Unlocking Health Insurance Options for the Self-Employed

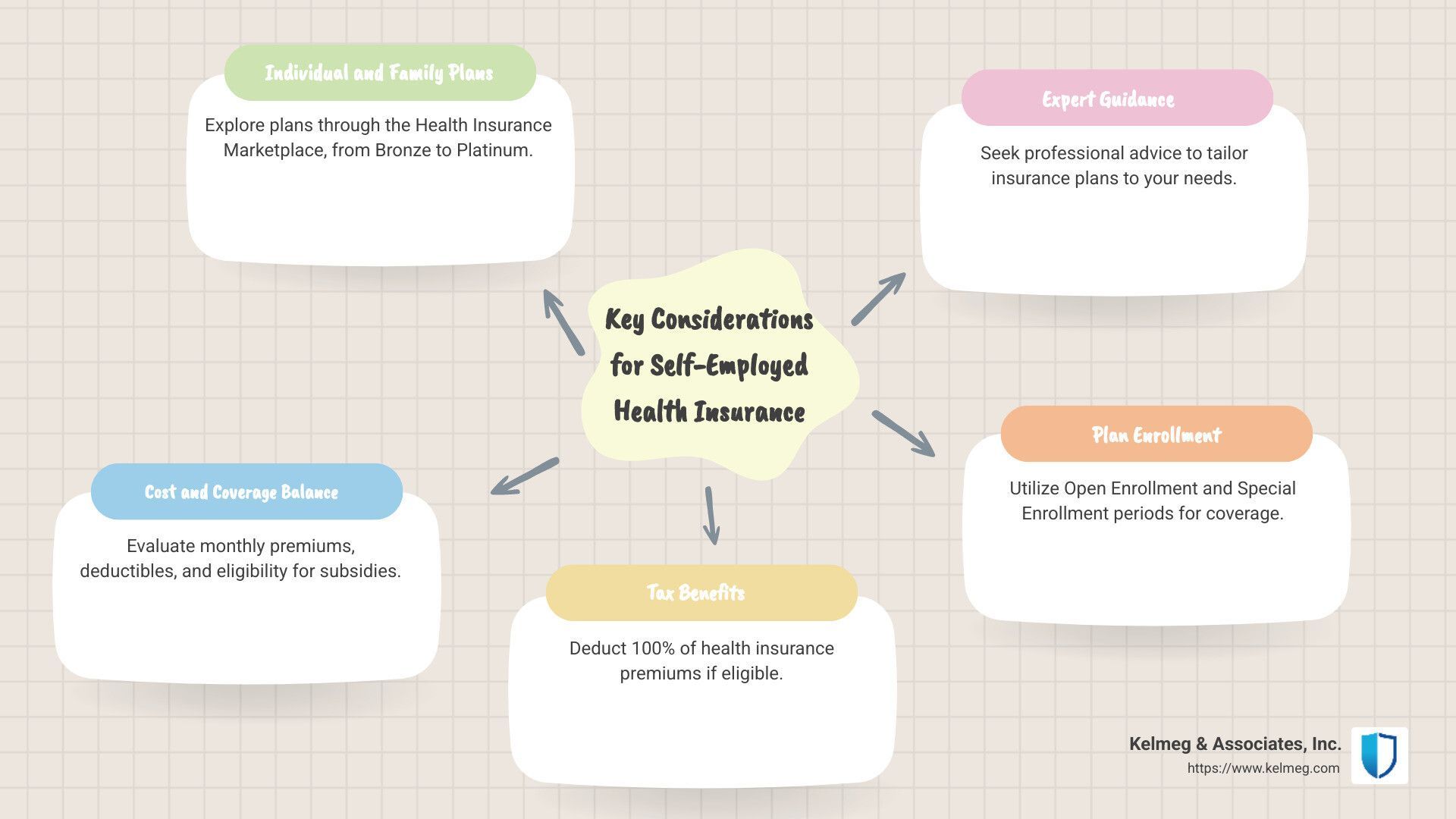

Health insurance for self employed is a responsibility that accompanies the autonomy and flexibility of working for yourself. Whether you're an entrepreneur, freelancer, gig worker, or small business owner, navigating health insurance can be daunting yet is essential for your wellbeing. Here's a quick look at some of the fundamentals you'll encounter:

- Explore a variety of individual and family health plans: These are often available through the Health Insurance Marketplace, providing structured options from Bronze to Platinum levels to suit different budgets and coverage needs.

- Balance between cost and coverage: Consider factors like monthly premiums, deductibles, and eligibility for cost-saving subsidies or tax credits that can ease financial burdens.

- Leverage tax benefits: You might be eligible to deduct 100% of your health insurance premiums from your taxes if you meet specific criteria.

My name is Kelsey Mackley, and as an insurance specialist with Kelmeg & Associates, Inc., I have spent years helping self-employed individuals like you open up health insurance options that meet unique lifestyle and budgetary needs. Now, let’s dive deeper into how you can find the right plan for you.

Understanding Health Insurance for Self-Employed Individuals

When you're self-employed, finding the right health insurance isn't just important—it's essential. The Health Insurance Marketplace is a great place to start. This platform, established by the Affordable Care Act (ACA), offers a variety of individual and family plans custom to different needs and budgets.

ACA Metal Levels

The Marketplace categorizes plans into four metal levels: Bronze, Silver, Gold, and Platinum. Here's a quick breakdown:

- Bronze Plans: Lower monthly premiums but higher deductibles. Ideal if you want to keep upfront costs low and don't expect frequent medical visits.

- Silver Plans: A middle ground with moderate premiums and deductibles. Eligible individuals can also access cost-sharing reductions with these plans.

- Gold Plans: Higher premiums but lower deductibles, which can save money if you need regular medical care.

- Platinum Plans: Highest premiums but the lowest out-of-pocket costs. Best for those who frequently use medical services.

Individual and Family Plans

These plans are designed to cover you and your family, offering flexibility to choose what fits your healthcare needs. Whether you're single, have a partner, or have kids, there's an option for you. Plans vary by state, so it's wise to explore what's available in your area.

Key Considerations:

- Coverage Needs: Assess your healthcare needs and those of your family. Do you need regular doctor visits or just basic coverage?

- Budget: Balance between what you can afford monthly and potential out-of-pocket costs. Higher premiums often mean lower deductibles.

- Eligibility for Subsidies: Depending on your income, you might qualify for subsidies that can significantly reduce your premium costs.

Navigating these options might seem overwhelming, but understanding the basics of the Health Insurance Marketplace and ACA metal levels can make the process easier. At Kelmeg & Associates, Inc., we're here to guide you through every step, ensuring you find a plan that offers both security and peace of mind.

Now that you have a grasp on the types of plans available, let's explore the cost considerations that come with self-employed health insurance.

Cost Considerations for Self-Employed Health Insurance

When you're self-employed, managing costs is a big part of choosing the right health insurance. Here's what you need to know about plan metal levels, subsidies, cost-sharing reductions, and the premium tax credit.

Plan Metal Levels

The Marketplace categorizes plans into four metal levels, each with different cost structures:

- Bronze Plans: These have the lowest monthly premiums but come with higher deductibles. You'll pay more out-of-pocket when you need care, but it's a good choice if you rarely visit the doctor.

- Silver Plans: These strike a balance with moderate premiums and deductibles. If you're eligible, you can also benefit from cost-sharing reductions, making them a popular choice.

- Gold Plans: With higher premiums and lower deductibles, these plans are ideal if you expect to need more frequent medical care.

- Platinum Plans: These have the highest premiums but the lowest out-of-pocket costs, making them suitable for those who require regular medical attention.

Subsidies and Cost-Sharing Reductions

Subsidies, like premium tax credits, can help lower your monthly insurance costs. Whether you qualify depends on your income and household size. These credits can be applied directly to your monthly premium, making health insurance more affordable.

Cost-Sharing Reductions (CSRs) are another type of subsidy available to eligible individuals who choose a Silver Plan. CSRs lower out-of-pocket costs like deductibles and copayments, making healthcare more accessible.

Premium Tax Credit

The Premium Tax Credit is a key financial aid for those buying insurance through the Marketplace. It helps lower your monthly premium costs based on your income and family size. The credit can be applied in advance or reconciled when you file your taxes.

Key Points to Remember:

- Eligibility: Your eligibility for subsidies and tax credits depends on your income and household size.

- Income Changes: If your income fluctuates, your eligibility for these financial aids might change. Keeping your information updated with the Marketplace is crucial.

- Tax Deductions: Self-employed individuals can potentially deduct 100% of their health insurance premiums from their adjusted gross income, offering significant tax relief.

Understanding these cost considerations can help you make informed decisions about your health insurance. At Kelmeg & Associates, Inc., we're here to help you steer these options to find a plan that fits your financial and healthcare needs.

Next, let's discuss the enrollment options available for self-employed workers.

Enrollment Options for Self-Employed Workers

When it comes to health insurance for self-employed individuals, understanding your enrollment options is crucial. Let's explore the Open Enrollment Period, Special Enrollment Period, and qualifying life events that can impact your ability to get coverage.

Open Enrollment Period

The Open Enrollment Period (OEP) is the annual window when you can sign up for a health insurance plan through the Health Insurance Marketplace. For most states, this period runs from November 1 to January 15. During this time, you can choose a new plan, switch plans, or make changes to your existing coverage. It's the best time to assess your healthcare needs and ensure your plan aligns with your financial situation and health requirements.

Special Enrollment Period

Outside of the Open Enrollment Period, you may qualify for a Special Enrollment Period (SEP) if you experience certain life events. This is a flexible option that allows you to enroll in or change your health insurance plan when unexpected changes occur. SEPs typically last for 60 days from the date of the qualifying event.

Qualifying Life Events

Qualifying life events trigger a Special Enrollment Period. These events include:

- Marriage or Divorce: Changes in your marital status can affect your eligibility and coverage needs.

- Birth or Adoption of a Child: Adding a new member to your family allows you to adjust your insurance plan to accommodate their needs.

- Loss of Health Coverage: If you lose your job-based insurance or COBRA coverage, you're eligible for a SEP.

- Moving to a New State: Relocation can impact your insurance options, qualifying you for a SEP to ensure continuous coverage.

Understanding these enrollment options ensures you're covered when you need it most. At Kelmeg & Associates, Inc., we can guide you through these processes, helping you find the right plan at the right time.

Next, we'll explore the tax benefits available to self-employed individuals when it comes to health insurance.

Tax Benefits for Self-Employed Health Insurance

Being self-employed comes with its own set of perks and challenges, especially when it comes to health insurance. But here's some good news: there are tax benefits that can help ease the financial burden.

Self-Employed Health Insurance Deduction

If you're self-employed, you might be eligible to deduct 100% of your health insurance premiums from your adjusted gross income (AGI). This deduction applies to premiums for yourself, your spouse, and your dependents. It's a valuable benefit because it helps lower your taxable income, which could result in lower overall taxes.

To qualify, you need to ensure that you aren't covered by any other health insurance plan, such as an employer's group plan or your spouse's plan. You must also have some self-employment income to claim this deduction.

Pro Tip: If you have multiple streams of self-employment income, you can only use this deduction against one of them—typically the one with the highest income.

Adjusted Gross Income (AGI)

Your AGI is a critical figure in determining your eligibility for various tax benefits, including the self-employed health insurance deduction. It's your total income minus specific deductions, like student loan interest and retirement plan contributions. Lowering your AGI through the health insurance deduction can make you eligible for other tax credits and deductions.

Tax Credits

Tax credits directly reduce the amount of tax you owe. For self-employed individuals, the Premium Tax Credit (PTC) is particularly useful. This credit can help lower the cost of health insurance premiums purchased through the Health Insurance Marketplace. The amount of the PTC depends on your income and family size.

If you're eligible, you can choose to have the credit paid directly to your insurance company to lower your monthly premiums, or you can claim it when you file your tax return.

To sum up, navigating health insurance for self-employed individuals can be complex, but understanding these tax benefits can significantly ease the financial load. At Kelmeg & Associates, Inc., we're here to help you make the most of these opportunities and find a plan that fits your needs.

Next, we'll tackle some frequently asked questions about health insurance for the self-employed.

Frequently Asked Questions about Health Insurance for Self-Employed

What insurance is best for self-employed?

When you're self-employed, finding the right health insurance can feel overwhelming. The Health Insurance Marketplace is a great starting point. It offers a range of plans under the Affordable Care Act (ACA), categorized by metal levels: Bronze, Silver, Gold, and Platinum. Each level varies in cost and coverage. Bronze plans have the lowest premiums but higher out-of-pocket costs, while Platinum plans have higher premiums with lower out-of-pocket expenses.

For many self-employed individuals, ACA plans provide comprehensive coverage and access to essential health benefits. Additionally, subsidies may be available to help reduce costs based on your income and family size.

Tip: If you expect lower medical expenses, a Bronze plan might be suitable. But if you anticipate needing more medical care, consider a Silver or Gold plan for better cost-sharing.

Is $200 a month a lot for health insurance?

The cost of health insurance can vary widely depending on several factors, including your age, location, and the type of plan you choose. On average, plans can start around $350 a month, but with subsidies, some individuals may pay as little as $200 or less.

Subsidies, like the Premium Tax Credit, can significantly lower your monthly premium if you qualify. These credits are based on your household income and can make health insurance more affordable.

Example: In some states, nearly 25% of marketplace enrollees have $0 premiums due to subsidies, making health insurance accessible even for those with limited income.

Can self-employed individuals deduct the cost for health insurance?

Yes, self-employed individuals may be eligible to deduct 100% of their health insurance premiums from their adjusted gross income. This deduction applies to premiums for yourself, your spouse, and your dependents, potentially reducing your overall taxable income.

To qualify for this deduction, you must not have access to any other health insurance, like an employer-sponsored plan or your spouse's group plan. Additionally, you must have earned self-employment income during the year.

The Premium Tax Credit is another financial benefit available to those who purchase insurance through the marketplace. This credit can lower your monthly premium costs, either upfront or when you file your taxes.

Important: Always consult with a tax advisor to ensure you're maximizing your deductions and credits effectively.

These FAQs aim to clarify some key aspects of health insurance for self-employed individuals. At Kelmeg & Associates, Inc., we're dedicated to helping you steer these options to find the best plan for your unique situation.

Conclusion

Navigating health insurance for self-employed individuals can be challenging, but you don't have to do it alone. At Kelmeg & Associates, Inc., we offer expert guidance to help you find personalized insurance plans that fit your unique needs and budget. Our team understands the complexities of self-employment and is committed to simplifying the process for you.

Whether you're a freelancer, small business owner, or gig worker, our goal is to ensure you have access to the best coverage available. We specialize in providing personalized service, ensuring that you understand your options and make informed decisions about your health insurance.

Our services extend beyond just finding a plan; we are here to answer your questions and provide ongoing support. With locations throughout Colorado, including Lafayette, Broomfield, Boulder, and Adams County, we are conveniently positioned to serve your insurance needs.

Choosing the right health insurance is a crucial step in securing your health and financial well-being. Let us help you open up the best options for your situation. Contact us today to explore how we can assist you in finding the perfect health insurance plan custom just for you.