Navigating Health Insurance: Top Consultants in Colorado

Health insurance consultants Colorado are essential guides in navigating the complex world of health coverage options. Whether you're an individual worried about securing affordable, comprehensive health plans, or a business eager to provide optimal benefits to employees, expert consultants can illuminate the path to the right insurance solutions. Here's a quick overview to address the search intent:

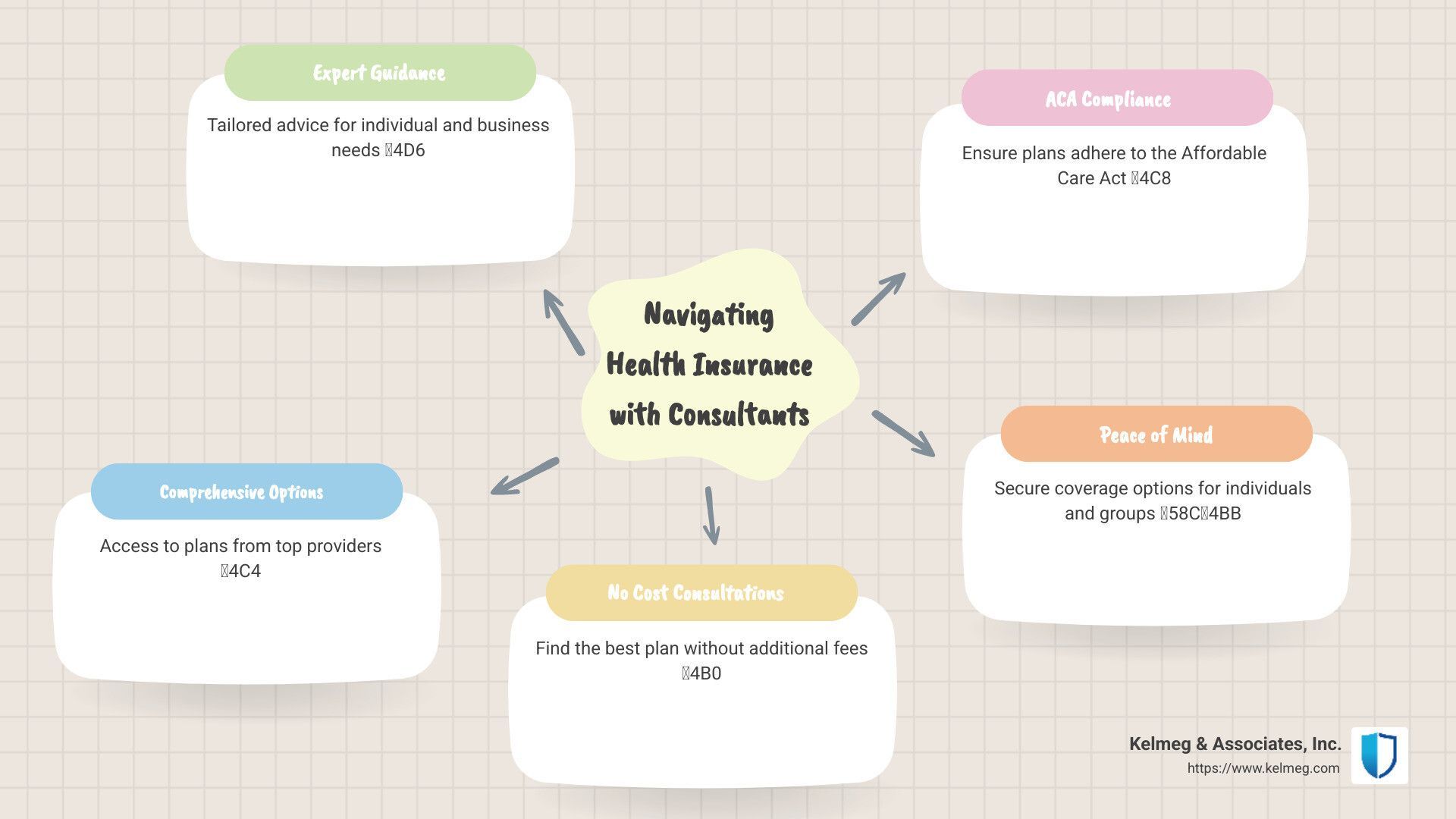

- Expert guidance custom to individual or business needs.

- Comprehensive coverage options from multiple top providers.

- No cost consultations, ensuring you find the best plan without additional fees.

When venturing into the field of health insurance, the choices can indeed feel overwhelming. The Affordable Care Act (ACA) mandates insurance coverage for most Americans, making it increasingly crucial to understand available options. Choosing the right plan, whether for yourself or for a group, can mean substantial savings and peace of mind.

As a seasoned insurance specialist at Kelmeg & Associates, Inc., I, Kelsey Mackley, bring dedication and expertise as a top resource among health insurance consultants Colorado. My role involves simplifying complex insurance landscapes to ensure every client can access personalized, effective solutions, seamlessly transitioning you to deeper insights on the subject.

The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Expert Guidance

Health insurance consultants are experts in the field. They are well-versed in the latest healthcare laws and regulations, such as the Affordable Care Act (ACA). This expertise ensures you receive accurate advice custom to your unique circumstances. By understanding the complex terms and conditions of various plans, consultants can help you make informed decisions that align with your health and financial needs.

No Extra Fees

A common concern when seeking professional advice is the cost. However, using a health insurance consultant often comes at no extra fees. For example, Kelmeg & Associates, Inc. provides their services without additional charges, ensuring you get expert help without impacting your budget. This means you can benefit from their knowledge and experience without worrying about hidden costs.

Health insurance consultants are invaluable in simplifying the insurance process. They offer cost savings, expert guidance, and peace of mind—all without extra fees. This makes them a crucial partner in your health insurance journey.

Next, we'll dig into key considerations when choosing a health insurance consultant in Colorado.

Health Insurance Consultants Colorado: Key Considerations

Choosing the right health insurance consultants in Colorado is crucial. They help you steer the complexities of insurance, ensuring compliance and the best coverage options. Let's break down the key considerations:

Compliance

Staying compliant with health insurance laws is vital. Consultants like Kelmeg & Associates, Inc. are well-versed in federal and state regulations, ensuring you meet all legal requirements. They keep up with the latest updates, helping you avoid penalties and ensuring your coverage is always in line with current laws.

ACA Updates

The Affordable Care Act (ACA) is a significant part of the health insurance landscape. It requires insurers to cover everyone, regardless of pre-existing conditions, and mandates that most Americans have health insurance. Consultants monitor ACA updates to ensure your plan remains compliant. This vigilance helps you avoid unexpected tax penalties and ensures your coverage meets the latest standards.

Coverage Options

Understanding the variety of health insurance options can be overwhelming. Consultants simplify this process by explaining different plans such as individual, family, and business health insurance. They assess your needs and guide you to options that provide the best balance of coverage and cost. Whether it's a plan through Connect for Health Colorado or a private insurer, they'll help you find the right fit.

In summary, a knowledgeable consultant ensures compliance, stays updated on ACA changes, and helps you choose the best coverage. This expertise makes navigating the health insurance landscape in Colorado much more manageable.

Next, we'll address some frequently asked questions about health insurance consultants.

Frequently Asked Questions about Health Insurance Consultants

How much do insurance consultants charge?

Insurance consultants typically charge nothing extra for their services. When you work with a consultant like those at Kelmeg & Associates, Inc., you receive expert advice without additional fees. The cost of the consultant's service is usually covered by the insurance companies as part of the policy premium. This means you get professional guidance without paying more than you would if you steerd the complex world of health insurance alone.

What does a health insurance consultant do?

A health insurance consultant is like your personal guide through the insurance maze. They offer advice on choosing the best policy based on your needs and budget. Consultants stay informed about the latest regulations to ensure your plan is compliant with laws like the ACA. They break down complex terms and conditions, helping you understand your coverage options. Their goal is to simplify the process, making it easier for you to secure the right insurance.

Is it cheaper to get health insurance through an agent?

Yes, it can be cheaper. Working with an agent often leads to cost savings. Agents have access to a wide range of plans and can help you find options that might not be easily visible to the average consumer. They can also identify potential agent benefits, such as subsidies or discounts, that you might qualify for. Plus, since agents' fees are typically included in the policy premium, you'll pay the same amount whether you use an agent or buy directly from the insurer. This makes using an agent a smart choice for both convenience and cost-effectiveness.

In the next section, we'll wrap up with how Kelmeg & Associates, Inc. can be your trusted partner in navigating health insurance.

Conclusion

When it comes to navigating the complex world of health insurance, Kelmeg & Associates, Inc. stands out as a trusted partner in Colorado. Our commitment to providing expert guidance ensures that you receive personalized plans custom to your specific needs.

We understand that health insurance can be overwhelming. That's why our team is dedicated to simplifying the process for you. With locations across Colorado, including Lafayette, Broomfield, and Boulder, we're conveniently situated to offer local expertise and personalized service.

At Kelmeg & Associates, Inc., we emphasize personalized plans. Whether you're looking for Medicare, individual, family, or group insurance, our consultants are here to help you find the best coverage. We believe in offering guidance at no extra cost, ensuring that you can focus on what matters most—your health and well-being.

Our goal is to make sure you have peace of mind knowing you're covered. We're here to answer your questions, provide support, and ensure you have the best possible insurance plan. Experience the difference with Kelmeg & Associates, Inc., where your needs are our priority.

Explore our services and let us help you steer your health insurance options. Visit our services page to learn more and get started on finding the perfect plan for you.