Understanding the Average Cost of Family Health Insurance in Colorado

The average cost of health insurance family colorado can vary depending on multiple factors. If you're looking for quick insight: a family plan's average monthly premium tends to hover around $1,300 to $1,600. This range reflects the complexity of family plans in the state and the various elements influencing their cost.

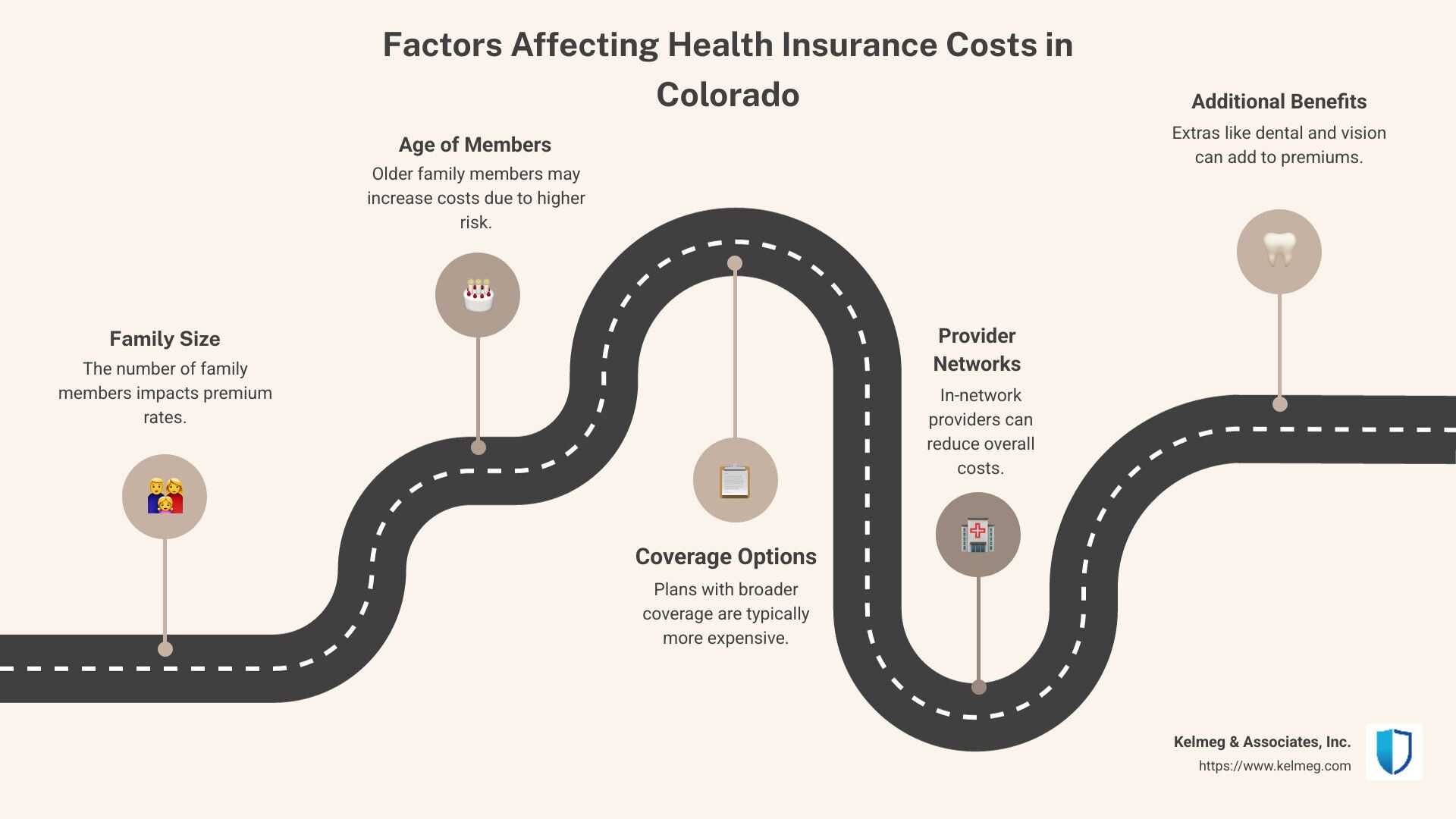

When it comes to Colorado health insurance, especially for families, understand the impact of coverage options, provider networks, and additional benefits. Costs can be influenced by factors such as the number of family members, age, and the specific healthcare services your family uses frequently. Balancing premium costs with out-of-pocket expenses is crucial when choosing the right family plan.

My name is Kelsey Mackley, an insurance specialist with experience in tailoring health insurance solutions. As someone deeply familiar with average cost of health insurance family colorado, I've dedicated my career to helping clients, individuals, and businesses steer these complexities effectively. Let's explore the critical elements affecting your policy choice and ensure you find the ideal coverage.

Factors Influencing Health Insurance Costs in Colorado

When choosing a health insurance plan in Colorado, several factors can significantly impact the cost. Understanding these can help you make informed decisions for your family.

Coverage Needs

Every family has unique healthcare needs. Some families might need frequent doctor visits, while others may require specialist care or prescription medications. Evaluating your family's specific needs can help tailor a plan that provides the right coverage without unnecessary costs.

Budget Considerations

Balancing your budget with healthcare needs is crucial. Plans with lower monthly premiums might seem appealing, but they often come with higher deductibles and out-of-pocket costs. Sometimes, paying a higher premium can save money in the long run if your family uses healthcare services frequently.

Provider Network

Your choice of doctors and hospitals can also affect costs. Ensure that your preferred healthcare providers are within the plan's network to avoid higher out-of-network charges. This is especially important if you have established relationships with specific doctors or specialists.

Additional Benefits

Some insurance plans offer extra perks like wellness programs, telemedicine, or mental health services. These can add value to your plan and improve overall health outcomes for your family. Consider what additional benefits are important to you when comparing plans.

These factors are vital when considering the average cost of health insurance family colorado. By evaluating these elements, you can find a plan that fits both your healthcare needs and budget.

Average Cost of Health Insurance for Families in Colorado

Understanding the average cost of health insurance family Colorado is key when you are looking for the right plan. In 2022, the average premium for a non-subsidized family health insurance plan was $1,437 per month. However, costs can vary based on several factors.

Monthly Premiums

Monthly premiums are the regular payments you make to keep your insurance active. In Colorado, these premiums can differ widely depending on the type of plan you choose. For example, a Bronze Plan typically has lower monthly premiums but higher out-of-pocket costs. In contrast, a Gold Plan offers higher premiums with lower out-of-pocket expenses.

Here’s a quick look at what you might expect to pay monthly:

- Bronze Plan: Lower premiums, higher out-of-pocket costs

- Silver Plan: Mid-range premiums and cost-sharing reductions available for those who qualify

- Gold Plan: Higher premiums, lower out-of-pocket costs

Annual Costs

When considering health insurance, it's important to look beyond just the monthly premiums. Annual costs include premiums, deductibles, copays, and coinsurance. It's crucial to factor in these additional costs, as they can significantly impact your overall spending on healthcare.

For instance, if your family frequently visits doctors or specialists, a plan with a higher premium but lower out-of-pocket costs might be more cost-effective in the long run.

Balancing Costs and Coverage

To find the best plan for your family, consider both the monthly premiums and the potential annual costs. Evaluate your family's healthcare usage—like doctor visits, medications, and any ongoing treatments—to make sure you choose a plan that offers the best valu

By carefully considering these aspects, you can steer the complexities of family health insurance in Colorado and find a plan that meets both your healthcare needs and financial situation.

Comparing Health Insurance Plans in Colorado

When choosing a health insurance plan in Colorado, understand the differences between individual vs. family plans, on-exchange vs. off-exchange plans, and the Colorado Option Plans. Each type has unique features that can impact your costs and coverage

Individual vs. Family Plans

Individual plans are designed for single persons who need health coverage. These plans typically have lower premiums compared to family plans because they cover just one person. However, if you have a family, an individual plan for each member can add up quickly.

Family plans, on the other hand, cover multiple people—usually a parent or parents and their children. While the upfront premium might be higher, family plans often offer better value when insuring multiple people. They consolidate the coverage into one plan, which can simplify management and potentially offer savings on premiums compared to having multiple individual plans.

On-Exchange vs. Off-Exchange Plans

On-exchange plans are available through the federal or state marketplaces, such as Connect for Health Colorado. These plans may qualify for subsidies based on income, which can significantly lower your costs. If your income is within certain limits, you might get help paying for premiums and out-of-pocket expenses, making on-exchange plans an attractive option for many families.

Off-exchange plans are purchased directly from insurance companies or brokers and are not eligible for subsidies. Although they don't offer financial assistance, off-exchange plans might provide more flexibility in terms of coverage options and networks. This can be beneficial if you have specific healthcare providers you want to keep seeing.

Colorado Option Plans

The Colorado Option is a state-specific plan aimed at increasing affordability and accessibility. These plans are available both on and off the exchange and are designed to offer lower premiums and out-of-pocket costs by setting a standard for what insurance companies can charge. They also emphasize comprehensive coverage, including essential health benefits.

Comparing these options requires considering your family's specific healthcare needs, financial situation, and whether you qualify for income-based assistance. By understanding these differences, you can make an informed decision and choose a plan that aligns with your family's needs and budget.

Navigating Health Insurance Options with Kelmeg & Associates, Inc.

Finding the right health insurance can feel like solving a puzzle with too many pieces. But with Kelmeg & Associates, Inc., you're not alone. Our team offers personalized guidance to help you steer the maze of health insurance options in Colorado.

Personalized Guidance

At Kelmeg & Associates, we understand that every family is unique. That’s why we focus on providing custom advice specific to your situation. Whether you're a young family just starting out or you have more complex healthcare needs, our experts are here to help you find the best plan. We consider your medical needs, preferred doctors, and budget to find options that fit your life.

Expert Advice

Health insurance is complicated, but it doesn't have to be. Our team has years of experience and a deep understanding of the Colorado health insurance market. We stay updated with the latest changes and options, so you don’t have to. Our experts can explain things in simple terms, making it easier for you to understand your choices and make informed decisions.

No Extra Cost

The best part? Our services come at no extra cost to you. We work with various insurance providers, but our loyalty is to you. We aim to ensure you find a plan that offers the best value and coverage, without you having to pay more for our guidance. It's like having a knowledgeable friend guide you through the process, ensuring you get the best deal possible.

Choosing the right health insurance plan can make a big difference in your family's healthcare experience and financial well-being. With Kelmeg & Associates, Inc., you get the support you need to make the best choice.

Now that you know how to steer your options with Kelmeg & Associates, let's dive into some common questions about family health insurance in Colorado.

Frequently Asked Questions about Family Health Insurance in Colorado

What is the average monthly cost for a family health insurance plan in Colorado?

The average cost of health insurance family Colorado can vary widely. In 2022, the average premium for a non-subsidized family of four was about $1,437 per month. However, this is just an average. Your actual costs may differ based on factors like the type of plan you choose and the size of your family.

Monthly premiums can also fluctuate due to changes in the insurance market or updates to healthcare policies. It's important to review your options annually to ensure you're getting the best deal for your family's needs.

How do age and income affect health insurance costs in Colorado?

Age is a significant factor in determining your health insurance costs. Younger families typically benefit from lower premiums. For example, a 27-year-old might pay around $450 per month, while a 60-year-old could see costs more than double that amount.

Income also plays a crucial role. If you buy insurance through the Health Insurance Marketplace, you might qualify for income-based discounts or subsidies. These can significantly reduce your monthly premiums, making health insurance more affordable. The amount of subsidy you receive depends on your earnings and family size, as well as the cost of coverage in Colorado.

What are the benefits of using a health insurance brokerage like Kelmeg & Associates, Inc.?

Using a brokerage like Kelmeg & Associates, Inc. offers several advantages. First, you receive expert guidance from professionals who understand the complexities of the health insurance landscape. They can help you steer through the myriad of options and find a plan that suits your family's needs.

Second, the service is personalized. Kelmeg & Associates takes into account your unique situation, including medical needs, preferred providers, and budget, to recommend the best plans for you.

Lastly, this service comes at no extra cost to you. The brokerage works with various insurance providers, ensuring you receive unbiased advice aimed at securing the best possible coverage without additional fees. It's like having a knowledgeable ally in your corner, helping you make informed decisions that benefit your family's health and financial future.

Understanding these factors can help you make more informed choices about your family's health insurance. Next, let's explore how to compare different health insurance plans in Colorado.

Conclusion

Choosing the right health insurance plan for your family can feel overwhelming, but it doesn't have to be. At Kelmeg & Associates, Inc., we're here to help you make informed decisions that lead to optimal coverage for your unique needs.

Our team offers personalized guidance to steer the complex world of health insurance. We understand that every family is different, and we're committed to finding the best plan that fits your budget, coverage needs, and preferred healthcare providers.

One of the key benefits of working with us is the expert advice you receive at no extra cost. We partner with a variety of insurance providers, giving us the flexibility to recommend plans that truly meet your family's needs without any bias. Our goal is to ensure that you have peace of mind knowing your loved ones are protected.

In a rapidly changing healthcare landscape, having a knowledgeable partner by your side can make all the difference. Whether you're considering individual or family plans, on-exchange or off-exchange options, or even the Colorado Option Plans, we are here to help you understand your choices.

For families in Colorado looking for comprehensive health insurance solutions, Kelmeg & Associates, Inc. is your trusted ally. Let us help you secure the best coverage, so you can focus on what truly matters: the health and well-being of your family.