of Colorado Springs residents and are familiar with local healthcare providers. This local insight allows them to offer personalized service that addresses your individual circumstances.

- Accessible and Approachable: Being local means they’re available for face-to-face meetings, providing a personal touch.

- Community Knowledge: They know the ins and outs of local healthcare networks and can guide you to the best plan for your area.

Personalized Plans: Custom Just for You

Every individual has different healthcare needs, and a one-size-fits-all approach doesn’t work with Medicare. Local brokers specialize in crafting personalized plans that fit your medical needs and financial situation.

- Customized Coverage: From Medicare Advantage to Medigap, brokers help you choose the plan that covers what you need without paying for what you don’t.

- Budget-Friendly Options: They help find plans that fit your budget, ensuring you get the best value for your money.

Expert Advice: Making Informed Decisions

Choosing the right Medicare plan involves understanding complex terms and conditions. Fortunately, Colorado Springs brokers provide expert advice to help you make informed decisions.

- Clarity and Simplicity: They break down complex terms into simple language, making it easier for you to understand.

- Ongoing Support: Brokers offer continuous support, helping you adapt to any changes in Medicare regulations or your personal health needs.

The Kelmeg & Associates, Inc. Advantage

At Kelmeg & Associates, Inc., we pride ourselves on being a trusted Colorado Springs Medicare Insurance Agency. Our dedicated team is here to help you steer the complexities of Medicare with ease. We offer:

- Comprehensive Support: From initial consultation to ongoing plan management, we’re with you every step of the way.

- Proven Track Record: With years of experience, we have helped thousands of clients find the right Medicare solutions.

By partnering with a local broker, you gain a trusted ally in your healthcare journey. Whether you’re new to Medicare or looking to optimize your current plan, let us help you find the best path forward.

Benefits of Working with a Medicare Insurance Broker

When it comes to navigating Medicare, having an independent broker by your side can make all the difference. Here's why working with a Medicare insurance broker is beneficial:

Independent Brokers: Your Unbiased Allies

Independent brokers are not tied to any specific insurance company. This freedom allows them to present you with a wide range of options without any bias.

- Objective Advice: They focus on finding what truly fits your needs, not what benefits a particular insurer.

- Broad Access: With connections to various insurance providers, they can offer more choices and better deals.

Personalized Service: Custom to You

A personalized approach is at the heart of what brokers do. They take the time to understand your unique situation and healthcare needs.

- One-on-One Attention: Brokers provide dedicated, individualized support to ensure you get the coverage that’s right for you.

- Custom Solutions: They craft plans that align with both your health requirements and financial goals.

Cost-Effective Solutions: Maximizing Your Value

Finding a plan that fits your budget is crucial, and brokers excel at identifying cost-effective solutions.

- Value for Money: They help you avoid unnecessary expenses by selecting plans that offer the best value.

- Savings Opportunities: Brokers are skilled at finding discounts and savings that you might not find on your own.

Ongoing Support: A Partner for the Long Haul

The relationship with a broker doesn’t end once you’ve chosen a plan. They provide ongoing support to ensure your coverage remains optimal.

- Annual Reviews: Brokers conduct yearly check-ins to make sure your plan still meets your needs as circumstances change.

- Adaptability: They help you steer any changes in Medicare policies or personal health needs.

The Kelmeg & Associates, Inc. Advantage

At Kelmeg & Associates, Inc., we are proud to be a leading Colorado Springs Medicare Insurance Agency. Our team is committed to providing:

- Expert Guidance: With years of experience, we offer reliable advice and support throughout your Medicare journey.

- Comprehensive Service: From the initial consultation to ongoing plan management, we are here to help you every step of the way.

Choosing to work with a local Medicare broker means having a trusted partner by your side, ready to help you make informed decisions about your healthcare. Whether you're new to Medicare or looking to improve your current plan, our team is here to guide you.

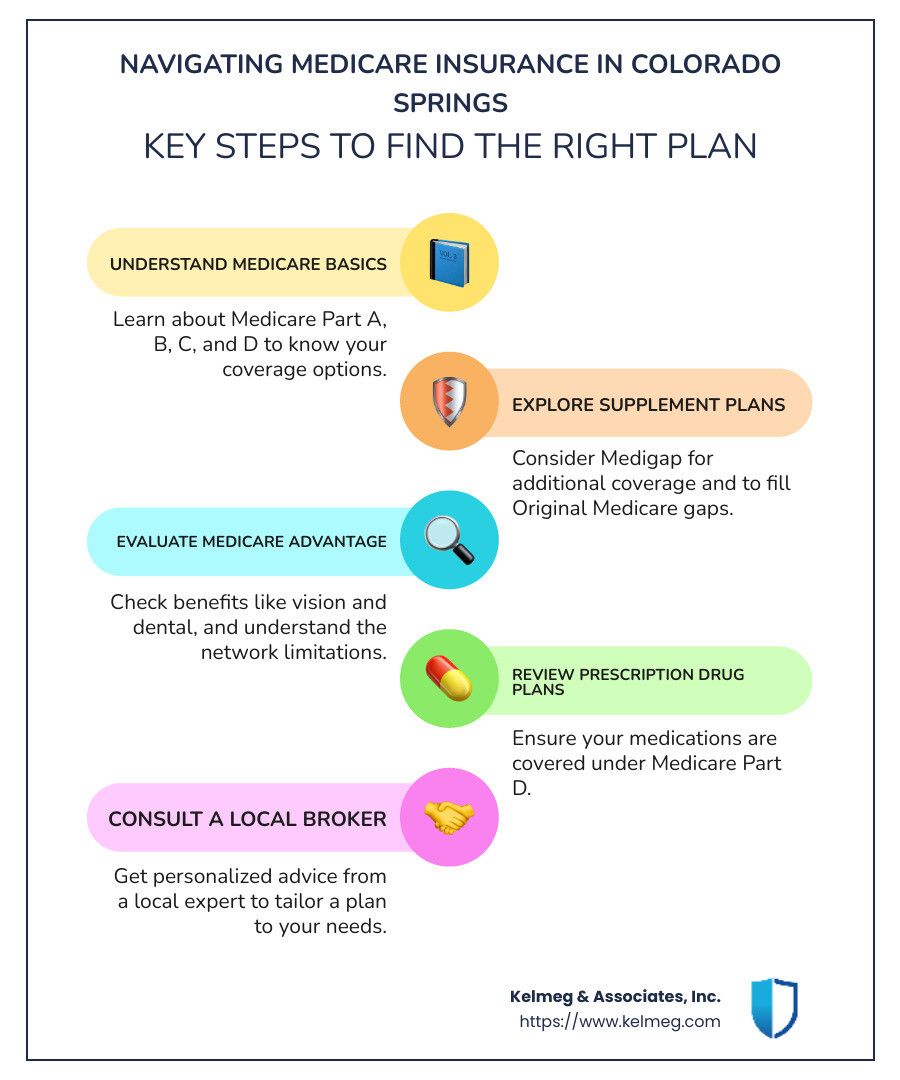

How to Choose the Right Medicare Plan

Deciding on the right Medicare plan can feel like solving a puzzle. But with a clear approach, you can find a plan that fits your needs and budget. Here’s how to do it:

Plan Comparison: Know Your Options

Start by understanding the different types of Medicare plans available. Each plan type has its own set of benefits and limitations.

- Medicare Advantage Plans: These plans often include additional benefits like vision or dental coverage. They might have lower premiums but require you to use a network of doctors.

- Medigap (Supplement) Plans: These plans help cover costs that Original Medicare doesn’t, like copayments and deductibles. They offer more flexibility in choosing healthcare providers.

Comparing plans side-by-side can help you see which one offers the best combination of coverage and cost for your situation.

Coverage Options: Match Your Health Needs

Consider your current and future health needs when choosing a plan. Do you need regular doctor visits, or do you have specific healthcare requirements?

- Prescription Drug Coverage: Check if the plan covers your medications and what the costs are. This is crucial if you rely on specific prescriptions.

- Specialized Care: If you need specialized services, ensure the plan covers those needs without excessive out-of-pocket costs.

Budget Considerations: Balance Cost and Coverage

Your budget is a key factor in choosing a Medicare plan. Here’s how to manage it effectively:

- Monthly Premiums vs. Out-of-Pocket Costs: Sometimes a plan with a higher premium might save you money if it has lower copayments and deductibles.

- Annual Out-of-Pocket Maximums: Medicare Advantage plans have a cap on what you’ll spend each year. Understanding this can help protect you from unexpected expenses.

Expert Advice: Seek Professional Guidance

Navigating Medicare can be complex, and getting expert help can make a big difference. A local Colorado Springs Medicare insurance agency like Kelmeg & Associates, Inc. can provide:

- Personalized Assistance: Custom advice to help you choose a plan that meets your specific needs and budget.

- Ongoing Support: Continued guidance to ensure your plan remains the best fit as your needs change.

Choosing the right Medicare plan is about finding the best fit for your health needs and financial situation. With careful consideration and expert guidance, you can confidently select a plan that works for you.

Frequently Asked Questions about Medicare Insurance

Who is the best person to talk to about Medicare?

Finding the right person to discuss Medicare options with can make a huge difference. Local organizations often have knowledgeable staff who understand the specific needs of Colorado Springs residents. They can offer personalized advice based on your situation.

For quick questions, many agencies, like Kelmeg & Associates, Inc., offer live chat options. This allows you to get immediate answers from experts who can guide you through your Medicare choices.

What are the 6 things Medicare doesn't cover?

Medicare provides extensive coverage but doesn't cover everything. Here are six things typically not included:

- Eye Exams: Routine vision checks and glasses are not covered. You'll need separate vision insurance or pay out-of-pocket.

- Long-Term Care: Medicare doesn't cover extended stays in nursing homes or assisted living facilities. Consider long-term care insurance for these needs.

- Cosmetic Surgery: Procedures aimed at improving appearance are not covered unless medically necessary.

- Dental Care: Routine dental care, including checkups, cleanings, and dentures, is not part of Medicare coverage.

- Hearing Aids: While some Medicare Advantage plans may offer hearing benefits, Original Medicare does not cover hearing aids.

- Foot Care: Routine foot care, like nail trimming, is generally not covered unless you have specific medical conditions like diabetes.

Why are people leaving Medicare Advantage plans?

While Medicare Advantage plans offer additional benefits, some people choose to leave them for a few reasons:

- Limited Network: These plans often require you to use a network of doctors and hospitals, which can be restrictive if your preferred providers aren't included.

- Copays and Deductibles: Some plans have higher out-of-pocket costs, like copayments and deductibles, which can add up over time.

- Plan Changes: Each year, plans can change their benefits, costs, or provider networks, leading some to seek other options that better fit their needs.

Understanding these factors can help you decide if a Medicare Advantage plan is right for you or if another option might be a better fit. Always consider your personal health needs and financial situation when making this decision.

Conclusion

Navigating Medicare insurance can feel overwhelming, but Kelmeg & Associates, Inc. is here to make the process simple and stress-free. As a trusted Colorado Springs Medicare insurance agency, we offer personalized guidance and expert support to ensure you find the best coverage for your unique needs.

Our team understands that choosing a Medicare plan is not just about picking any policy. It's about finding a plan that fits your health requirements, budget, and lifestyle. We take pride in offering customized solutions that provide peace of mind and financial security.

At Kelmeg & Associates, Inc., we believe in building lasting relationships with our clients. Our goal is to be your go-to resource for all things Medicare, offering support every step of the way. Whether you're exploring Medicare Advantage, Medigap, or Part D plans, our experienced brokers are ready to help you make informed decisions with confidence.

Don't steer the complexities of Medicare alone. Let us be your guide to comprehensive coverage and expert advice. For more information on how we can assist you, visit our Medicare services page and find the difference personalized guidance can make.

Thank you for trusting us with your Medicare needs. We look forward to serving you with dedication and excellence.