Anthem PPO Plans in Colorado: A Comprehensive Comparison

Anthem PPO Colorado plans stand out as a versatile solution for those seeking substantial health coverage in the state. Whether you're navigating individual needs or group plans, Anthem offers an array of flexible options with robust provider networks. Here's a quick glimpse at what to expect:

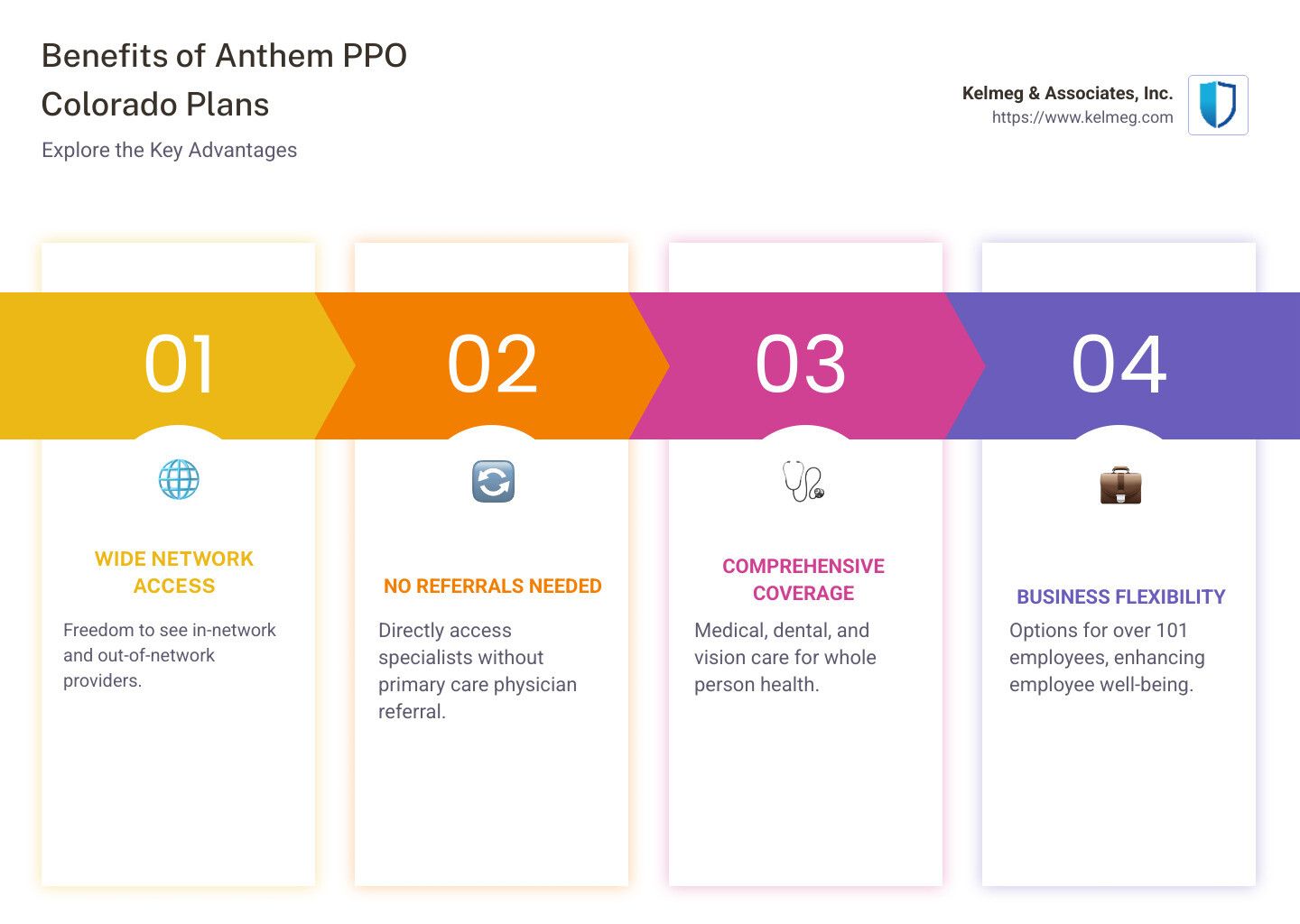

- Wide Network Access: Enjoy the freedom to see both in-network and out-of-network providers with greater coverage for the former.

- No Referrals Needed: Directly access specialists without needing a primary care physician's referral.

- Comprehensive Coverage: Includes medical, dental, and vision plans catering to whole person care.

Anthem PPO plans are particularly beneficial for businesses looking to improve employee well-being while ensuring cost-effectiveness. With options for over 101 employees, the plans provide both choice and flexibility, making them a competitive advantage in the Colorado marketplace.

As an insurance specialist at Kelmeg & Associates, Inc., I, Kelsey Mackley, bring extensive experience to the table in guiding individuals and businesses through the complexities of Anthem PPO Colorado plans. My focus is on aligning your unique needs with the ideal health solution, ensuring a blend of comprehensive coverage and financial peace of mind.

Understanding Anthem PPO Plans

Preferred Provider Organization (PPO) plans offer a unique blend of flexibility and choice, making them a popular option for many individuals and groups in Colorado. Here's what sets Anthem PPO plans apart:

What is a PPO?

A Preferred Provider Organization (PPO) is a type of health insurance plan that provides a network of healthcare providers to choose from. Unlike some other plan types, PPOs offer you the freedom to visit any healthcare provider you wish, but you'll save more money by choosing providers within the plan's network.

Network Providers

Anthem PPO Colorado plans boast an extensive network of healthcare providers. This includes a wide range of hospitals, doctors, and specialists across the state. You have the flexibility to see both in-network and out-of-network providers, though choosing in-network providers typically results in lower out-of-pocket costs.

- In-Network Providers: These are healthcare providers that have an agreement with Anthem to offer services at reduced rates. You’ll pay less when you visit these providers.

- Out-of-Network Providers: You can still see providers who are not in the network, but it will cost more. This is a key difference from HMO plans, which often do not cover out-of-network care at all.

Specialist Referrals

One of the standout features of Anthem PPO Colorado plans is the ability to see specialists without needing a referral from a primary care physician. This means you can directly book an appointment with a specialist, saving time and reducing the hassle of additional doctor visits. This flexibility is particularly beneficial for those with ongoing health conditions that require regular specialist care.

In summary, Anthem PPO plans provide a flexible, comprehensive healthcare solution. With broad access to providers and the freedom to see specialists without referrals, these plans are designed to meet diverse health needs effectively.

Anthem PPO Plans in Colorado

Anthem Blue Cross Blue Shield offers a range of PPO plans in Colorado that cater to both individuals and groups. These plans are designed to provide comprehensive coverage while offering the flexibility to choose healthcare providers.

Plan Options

Anthem provides several plan options to suit different needs and budgets. These include:

- Bronze, Silver, Gold, and Platinum Tiers: Each tier represents a different level of coverage and cost-sharing. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums and lower out-of-pocket expenses.

- Large Group Health Plans: For businesses with over 101 employees, Anthem offers a variety of PPO, HMO, EPO, and high deductible health plans. These plans come with a choice of networks to provide custom solutions for large groups.

Coverage Details

Anthem's PPO plans in Colorado offer extensive coverage that includes:

- Medical Expenses: Coverage for doctor visits, hospital stays, and emergency care.

- Pharmacy Benefits: Most plans include coverage for generic and brand-name prescription drugs. Some medications may be available starting as low as $0, depending on the plan.

- Preventive Care: Anthem covers preventive services, such as checkups and vaccinations, at no cost when using in-network providers. This helps members maintain their health and catch potential issues early.

- Specialist Access: Members can see specialists without needing a referral, providing greater flexibility and convenience.

Additional Features

Anthem PPO plans also come with several features designed to improve the member experience:

- Digital Tools: The Sydney Health app allows members to manage their health on the go, offering features like virtual care visits and health management tools.

- Whole Health Connection®: This feature integrates medical, pharmacy, and specialty benefits, making it easier for members to manage all aspects of their care.

Anthem's PPO plans in Colorado are designed to offer flexibility, comprehensive coverage, and access to a broad network of providers, making them a popular choice for those seeking quality healthcare solutions.

Comparing Anthem PPO with Other Plan Types

When choosing a health plan, it's important to understand how an Anthem PPO plan in Colorado stacks up against other types of plans like HMOs, EPOs, and high deductible health plans.

HMO vs. PPO

Health Maintenance Organizations (HMOs) typically require members to use a network of doctors and hospitals. You'll need a referral from your primary care doctor to see a specialist. This can be a hassle if you need specialized care. However, HMOs often have lower premiums compared to PPOs.

In contrast, Anthem PPO plans offer more flexibility. You can see specialists without a referral and have the option to go out-of-network, though it might cost more. This flexibility is a big plus for those who want more control over their healthcare choices.

EPO vs. PPO

Exclusive Provider Organizations (EPOs) are a middle ground between PPOs and HMOs. Like PPOs, they don't require referrals for specialists. However, EPOs don't cover out-of-network care unless it's an emergency. This can limit your choices if you prefer seeing specific providers.

Anthem PPO plans offer broader access by covering some out-of-network services, albeit at a higher cost. This makes PPOs ideal for those who travel often or want the freedom to choose their healthcare providers.

High Deductible Health Plans

High Deductible Health Plans (HDHPs) usually have lower premiums but higher out-of-pocket costs before coverage kicks in. They're often paired with Health Savings Accounts (HSAs), allowing you to save pre-tax dollars for medical expenses.

While Anthem PPO plans can be more expensive upfront, they offer more predictable costs and comprehensive coverage. This is beneficial if you have regular healthcare needs and prefer not to manage a high deductible.

Key Takeaways

- Flexibility: Anthem PPO plans provide the most flexibility in choosing healthcare providers and accessing specialists without referrals.

- Coverage: PPOs cover some out-of-network care, unlike EPOs and HMOs.

- Cost: While PPOs may have higher premiums, they offer comprehensive coverage and predictable costs, which can be valuable for frequent healthcare users.

Choosing between these plans depends on your healthcare needs, budget, and preference for provider flexibility. Understanding these differences can help you make an informed decision that best suits your lifestyle and health requirements.

Benefits of Choosing Anthem PPO

Choosing an Anthem PPO plan in Colorado comes with several advantages that cater to your healthcare needs while providing flexibility and comprehensive care.

Quality Care

With Anthem PPO, you have access to a wide range of healthcare providers. This means you can choose from a large network of doctors and specialists without needing a referral. This flexibility allows you to get the care you need when you need it.

Anthem is committed to providing quality healthcare access. They invest in people, tools, and technology to ensure you have the support you need for better health outcomes. Their approach focuses on whole-health, addressing not just physical but also behavioral and social factors.

Pharmacy Coverage

Your Anthem PPO plan includes comprehensive pharmacy coverage. This means you have access to a variety of prescription medications, from generics to brand-name drugs. Some medications are available at very low costs, and for Colorado Option members, diabetic supplies can be obtained with a $0 copay at in-network pharmacies.

For those who need regular medications, this coverage can lead to significant savings. It also ensures you have access to necessary treatments without financial strain.

Preventive Care

Preventive care is a key part of staying healthy, and with Anthem PPO, many preventive services are covered at no cost to you. This includes regular checkups, screenings, and vaccinations when you visit in-network providers.

By catching health issues early or preventing them altogether, you can avoid more serious and costly health problems down the line. Anthem’s emphasis on preventive care reflects their commitment to improving health outcomes and keeping healthcare affordable.

Key Benefits

- Flexibility: Choose your providers and access specialists without referrals.

- Comprehensive Pharmacy Coverage: Access a wide range of medications with low out-of-pocket costs.

- $0 Preventive Care: Stay healthy with free access to preventive services.

Anthem PPO plans offer a balance of flexibility, comprehensive coverage, and preventive care, making them a strong choice for those seeking quality healthcare in Colorado.

Frequently Asked Questions about Anthem PPO Colorado

What does Anthem PPO mean?

A Preferred Provider Organization (PPO) plan, like those offered by Anthem in Colorado, provides you with a great deal of flexibility. With an Anthem PPO plan, you can see any doctor or specialist without needing a referral. This is a big plus if you prefer choosing your own healthcare providers.

In a PPO, you have a network of doctors, hospitals, and other healthcare providers who have agreed to provide services at reduced rates. If you visit a provider in this network, your costs will generally be lower. However, unlike some other plans, PPOs also offer coverage for out-of-network services, though at a higher cost.

Does Colorado have PPO plans?

Yes, Colorado residents can access PPO plans through Anthem Blue Cross Blue Shield. Anthem is well-known for offering a variety of health insurance plans, including PPO options that cater to both individuals and groups. These plans are designed to provide comprehensive coverage while giving you the freedom to choose your healthcare providers.

Anthem's presence in Colorado is significant, with a robust network that ensures residents have access to quality healthcare. Whether you're looking for individual coverage or a plan for your employees, Anthem offers PPO options that can meet your needs.

Is Blue Cross Blue Shield the same as Anthem Colorado?

Anthem and Blue Cross Blue Shield are closely related, but they are not exactly the same. Anthem Blue Cross Blue Shield is part of the Blue Cross Blue Shield Association, a federation of 35 independent companies. Anthem operates under the Blue Cross Blue Shield brand in several states, including Colorado.

In simple terms, when you enroll in an Anthem plan in Colorado, you're getting a Blue Cross Blue Shield plan. This means you benefit from the extensive network and resources that the Blue Cross Blue Shield Association provides, while also enjoying the local expertise and personalized service that Anthem offers.

Anthem's strong presence in Colorado, combined with the trust and reliability of the Blue Cross Blue Shield brand, makes it a popular choice for those seeking flexible and comprehensive health insurance options.

Conclusion

Choosing the right health insurance plan is a crucial decision, and at Kelmeg & Associates, Inc., we're here to help you every step of the way. Our expertise in the Colorado insurance market ensures that you receive the best guidance custom to your unique needs.

With Anthem PPO plans in Colorado, you gain flexibility and comprehensive coverage, allowing you to access a wide network of healthcare providers without the need for referrals. This flexibility is a significant advantage for those who value choice and convenience in their healthcare options.

At Kelmeg & Associates, Inc., we understand that navigating health insurance can be daunting. That's why we offer personalized plans and expert guidance at no extra cost. Our goal is to ensure you find the coverage that best suits your needs, whether it's for individual, family, or group insurance.

Our commitment to clear communication and personalized service sets us apart. We take the time to understand your situation and help you make informed decisions about your health insurance options. Whether you're considering an Anthem PPO plan or exploring other options, we're here to provide the support and information you need.

For more details on how we can assist you in finding the right plan, visit our Medicare service page. Let us help you secure the peace of mind that comes with knowing you have the right coverage for your healthcare needs.