Colorado's Best Medicare Advantage Plans: Your 2025 Options

Best Medicare Advantage Plans Colorado are in high demand as more residents turn 65, seeking affordable and comprehensive healthcare options. For 2025, residents in Colorado have a variety of standout choices to consider, each offering unique benefits tailored to different needs.

As your go-to source for Medicare Advantage guidance, I’m Kelsey Mackley. At Kelmeg & Associates, I specialize in connecting individuals and businesses with the best medicare advantage plans colorado. My extensive experience ensures you receive personalized and insightful advice custom to maximize your healthcare benefits.

Understanding Medicare Advantage Plans

Medicare Advantage, also known as Medicare Part C, is a popular alternative to Original Medicare. These plans are offered by private insurance companies and provide all the benefits of Medicare Part A (hospital insurance) and Part B (medical insurance). In addition, they often include extra perks like dental, vision, and hearing coverage.

Why Choose Medicare Advantage?

One of the main reasons people opt for Medicare Advantage is the bundled benefits. These plans often come with lower out-of-pocket costs compared to Original Medicare combined with a separate Medicare Supplement plan.

Key Benefits:

- Comprehensive Coverage: Medicare Advantage plans include the benefits of Original Medicare and often add extras like fitness programs and wellness services.

- Cost Savings: Many plans offer $0 premiums, low copays, and out-of-pocket limits, making them more affordable for many beneficiaries.

- Network Flexibility: While plans usually require using a network of doctors and hospitals, some plans, like PPOs, allow for out-of-network care at a higher cost.

How Do These Plans Work?

Medicare Advantage plans are managed by private insurers but regulated by the Centers for Medicare & Medicaid Services (CMS). Each year, CMS evaluates these plans and assigns star ratings based on quality and performance, helping you make informed decisions.

Types of Medicare Advantage Plans

- Health Maintenance Organization (HMO): Requires members to use a network of doctors and hospitals. You'll need a referral to see specialists.

- Preferred Provider Organization (PPO): Offers more flexibility with a larger network and the ability to see out-of-network providers at a higher cost.

- Special Needs Plans (SNP): Custom for people with specific diseases or characteristics. These plans are designed to meet the unique needs of their members.

- Private Fee-for-Service (PFFS): Allows you to see any Medicare-approved provider that accepts the plan's terms.

Choosing the Right Plan

When selecting a Medicare Advantage plan, consider your healthcare needs, budget, and preferred healthcare providers. Use the star ratings and plan comparisons to guide your decision.

For personalized assistance, our team at Kelmeg & Associates is here to help you steer your options and find the perfect fit. Whether you're looking for low-cost plans or comprehensive coverage, we ensure you get the most out of your Medicare Advantage benefits.

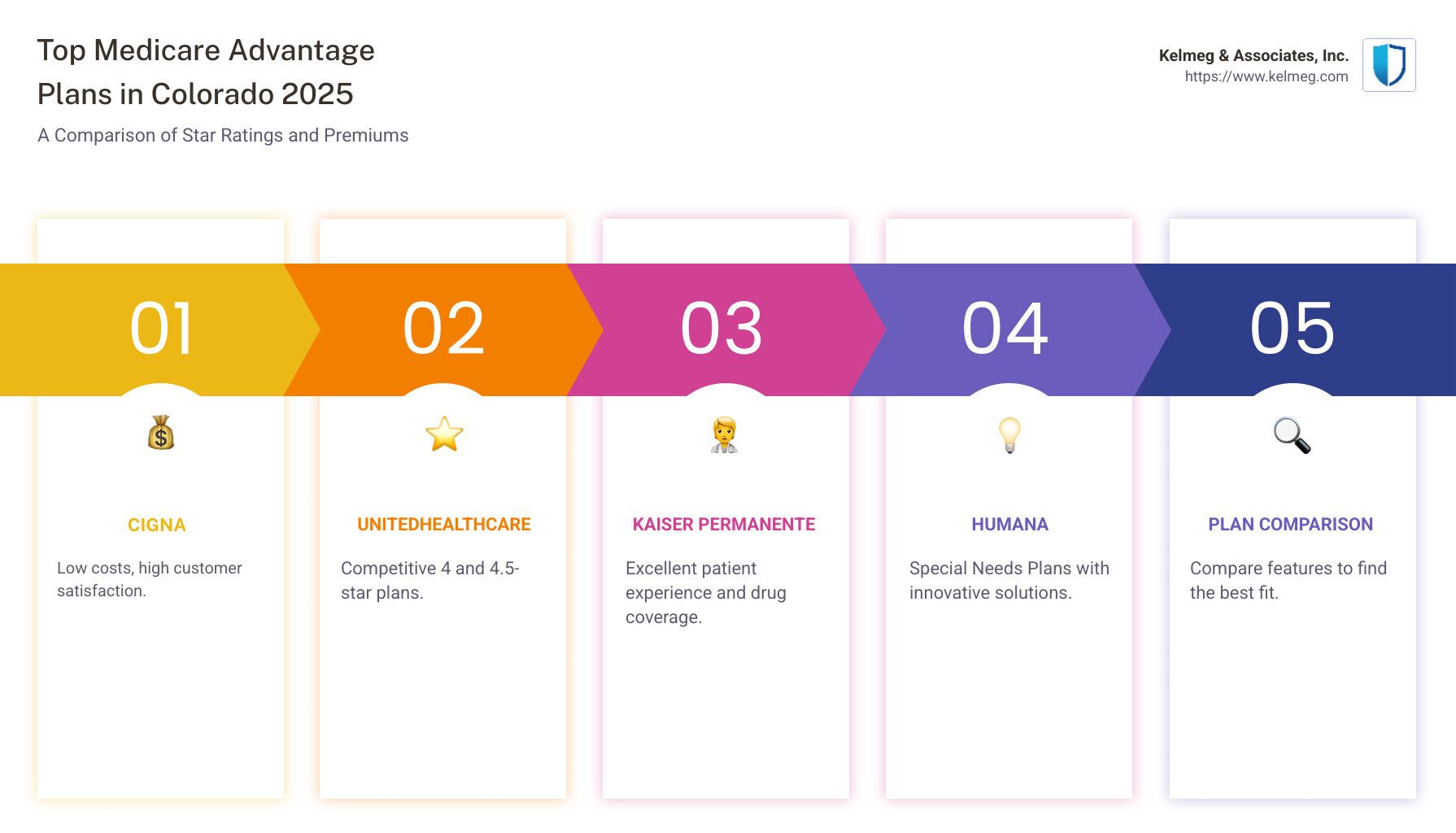

Top Medicare Advantage Plans in Colorado for 2025

Finding the best Medicare Advantage plans in Colorado for 2025 can feel overwhelming with so many options available. But don't worry, we're here to simplify the process and help you make an informed choice.

2025 Plan Options

In 2025, Colorado offers 120 different Medicare Advantage plans. This is slightly fewer than the 132 plans available in 2024, but the variety still ensures that there's a plan suitable for everyone's needs.

Key Stats:

- Average Monthly Premium: $12.20, down from $15.11 in 2024.

- Access to $0-Premium Plans: 99.7% of Medicare-eligible individuals in Colorado can choose a plan with no monthly premium.

Top-Rated Plans

The Centers for Medicare & Medicaid Services (CMS) rates Medicare Advantage plans annually. These ratings help you compare plans based on quality and performance.

5-Star Plans:

- Currently, no specific 5-star plans are highlighted in the research for 2025 in Colorado. However, keep an eye out for updates as CMS ratings can change.

4.5-Star Plans:

- UnitedHealthcare: Known for excellent customer service and comprehensive coverage options.

4-Star Plans:

- Select Health: Provides solid plan choices with good member satisfaction.

- UnitedHealthcare: Offers a variety of plans with reliable coverage.

Plan Comparison

When comparing plans, consider these factors:

- Costs: Look at premiums, deductibles, and copays. Can you afford them comfortably?

- Network: Ensure your preferred doctors and hospitals are in-network.

- Extras: Check if the plan offers additional benefits like dental, vision, or wellness programs.

Making Your Choice

Choosing the right Medicare Advantage plan involves balancing your healthcare needs with your budget. Consider what medical services you use most often and whether you prefer lower monthly premiums or lower out-of-pocket costs.

Pro Tip: Use CMS star ratings as a guide, but also consider personal priorities like specific provider networks or additional services.

For detailed, personalized assistance, reach out to Kelmeg & Associates. Our team is ready to help you explore your options and find a plan that fits your lifestyle and healthcare needs.

Enrollment Periods and Eligibility

Understanding when and how you can enroll in a Medicare Advantage plan is crucial. Let's break down the key periods and criteria you need to know.

Open Enrollment Period

The Annual Open Enrollment Period runs from October 15 to December 7 each year. During this time, you can:

- Switch from Original Medicare to a Medicare Advantage Plan.

- Change from one Medicare Advantage Plan to another.

- Join, switch, or drop a Medicare Part D prescription drug plan.

Any changes made during this period will take effect on January 1 of the following year.

Medicare Advantage Open Enrollment Period

From January 1 to March 31, if you're already enrolled in a Medicare Advantage Plan, you have another chance to:

- Switch to a different Medicare Advantage Plan.

- Disenroll from your current plan and return to Original Medicare.

This period is specifically for those who want to make changes to their existing Medicare Advantage coverage.

Special Enrollment Periods

Certain life events may qualify you for a Special Enrollment Period (SEP), allowing you to make changes outside the regular enrollment periods. Some qualifying events include:

- Moving out of your plan's service area.

- Losing other health coverage, such as employer-based insurance.

- Gaining eligibility for programs like Medicaid or Extra Help.

These SEPs ensure that you can adjust your coverage to best suit your changing circumstances.

Eligibility Criteria

To enroll in a Medicare Advantage Plan, you must:

- Be enrolled in both Medicare Part A and Part B.

- Live in the service area of the plan you want to join.

Additionally, you cannot have End-Stage Renal Disease (ESRD) at the time of enrollment, although there are exceptions for certain plans specifically designed for ESRD patients.

Navigating these enrollment periods and understanding eligibility criteria can be complex. For personalized guidance, Kelmeg & Associates is here to help you every step of the way. Whether it's choosing the right plan or understanding your enrollment options, we're committed to making Medicare work for you.

Key Features of Medicare Advantage Plans

Medicare Advantage plans in Colorado offer a variety of features that can make them a compelling choice for many. Let's explore some of the key aspects you should consider when evaluating these plans: coverage options, premiums, deductibles, and copays.

Coverage Options

Medicare Advantage plans, also known as Part C, provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage such as dental, vision, and hearing. Many plans also offer fitness programs like SilverSneakers and transportation services for medical appointments.

These plans are offered by private insurance companies and can vary widely in terms of the extra benefits they provide. It's essential to review the specific coverage details of each plan to ensure it meets your healthcare needs.

Premiums

The average monthly premium for a Medicare Advantage plan in Colorado in 2025 is $12.20, down from $15.11 in 2024. Remarkably, 99.7% of Medicare-eligible individuals in Colorado have access to a $0-premium plan. However, while some plans offer low or even zero premiums, they may come with higher out-of-pocket costs elsewhere.

Deductibles

Deductibles are the amount you pay out-of-pocket before your plan starts to pay. Medicare Advantage plans can have varying deductible amounts, especially for drug coverage. It's crucial to understand these costs as they can impact your overall healthcare expenses.

For instance, the 2024 Standard Prescription Drug Benefit deductible is set at $545, where beneficiaries pay 100% until reaching this amount. Always check the specific deductible terms of a plan to avoid unexpected costs.

Copays

Copays are fixed amounts you pay for services or prescriptions. Medicare Advantage plans typically have set copays for doctor visits, specialist appointments, and prescription drugs. These can differ significantly between plans, so it's important to compare them based on your regular healthcare needs.

For example, some plans might have low copays for primary care visits but higher costs for specialists. Understanding these details will help you choose a plan that aligns with your budget and healthcare requirements.

Navigating the details of Medicare Advantage plans can be challenging, but understanding these key features can help you make an informed decision. For personalized assistance, Kelmeg & Associates is here to guide you through the process, ensuring you find a plan that fits your needs.

Frequently Asked Questions about Medicare Advantage Plans

What is the difference between Medicare Advantage and Original Medicare?

Medicare Advantage, also known as Part C, is a type of health plan offered by private insurance companies. It bundles together the benefits of Original Medicare (Part A and Part B) and often includes extra perks like dental, vision, and hearing coverage.

Original Medicare, on the other hand, is a government program that covers hospital stays (Part A) and medical services (Part B). It doesn't usually cover additional benefits like dental or vision.

If you're considering switching to a Medicare Advantage plan, you might appreciate the extra coverage options. However, these plans typically require you to use a network of doctors and hospitals. So, it's important to check if your preferred providers are in-network.

How do I choose the best Medicare Advantage plan for my needs?

Selecting the best Medicare Advantage plan for your needs involves several key considerations:

- Costs: Look at premiums, deductibles, and copays. While some plans offer $0 premiums, they might have higher out-of-pocket costs elsewhere.

- Coverage: Make sure the plan covers the services you need, including any extra benefits like dental or vision care.

- Provider Network: Verify that your preferred doctors and hospitals are part of the plan's network.

- Prescription Drugs: Check if your medications are covered and what copays you'll need to pay.

To make the best choice, compare plans based on your personal healthcare needs and budget. For help navigating these options, Kelmeg & Associates offers expert guidance to tailor a plan that fits your lifestyle.

Can I switch Medicare Advantage plans outside the enrollment period?

Yes, you can switch Medicare Advantage plans outside the usual enrollment periods under certain conditions. This is known as a Special Enrollment Period (SEP).

You might qualify for an SEP if you experience life events like moving out of your current plan’s service area, losing other health coverage, or if your plan changes its contract with Medicare.

Outside of these situations, you can make changes during the Annual Enrollment Period, which runs from October 15 to December 7 each year. During this time, you can join, switch, or drop a plan.

Understanding these enrollment rules is crucial for keeping your healthcare coverage aligned with your needs. If you have questions about eligibility or need help switching plans, Kelmeg & Associates is ready to assist you with personalized advice.

Conclusion

At Kelmeg & Associates, we understand that navigating Medicare Advantage plans can be overwhelming. That's why we're here to provide expert guidance and support every step of the way. Our mission is to help you find the best Medicare Advantage plan that suits your unique needs and preferences.

Why Choose Kelmeg & Associates?

- Personalized Plans: We know that each individual has different healthcare needs. Our team takes the time to understand your situation and tailors a plan that fits your lifestyle and budget.

- Expert Guidance: With years of experience in the health insurance industry, our knowledgeable consultants are equipped to answer your questions and clarify any doubts you might have about Medicare and Medicare Advantage plans.

- No Extra Cost: Our services come at no additional cost to you. We are committed to helping you find the right coverage without adding financial stress.

- Local Expertise: With locations in Lafayette, Broomfield, Boulder, and Adams County, we are deeply rooted in the Colorado community. We understand the local healthcare landscape and are here to serve you better.

Choosing the right Medicare Advantage plan is a crucial decision for your health and financial well-being. Let us help you make an informed choice. Contact us today to explore your options and secure a plan that gives you peace of mind.