The Best Group Insurance Plans in Colorado: A Comprehensive List

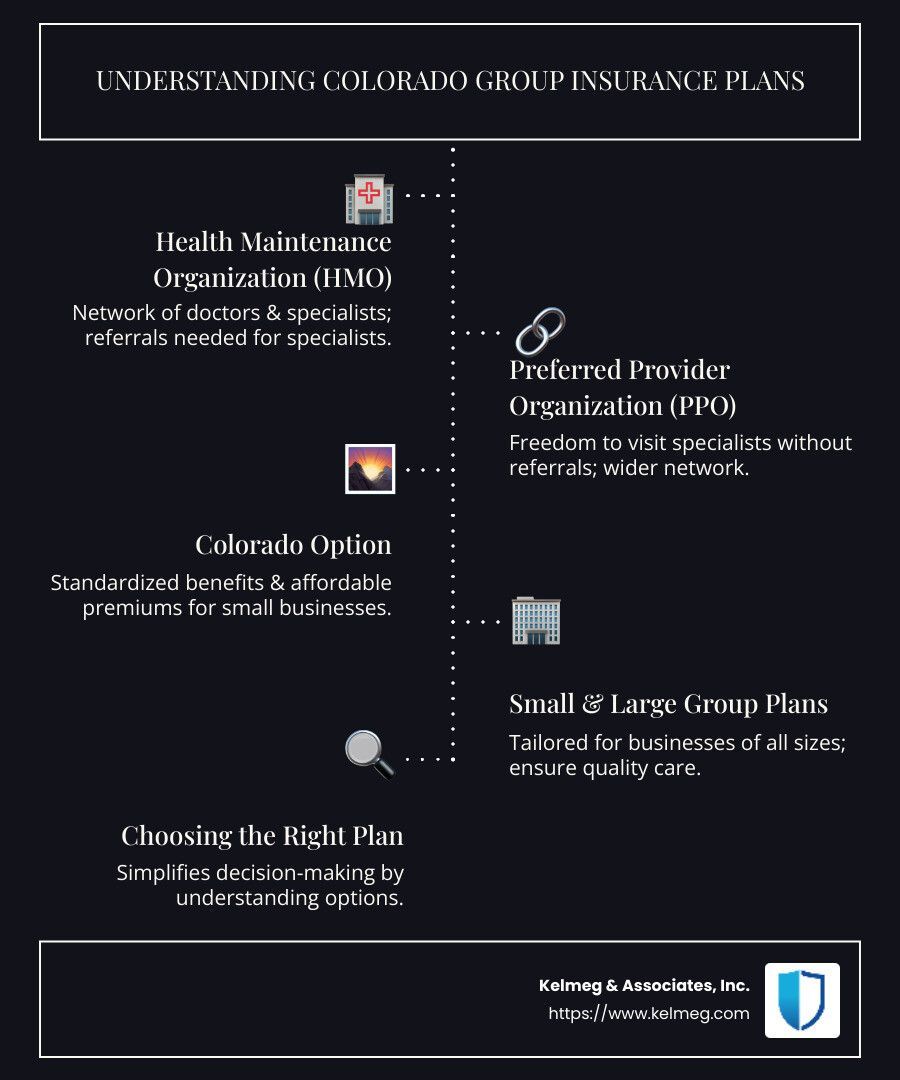

When it comes to Colorado group insurance plans, there's a variety of options available that cater to both small businesses and larger enterprises. These plans are designed to provide comprehensive and affordable health coverage, ensuring employees have access to necessary medical services without the financial burden. Options such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and the unique Colorado Option present varied benefits to meet diverse needs.

- Health Maintenance Organization (HMO): Offers a network of doctors and specialists; typically requires referrals for specialist visits.

- Preferred Provider Organization (PPO): Provides freedom to see specialists without referrals and access to a wider network of doctors.

- Colorado Option: Ensures standardized benefits and affordable premiums, making it an attractive choice for small businesses.

- Small and Large Group Plans: Custom for businesses with varying employee numbers, ensuring quality care and lower costs.

Choosing the right group insurance plan can be daunting; however, understanding these options can significantly simplify the process. My name is Kelsey Mackley, and I specialize in guiding businesses and individuals through the complexities of Colorado group insurance plans. With expertise in aligning insurance solutions to fit unique needs, I’m dedicated to providing clear and personalized advice.

Understanding Group Insurance Plans

When navigating Colorado group insurance plans, understand the variety of plan types available. Each type offers unique benefits and structures, catering to different needs and preferences. Let's break them down simply:

Health Maintenance Organization (HMO)

HMOs are all about networks. They provide access to a list of doctors and specialists within a specific network. To see a specialist, you usually need a referral from your primary care physician. This structure helps keep costs down but limits flexibility in choosing healthcare providers.

Preferred Provider Organization (PPO)

PPOs offer more freedom than HMOs. You can visit any healthcare provider, but staying within the network will save you money. No referrals are needed to see specialists, making it a flexible choice for those who prioritize access to a broad range of doctors.

Exclusive Provider Organization (EPO)

EPOs combine elements of HMOs and PPOs. Like HMOs, they require you to use network providers, but they don’t need referrals for specialists. This plan suits those who want some flexibility without the higher costs of out-of-network care.

Point of Service (POS)

POS plans are a hybrid of HMO and PPO models. They offer the network-based approach of HMOs but with the option to go out-of-network at a higher cost. Referrals are typically needed for specialists, making it a middle-ground choice for those who want flexibility and cost control.

High Deductible Health Plan (HDHP)

HDHPs feature lower premiums and higher deductibles. They are often paired with Health Savings Accounts (HSAs) to help manage the costs. This plan is ideal for those who are generally healthy and want to save on monthly premiums while having a safety net for major medical expenses.

Health Savings Account (HSA)

An HSA is not an insurance plan but a tax-advantaged savings account designed to work with HDHPs. It lets you save money for medical expenses, offering flexibility and control over your healthcare spending. Funds roll over year to year, making it a smart long-term option for managing health costs.

Understanding these options helps you choose the best fit for your business and employees’ needs. Each plan type offers different levels of flexibility, cost, and coverage, making it crucial to assess your specific requirements and budget.

Top Group Insurance Plans in Colorado

When it comes to Colorado group insurance plans, there are several standout options designed to meet the diverse needs of businesses and their employees. Let's explore some of the top plans available in the state:

Colorado Option

The Colorado Option is a game-changer for both small businesses and consumers. This plan is available to all Coloradans purchasing health insurance on the individual market and small employers with less than 100 employees. The standout feature of the Colorado Option is its affordability. It provides rich benefits at a lower cost compared to many other plans. Moreover, it simplifies the comparison process by offering standardized benefits across different insurance companies. This means you can focus on what truly matters: premiums, network of doctors, and customer service.

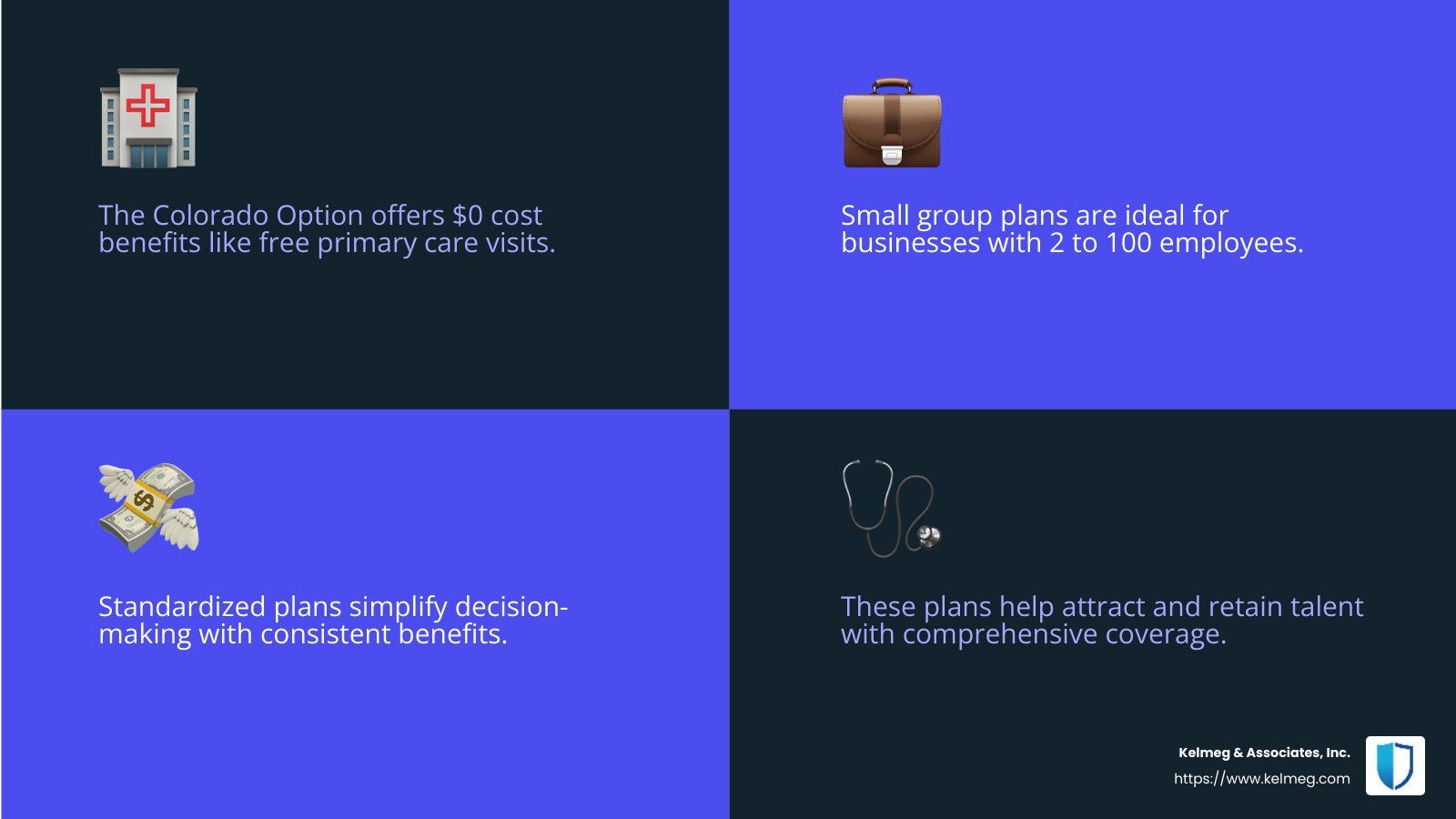

A key highlight of the Colorado Option is its $0 cost benefits. These include free primary care visits, mental health office visits, prenatal and post-pregnancy visits, and certain diabetic supplies. This plan is designed to make healthcare more accessible and predictable, using co-pays instead of coinsurance, so you always know what you'll pay for services.

Small Group Plans

For businesses with 2 to 100 employees, small group plans offer a custom approach to healthcare coverage. These plans are essential for small businesses looking to provide competitive benefits to their employees. Small group plans through the Colorado Option can be purchased through a broker, and coverage can begin as early as January 1, 2024.

These plans are particularly appealing because they provide businesses with the ability to offer a comprehensive health insurance package that includes access to a wide network of healthcare providers. This not only helps attract and retain talent but also ensures employees have the support they need to stay healthy and productive.

Standardized Plans

Standardized plans, like those offered under the Colorado Option, make it easier for businesses and individuals to compare options. By having a consistent set of benefits across different insurers, it simplifies decision-making and ensures that the focus remains on cost and network preferences. This standardization is part of a broader effort to improve transparency and make healthcare more consumer-friendly.

In summary, whether you're a small business owner looking to offer your team quality healthcare options or an individual seeking comprehensive coverage, Colorado's group insurance plans provide a variety of choices custom to meet diverse needs. With options like the Colorado Option and small group plans, businesses can offer valuable benefits while maintaining cost control and flexibility.

Benefits of Group Insurance Plans

Affordable Rates

One of the biggest advantages of Colorado group insurance plans is the cost savings they offer. Group plans typically have lower premiums compared to individual plans. This is because the risk is spread across a larger group of people, which helps keep costs down for everyone. For small businesses, this means you can provide quality health coverage to your employees without breaking the bank.

Employee Retention

Offering a solid group insurance plan is a powerful tool for keeping your workforce happy and loyal. Employees value health benefits highly, often ranking them just behind salary in terms of importance. By providing comprehensive health coverage, you show your employees that you care about their well-being. This can lead to increased job satisfaction and lower turnover rates. Plus, it makes your company more attractive to potential hires.

Comprehensive Coverage

Group insurance plans in Colorado are designed to offer broad coverage that meets the diverse needs of employees. Plans often include essential health benefits like doctor visits, hospital stays, and prescription drugs. Many plans also offer additional benefits like dental, vision, and mental health services. This comprehensive approach ensures that employees have access to the care they need, leading to healthier, more productive teams.

Group insurance plans are not just a benefit—they're an investment in your business and your employees. With affordable rates, improved employee retention, and comprehensive coverage, these plans help create a supportive work environment where everyone can thrive.

Next, let's look at how to choose the right group insurance plan for your business needs.

How to Choose the Right Group Insurance Plan

Selecting the right group insurance plan for your business can be challenging. But by focusing on key factors like network coverage, cost considerations, and plan flexibility, you can make a well-informed decision that benefits both your company and your employees.

Network Coverage

Network coverage is crucial when choosing a group insurance plan. This refers to the list of doctors, hospitals, and healthcare providers that are part of the insurance plan.

- HMO Plans typically require employees to choose a primary care doctor from a specific list and get referrals to see specialists. This can limit choices but often results in lower costs.

- PPO Plans offer more freedom, allowing employees to see any doctor without referrals, but they save the most money by staying within the network.

- EPO Plans have a mix of both, offering a network of providers but with fewer restrictions on seeing specialists.

When evaluating network coverage, consider the locations and needs of your employees. Are there enough quality providers nearby? Do employees have specific doctors they prefer to see?

Cost Considerations

Cost is always a major factor in choosing a group insurance plan. You want to provide good coverage without overspending.

- Premiums are the monthly costs you pay for the plan. Group plans often have lower premiums due to shared risk.

- Deductibles are what employees pay out-of-pocket before insurance kicks in. Plans with lower deductibles usually have higher premiums.

- Copayments and coinsurance are costs employees share for services. Consider how these affect employees’ overall expenses.

It's also important to be aware of potential financial help. Many businesses in Colorado may qualify for tax credits, which can further reduce costs.

Plan Flexibility

Finally, consider the flexibility of the plan. A flexible plan can adapt to the changing needs of your business and employe

- Customizable Options: Some plans allow you to add or remove certain benefits, tailoring the plan to fit your company’s needs.

- Scalability: If your business is growing, ensure the plan can accommodate more employees without a hitch.

- Additional Benefits: Look for plans that offer more than just basic health coverage, such as dental, vision, and wellness programs.

By carefully considering network options, costs, and flexibility, you can select a group insurance plan that provides the best value and meets the needs of your employees. With the right plan, you can support your team’s health and well-being while keeping your business financially healthy.

Next, we'll tackle some frequently asked questions about Colorado group insurance plans.

Frequently Asked Questions about Colorado Group Insurance Plans

What is the most popular health insurance in Colorado?

In Colorado, flexibility and comprehensive options are key factors that make certain health insurance plans stand out. Among the popular choices, PPO (Preferred Provider Organization) plans are well-liked due to their flexibility. PPO plans allow employees to see any doctor without the need for referrals, although they save more by visiting providers within the network. This flexibility makes PPOs appealing for those who want a wide range of healthcare options.

What are the most common group health insurance plans?

The most common group health insurance plans in Colorado include PPO, HMO (Health Maintenance Organization), POS (Point of Service), and EPO (Exclusive Provider Organization) plans.

- HMO Plans: These require employees to select a primary care physician and get referrals to see specialists, often resulting in lower costs due to a more restricted network.

- POS Plans: A combination of HMO and PPO features, POS plans offer the choice to use network providers at lower costs or go out-of-network at a higher cost.

- EPO Plans: These provide a network of providers without needing referrals for specialists, but usually do not cover out-of-network services except in emergencies.

These plans cater to different needs, offering a balance between cost, provider choice, and coverage.

Which is the best group insurance?

Determining the "best" group insurance plan depends on several factors, such as the claim settlement ratio and the availability of network hospitals. A high claim settlement ratio indicates that the insurance provider is reliable in paying out claims, which is crucial for employee satisfaction and trust.

Another important aspect is the network of hospitals and doctors. Plans with extensive networks offer more choices and convenience for employees, ensuring they can access quality care when needed.

The best plan is one that aligns with your company's budget, meets the specific needs of your workforce, and provides comprehensive coverage options. By evaluating these factors, businesses can choose a plan that not only attracts and retains top talent but also supports their employees' health and financial well-being.

Conclusion

Choosing the right Colorado group insurance plans can be a daunting task, but with the right guidance, it can be simplified. At Kelmeg & Associates, Inc., we specialize in helping businesses steer the complexities of group health insurance. Our mission is to provide expert guidance and tailor personalized plans that align with your company's unique needs.

We understand that every business is different, and so are its employees. That's why we take the time to understand your specific requirements and offer solutions that not only fit your budget but also provide comprehensive coverage. Our goal is to ensure that your employees feel secure and valued, leading to higher retention rates and a more motivated workforce.

By partnering with us, you gain access to a wealth of knowledge and experience. We stay updated on the latest health insurance policies and trends, ensuring you receive the most current and relevant advice. Our commitment to transparency and personalized service means that you can trust us to guide you through every step of the process.

Whether you're a small business looking for affordable options or a large corporation seeking extensive coverage, we are here to help. Let us assist you in finding the best group insurance plan that meets your needs.

For more information on how we can assist you in crafting the perfect group health insurance plan, visit our services page. Let's work together to secure a healthier future for your employees and your business.