Unlocking Affordable Family Health Insurance in Colorado

Affordable family health insurance colorado is essential for those seeking financial peace of mind while ensuring their loved ones have access to quality healthcare. In Colorado, navigating the health insurance marketplace can help families find budget-friendly options custom to their needs. Key strategies include comparing different plans, exploring subsidies, and utilizing expert guidance.

As Kelsey Mackley, a dedicated insurance specialist at Kelmeg & Associates, Inc., I have a wealth of experience in helping families secure affordable family health insurance colorado. My personalized approach ensures that every client finds a plan that perfectly meets their needs and budget.

Understanding the Health Insurance Marketplace in Colorado

Navigating the health insurance marketplace in Colorado can feel overwhelming, but understanding the basics can make the process much smoother. In Colorado, Connect for Health Colorado is the official state-based health insurance marketplace. It offers a variety of health plans that cater to different needs and budgets, making it a valuable resource for families seeking affordable coverage.

Connect for Health Colorado

Connect for Health Colorado provides a platform where residents can shop for health insurance plans. It is designed to help individuals and families find affordable family health insurance colorado options that meet their specific needs. The marketplace offers a range of plans, including Bronze, Silver, and Gold options, each with different levels of coverage and costs.

- Bronze Plans: These are ideal for those who prefer lower monthly premiums but are comfortable with higher out-of-pocket costs when accessing healthcare services.

- Silver Plans: These plans offer a balance between premium costs and out-of-pocket expenses, making them a popular choice for families with average healthcare needs.

- Gold Plans: These plans come with higher premiums but lower out-of-pocket costs, suitable for families who expect to use more healthcare services.

Enrollment Deadlines

Timing is crucial when it comes to enrolling in a health insurance plan. The open enrollment period for Connect for Health Colorado typically runs from November 1 to January 15. However, if you want your coverage to begin on January 1, you must enroll by December 15. Missing these deadlines could mean waiting until the next open enrollment period, unless you qualify for a Special Enrollment Period due to life events like marriage, birth, or loss of other coverage.

Did you know? If you enroll by December 15, your coverage starts on January 1. This is crucial to avoid a gap in coverage.

Coverage Options

Connect for Health Colorado offers a wide array of coverage options to suit different family needs. Beyond the standard health insurance plans, families can also find dental and vision insurance, ensuring comprehensive coverage for all aspects of health.

- Preventive Care: Many plans cover preventive services at no additional cost when using in-network providers.

- Virtual Care: Some plans offer virtual care options, allowing families to consult with doctors from the comfort of their home.

Understanding these elements of the marketplace is key to finding the right health insurance plan for your family in Colorado. By leveraging the resources provided by Connect for Health Colorado, families can make informed decisions and secure coverage that offers both financial protection and peace of mind.

Affordable Family Health Insurance Colorado: Key Considerations

Finding affordable family health insurance in Colorado requires understanding the balance between cost and coverage. Here's what you need to consider:

Individual & Family Health Plans

When choosing a health plan, consider the unique needs of your family. Anthem Individual & Family Plans offer a variety of options designed to meet different healthcare requirements and budgets. These plans not only cover doctor visits and hospital care but also include mental health benefits.

- Bronze Plans: These plans have lower monthly premiums but higher deductibles, making them suitable for families that don't expect frequent healthcare visits.

- Silver Plans: With moderate premiums and deductibles, these plans are great for families with average healthcare needs.

- Gold Plans: These come with higher premiums but lower deductibles, ideal for families with regular healthcare needs.

Affordability

One of the main goals is to find a plan that fits within your budget while providing the necessary coverage. Connect for Health Colorado offers subsidies to help lower the cost of premiums for those who qualify. This financial assistance can make a significant difference in affordability.

Subsidies and Tax Credits: Depending on your income, you may qualify for subsidies that reduce your monthly premiums. This financial aid is only available for plans purchased through the marketplace.

Coverage Needs

Understanding your family's healthcare needs is crucial. Consider factors like:

- Frequency of Doctor Visits: If your family visits the doctor often, a plan with lower out-of-pocket costs might be more economical.

- Prescription Drugs: Check if the plan covers the medications your family regularly uses.

- Preventive Services: Many plans offer preventive care at no additional cost when using in-network providers, which can save money in the long run.

Additional Coverage Options

Consider adding dental and vision insurance to ensure comprehensive coverage. Anthem's dental plans cover preventive services like exams and cleanings, while vision plans cover eye exams and offer allowances for glasses or contacts.

Virtual Care

Many plans available through Connect for Health Colorado offer virtual care options, allowing families to consult with healthcare professionals without leaving home. This can be a cost-effective and convenient option for managing healthcare needs.

By evaluating these key considerations, you can find a health insurance plan that not only meets your family's healthcare needs but also fits within your budget. This approach will help ensure that your family is covered without compromising on essential healthcare services.

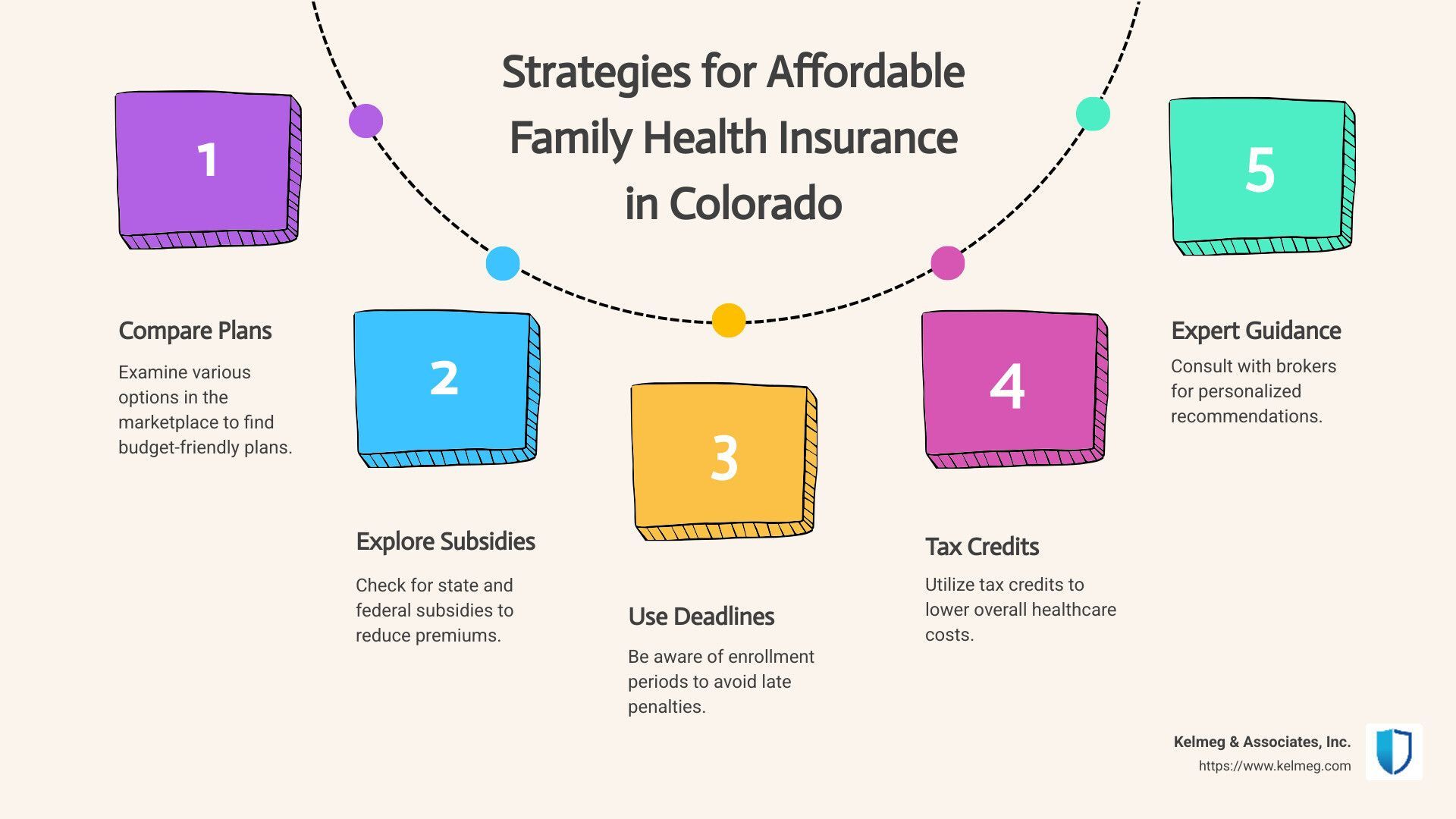

Top Strategies to Find Affordable Family Health Insurance in Colorado

Finding affordable family health insurance in Colorado can feel overwhelming, but with the right strategies, you can secure the best plan for your family. Here’s how:

Comparison Shopping

Start by comparing different health insurance plans. Look beyond the monthly premium. Consider the deductible, copays, and coinsurance. Anthem offers a variety of plans like Bronze, Silver, and Gold, each with different cost structures. Bronze plans have lower premiums but higher out-of-pocket costs, while Gold plans cost more monthly but cover more expenses upfront.

- Use Online Tools: Platforms like Connect for Health Colorado allow you to compare plans side-by-side. This helps you see what each plan covers and how much it will cost.

- Check Provider Networks: Ensure your preferred doctors and hospitals are in-network to avoid extra costs.

Subsidies and Financial Assistance

Many families qualify for subsidies that make health insurance more affordable. These subsidies can significantly reduce your monthly premium costs.

- Eligibility: Your eligibility for subsidies depends on your household income and size. Generally, if your income is between 100% and 400% of the federal poverty level, you may qualify.

- Tax Credits: Available through the Health Insurance Marketplace, tax credits can lower your monthly costs. These are applied directly to your premium, reducing what you pay out-of-pocket.

Expert Guidance

Navigating health insurance can be complex. This is where experts like Kelmeg & Associates, Inc. come in. They provide personalized service to help you find the best plan.

- Personalized Plans: Experts can assess your family’s specific needs and suggest plans that offer the best coverage for your situation.

- Peace of Mind: With professional guidance, you can feel confident that you’re making informed decisions about your family’s health insurance.

By leveraging these strategies, you can find a plan that provides the coverage you need without breaking the bank. This ensures your family is protected and can access necessary healthcare services when needed.

Frequently Asked Questions about Affordable Family Health Insurance Colorado

What is the best time to enroll?

The best time to enroll in affordable family health insurance in Colorado is during the Open Enrollment Period. For the 2025 coverage year, this period runs from November 1, 2024, to January 15, 2025. If you want your coverage to start on January 1, you must sign up by December 15, 2024. Missing this deadline means your coverage will begin on February 1, leaving you uninsured for January.

Outside of this period, you can only enroll if you qualify for a Special Enrollment Period due to life events like marriage, birth, or loss of other coverage.

How can I lower my health insurance costs?

Lowering your health insurance costs involves taking advantage of available financial assistance options. Here are some key strategies:

- Subsidies: If your income falls between 100% and 400% of the federal poverty level, you may qualify for subsidies. These can significantly reduce your premium costs.

- Tax Credits: Available through the Health Insurance Marketplace, these credits lower your monthly premium. They're applied directly to your premium, reducing what you pay each month.

- Choosing the Right Plan: Opt for a plan that matches your healthcare needs and financial situation. For instance, if you rarely visit the doctor, a Bronze plan with lower premiums might be more cost-effective.

What are the benefits of using a health insurance broker?

Using a health insurance broker like Kelmeg & Associates, Inc. offers numerous advantages:

- Expert Guidance: Brokers have the expertise to steer the complex health insurance landscape. They can help you understand different plans and what they cover.

- Personalized Plans: A broker will assess your family's unique needs and recommend plans that provide the best coverage at the lowest cost. This personalized approach ensures you get the most value from your insurance.

- Peace of Mind: With a broker's help, you can feel confident about your insurance choices, knowing that you have selected a plan that meets your family's needs and budget.

By understanding enrollment periods, utilizing subsidies, and seeking expert guidance, you can make informed decisions about your family's health insurance. This ensures you find the most affordable and suitable coverage available in Colorado.

Conclusion

Navigating health insurance can be overwhelming, but with the right support, it doesn't have to be. At Kelmeg & Associates, Inc., we're committed to helping you open up affordable family health insurance in Colorado with ease and confidence.

Our expert guidance is at the heart of what we do. We understand that every family has unique needs, and we take the time to listen and learn about your specific situation. This allows us to provide personalized service custom just for you. Our goal is to ensure you find the best coverage that aligns with your health needs and budget.

By partnering with us, you gain access to a team that knows the ins and outs of Colorado's health insurance landscape. We simplify the process, helping you compare plans, understand subsidies, and make informed decisions. Plus, our services come at no extra cost to you.

Whether you're a first-time buyer or looking to update your existing plan, let us be your trusted ally in securing the right health insurance. For more details about how we can assist you, visit our individual and family insurance page. Together, we can find a solution that provides peace of mind and protects what matters most—your family's health.